- Loan Service User Guide

- Schedule

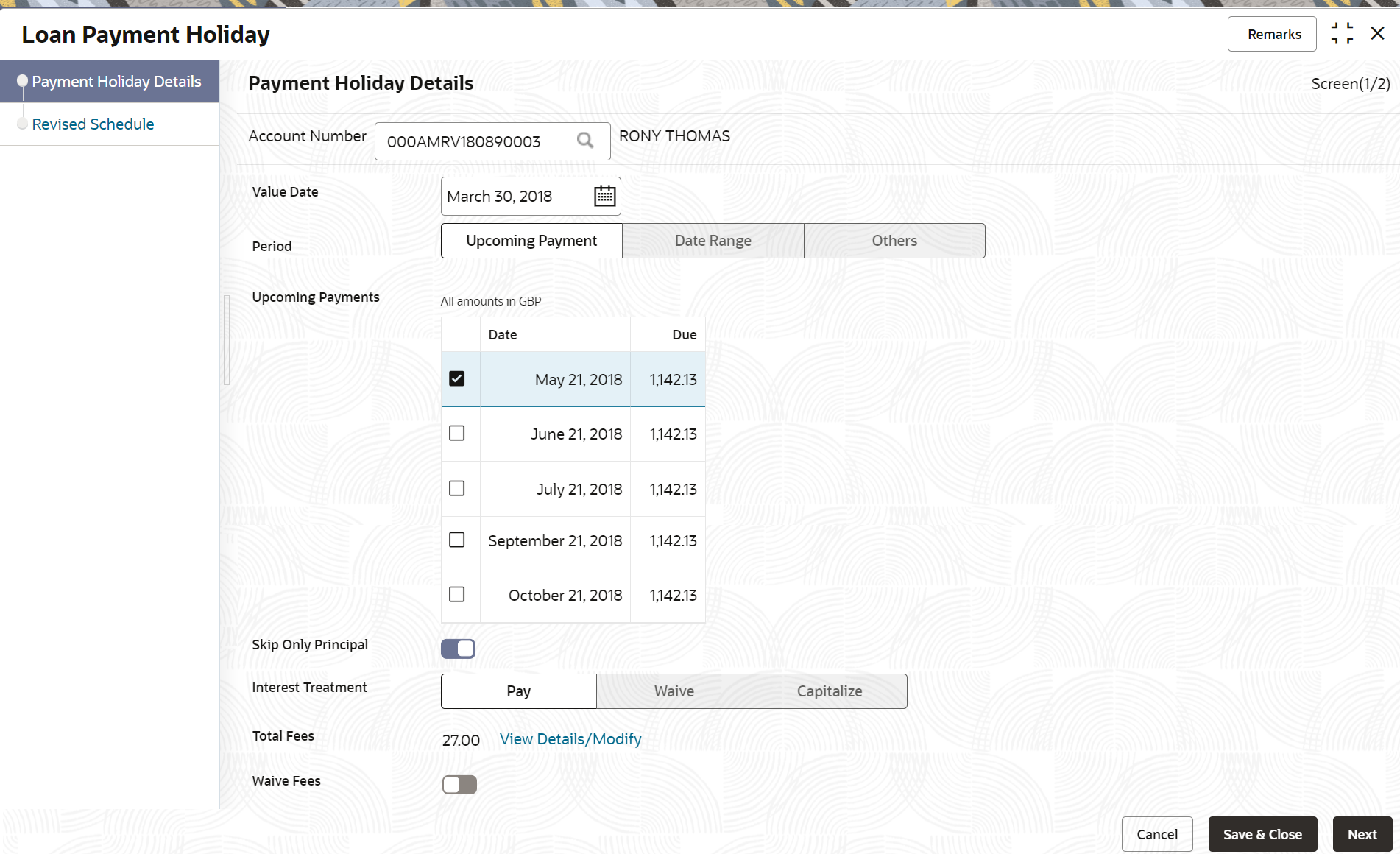

- Loan Payment Holiday

- Applying Repayment Holiday for Upcoming Payments

6.1.2 Applying Repayment Holiday for Upcoming Payments

You can select the installments from your next six installments displayed, for which repayment holiday is to be applied.

To apply repayment holiday for upcoming payments:

- Navigate to the screen and fetch the account. For more information, refer Navigating and Fetching Account.

- From the Period field, select the Upcoming

Payment option.The fields related to upcoming payment are displayed.

- On the Loan Payment Holiday screen, perform the action

for applying the repayment holiday for upcoming payments. For more information

on fields, refer to field description table below:

Table 6-1 Upcoming Payments – Field Description

Field Description Account Number Click the  icon and select the account number or specify the

account number for defining payment holiday.

icon and select the account number or specify the

account number for defining payment holiday.

Note:

As you specify the account number, the name of the account holder appears next to the account number.Value Date Select or specify the value date for performing the transaction. Note:

By default, the system displays the current date. If required, you can specify a future date. A back date is allowed only if no financial event has happened on the holiday period.Period Select the Upcoming Payments option. Note:

For more information on Date Range option, refer Applying Repayment Holiday for a Date Range.

For more information on Other option, refer Applying Repayment Holiday for Other Period.

Upcoming Payments Displays the repayment amount due amount date wise. The details are displayed in the Date and Due fields accordingly. Note:

You need to select payments to applying the repayment holiday.Skip Only Principal Switch to for repaying the interest part only that is, the

principal schedule will be excluded during the repayment

holiday period.

for repaying the interest part only that is, the

principal schedule will be excluded during the repayment

holiday period.

Note:

Principal schedule is amortized for the remaining period or for the tenor of the loan. For simple loans (Bearing Loans), the principal is recalculated for the remaining schedules.Switch to for including the principal and interest during

the repayment holiday period.

for including the principal and interest during

the repayment holiday period.

Note:

Outstanding Principal is amortized for the remaining period or for the tenor of the loan. For Simple Loans (Bearing Loans), the interest schedules for the period is also skipped.Interest Treatment Select the appropriate option for treating the interest. The options are: - Pay

- Waive

- Capitalise

Note:

This field is displayed, if you switch to from the Skip Only

Principal field.

from the Skip Only

Principal field.

Total Fees Displays the fee amount along with currency charged on the loan account. Note:

To view the fee details or modify the fees, click the View Details/Modify link displayed next to this field. For more information, refer Viewing and Manage Fees.Waive Fees Switch to

to waive the fees applied on the account.

to waive the fees applied on the account.

Switch to

to retain the fees applied on the account.

to retain the fees applied on the account.

- Click Next.

Note:

On click Next, the system displays an error message if:- Holiday interest formula is not maintained.

- Number of payments selected is not within the maximum

Interest Only Period maintained at the

product level. This validation is applicable only if Skip

Only Principal is switched to

.

.

- Selected schedules is not of continuous period.

- Final schedule is on the holiday period.

- Any selected schedule is partially or fully paid.

- No schedules exists of the loan account.

The Revised Schedule tab is displayed. - Click Submit.The screen is successfully submitted for authorization.

Parent topic: Loan Payment Holiday