- Teller User Guide

- Branch Maintenance

- Maintain Charge Decisions

Maintain Charge Decisions

The Charge Decision Maintenance screen is used to maintain the charge decisions.

- On the Homepage, from Teller mega menu, under

Branch Maintenance, click Charge Decision

Maintenance or specify Charge Decision

Maintenance in the search icon bar and select the screen.The Charge Decision Maintenance summary screen is displayed.

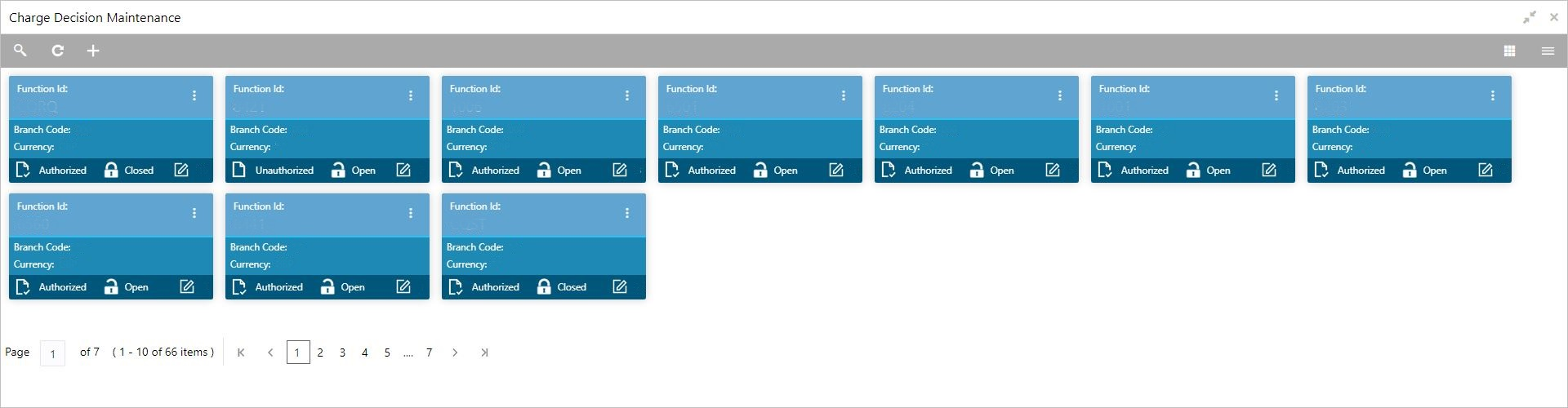

Figure 20-39 Charge Decision Maintenance (Summary)

- Click the

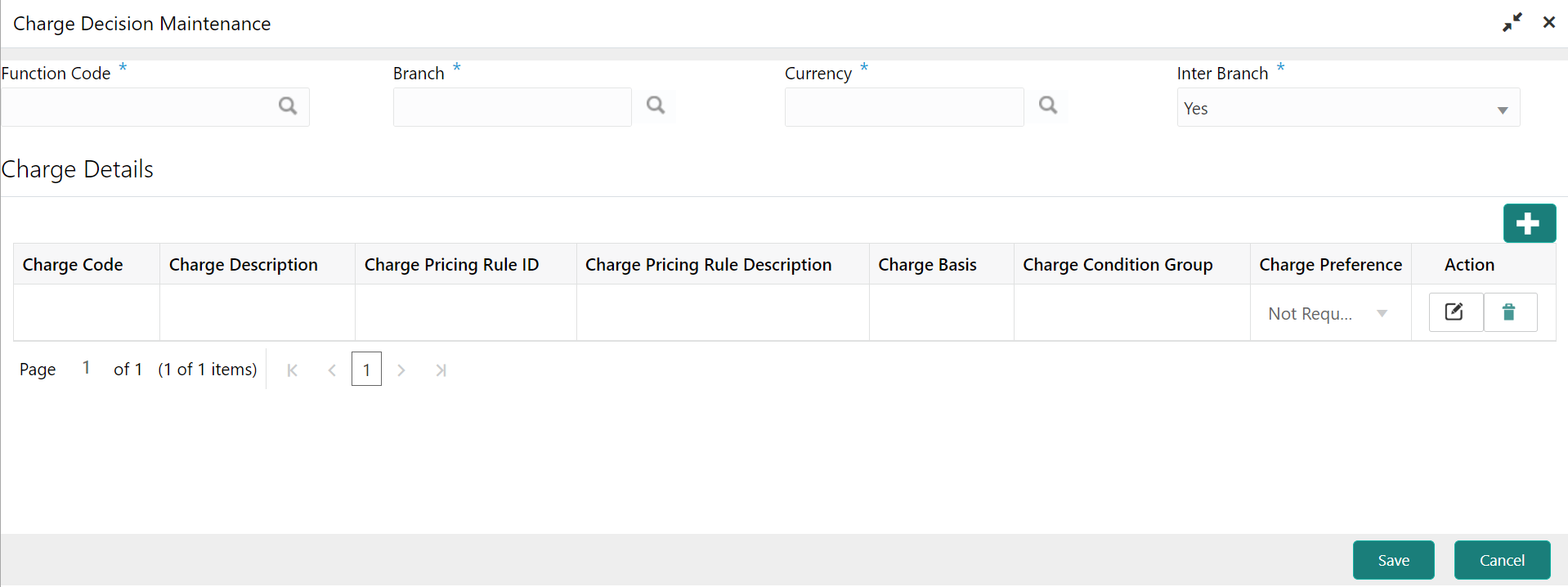

icon.The Charge Decision Maintenance screen is displayed.

icon.The Charge Decision Maintenance screen is displayed.Figure 20-40 Charge Decision Maintenance (New)

- On the Charge Decision Maintenance screen, specify the

fields. For more information on fields, refer to the field description

table.

Table 20-27 Charge Decision Maintenance - Field Description

Field Description Function Code

Specify the function code. You can also select from the list of values.

Branch

Specify the branch code. You can also select from the list of values.

Currency

Specify the currency code. You can also select from the list of values.

Inter Branch

Select the inter-branch requirement from the following drop-down values:-

Yes

-

No

-

Both

Charge Details

Specify the fields.

Charge Code

Specify the charge code. You can also select from the list of values.

Charge Description

Displays the description of the charge code specified.

Charge Pricing Rule ID

Specify the charge-pricing rule ID. You can also select from the list of values.Note:

You can choose the pricing rule ID to apply charge or choose a group code from which the pricing rule will be picked for calculation. You can only define the rule or group. Either the rule can be used, or a group can be used.Charge Pricing Rule Description

Displays the description of the charge-pricing rule ID specified.

Charge Basis

Specify the charge basis. You can also select from the list of values.

Charge Condition Group

Specify the charge condition group.

Charge Preference To capture the charge preference options, if a charge is flagged for tracking due to insufficient funds. The available drop-down options are: - Part Waive/Part Debit: If there is some amount in the account but not sufficient to collect the full charge, the system will collect the available amount and waive off the remaining amount. No tracking would be done for the waived amount. For example, If the charge amount is Rs. 100 and there is Rs. 70 in the customer account, then Rs. 70 would be collected as the charge and the remaining Rs. 30 would be waived off.

- Part Track/ Part Debit: If there is some amount in the account but not sufficient to collect the full charge, the system will collect the available amount and track the remaining amount. For example, If the charge amount is Rs. 100 and there is Rs. 70 in the customer account, then Rs. 70 would be collected as the charge and the remaining Rs. 30 would be tracked for collection.

- Full Waive: The full charge amount would be waived off if the amount in the account does not cover the charge fully. For example, If the charge amount is Rs. 100 and there is Rs. 70 in the account, the entire Rs. 100 charge would be waived off.

- Full Track: If the account does not have sufficient amount to cover the charge, the entire amount will be tracked. For example, If the charge is Rs. 100 and the amount in the account is Rs. 70, no charge would be collected, instead an amount block for Rs. 100 would be created and this would be tracked till closure.

- Force Debit: In this case, the charge amount would be forcibly debited to the customer's account. For example, If the charge is Rs. 100 and the customer account has Rs. 70, then the system would forcibly debit the customer account of Rs. 100 resulting in the customer account balance becoming Rs. -30. No Tracking of amounts is done in this case.

- Reject: Under this option, the entire transaction would be rejected if the amount in the customer account did not have sufficient amount for the charge. For example, If the transaction is a Cash Withdrawal of Rs. 500 and the charge is Rs. 100, then if the customer account balance is less than Rs. 600, then the entire transaction would be rejected. The customer can withdraw a maximum of Rs. 400.

Reset

Click Reset to reset the charges added.

Add Charges

Click Add Charges to add the charge decisions specified.

Charges Added

Displays the details of charge decisions added to the table. Once you add an account to the table, you can click the necessary icon to edit or delete the added entry.

-

- Click Save.The summary view is displayed with the configured details of charge decisions.

Parent topic: Branch Maintenance