- Loan Service User Guide

- Accounts

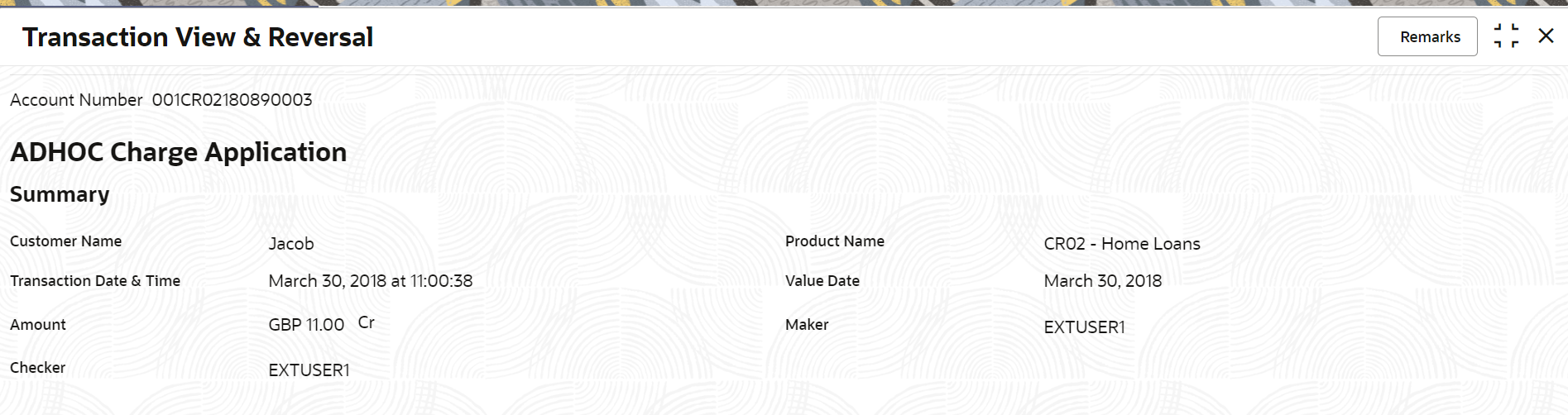

- Transaction View & Reversal

- Perform Reversal of Transaction

2.9.2 Perform Reversal of Transaction

You can initiate a reversal of the loan transaction only after the due diligence is completed on the loan account.

To perform reversal of transaction:

- To launch the screen, fetch account number, and view the account related transaction details, refer View Transaction Details.

- From the Transaction View & Reversal screen, in the

Transactions section, click

from the Action field.The Transaction View & Reversal screen is displayed.

from the Action field.The Transaction View & Reversal screen is displayed.

Description of the illustration transaction-view-and-reversal_summary.png - You can view the transaction summary. For more information on fields, refer to

field description table below:

Table 2-36 Transaction Reversal - Summary – Field Description

Field Description <Event Name> This section displays the event name for which the reversal is being performed. Summary This section displays the transaction summary of the account. Customer Name Displays the customer number and name. Product Name Displays the product code and description. Transaction Date & Time Displays the date and time, when the transaction was performed. Value Date Displays the value date of the transaction. Amount Displays the transaction amount with debit or credit indicator. Maker Displays the maker name who has performed the transaction along with date and time details. Checker Displays the checker name who has performed the transaction along with date and time details. - You can view more information related to the account transactions, in the

following tabs:

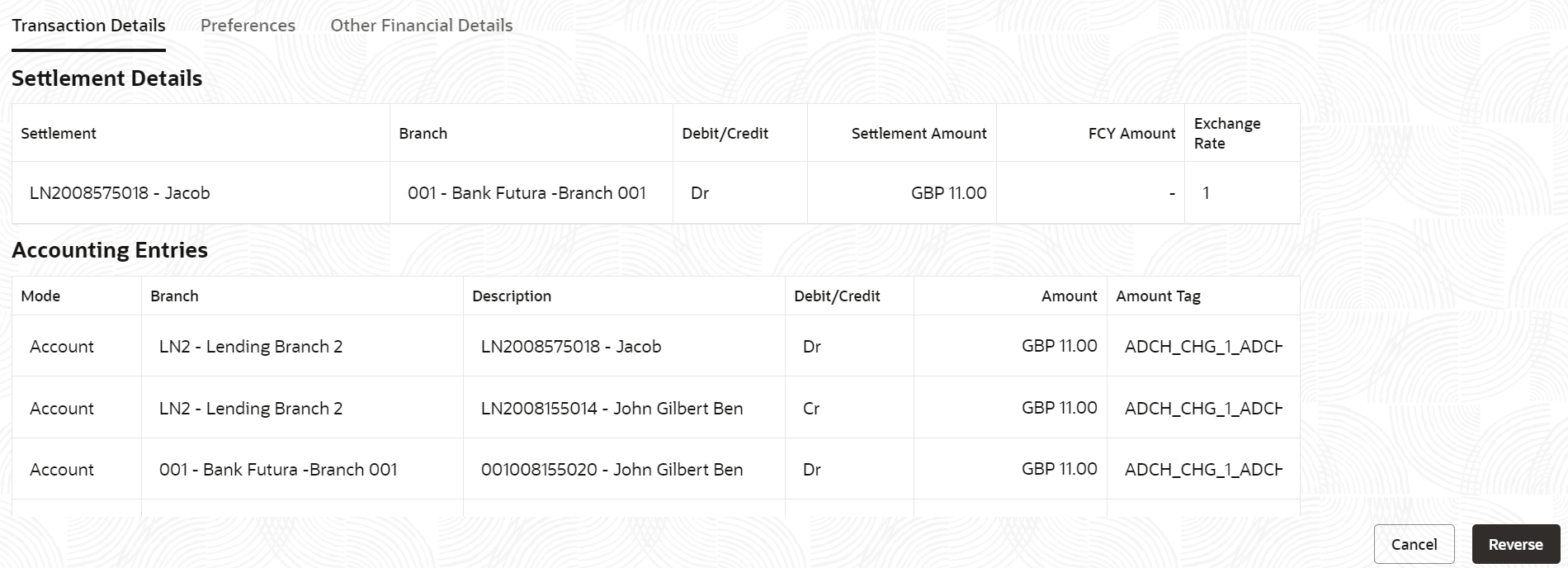

- Transaction Details

Description of the illustration transaction-view-and-reversal_transaction-details.pngFor more information on fields, refer to field description table below:

Table 2-37 Transaction Details tab – Field Description

Field Description Settlement Details This section displays all the settlement details related to the account. Settlement Displays the account or GL number along with the description. Note:

For external accounts, this field displays the external account number and name.Branch Displays the branch name and code. Debit/Credit Displays whether the transaction is of debit or credit in nature. Settlement Amount Displays the settlement amount in local currency. FCY Amount Displays the amount in foreign currency. Exchange Rate Displays the exchange rate in case of foreign currency. Component Details This section displays the component details, which is settled during the transaction. Note:

This section is displayed if component details are present for the selected transaction.Component Displays the name of the component. Due Displays the amount due. Paid Displays the amount paid. Waived Displays the waived amount. Capitalized Displays the capitalized amount. Write Off Details This section displays the write-off details of the account. Note:

This section will be displayed if there are write off events for the selected transaction.Amount Written Off Displays the write-off amount. Fee Details This section displays the fee details of the account. Note:

This section is displayed if charges or fees are collected as part of the event.Charges Displays the charges for the fees was charged. Settlement Amount Displays the settlement amount along with currency. Settlement Displays the settlement account number and name. Accounting Entries This section displays the accounting entries detail of the account. Note:

This section is displayed if accouting entries are related to the selected transaction.Mode Displays mode of the accounting entries as Account or Ledger. Branch Displays the branch where the transaction was performed. Description Displays the account or GL number along with description. Debit/Credit Displays whether the entries are of debit or credit in nature. Amount Displays the local currency amount. Amount Tag Displays the description for the amount tag. Status This section displays the status of the events. Note:

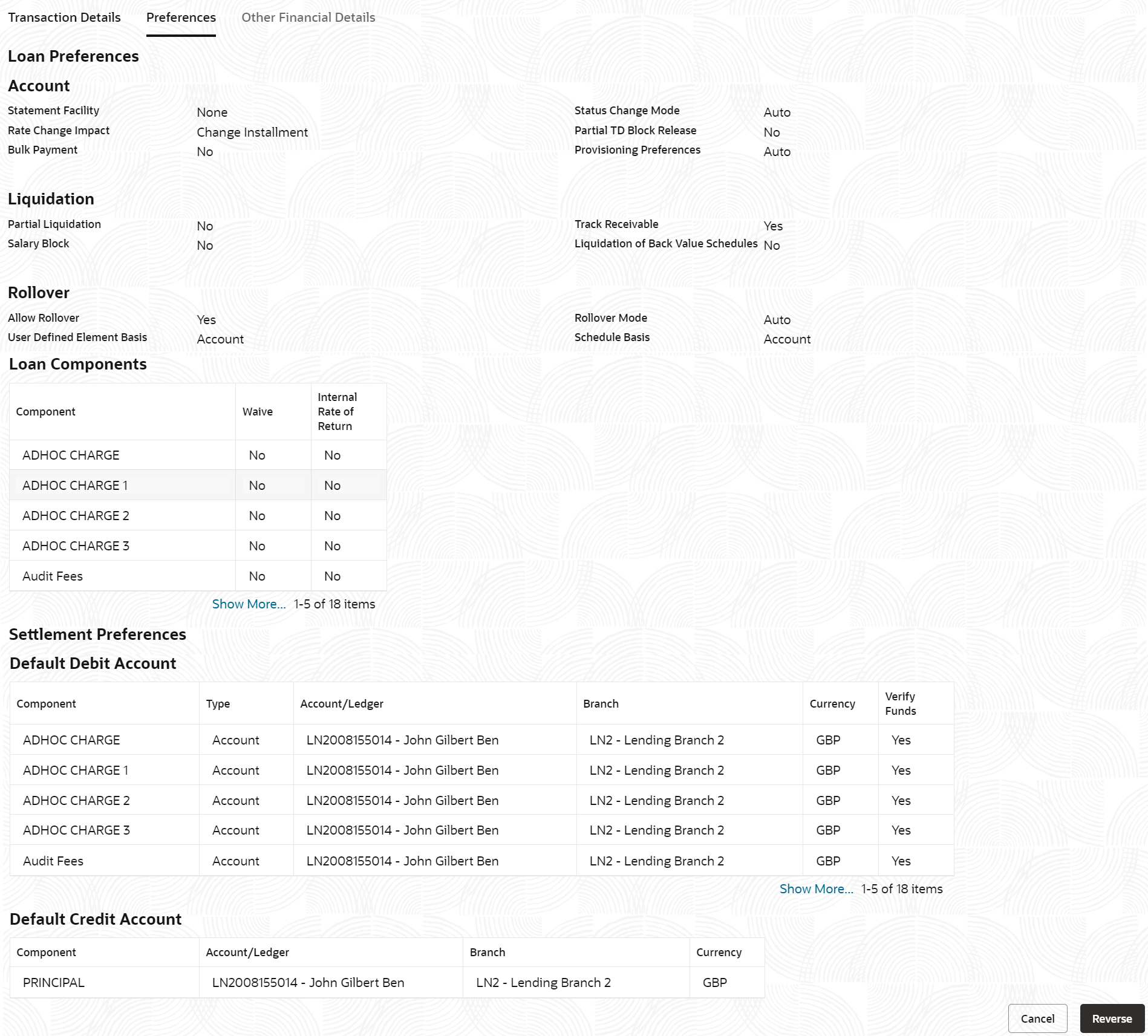

This section is displayed if there is a status change event for the transaction.Loan Current Status Displays the current status of the loan account. Loan New Status Displays the new status of the loan account. Effective Date Displays the date from which the loan status is effective. - Preferences

Description of the illustration transaction-view-and-reversal_preferences.pngTable 2-38 Preferences tab – Field Description

Field Description Loan Preferences This section displays the detail of loan account preferences. Account This section displays the account details. Statement Facility Displays the frequency of the statement. Status Change Mode Displays the mode as Auto or Manual. Rate Change Impact Displays the impact of rate change as Change Term or Change Installment. Partial TD Block Release Displays whether to release partial TD block or not. Bulk Payment Displayed whether bulk payment is allowed or not. Provisioning Preferences Displays the preferences for provisions as Auto or Manual. Liquidation This section displays the liquidation details. Partial Liquidation Displays whether partial liquidation is allowed or not. Track Receivable Displays whether to track receivables or not. Salary Block Displays whether to block salary or not. Liquidation of Back Value Schedules Displays whether liquidation of back value schedules are allowed or not. Rollover This section displays the rollover details. Allow Rollover Displays whether rollover of account is allowed or not. Rollover Mode Displays the mode of rollover as Auto or Manual. User Defined Element Basis Displays the basis of user defined element as Account or Contract. Schedule Basis Displays the basis of schedule as Contract or Account. Loan Components This section displays the loan component details. Component Displays the name of the component. Waive Displays whether waive is allowed or not. Internal Rate of Return Displays the internal rate of return is allowed or not. Settlement Preferences This section displays the settlement preferences details of the account. Default Debit Account This section displays the default debit account details. Component Displays the name of the component. Type Displays the type as Account, GL, or External Account. Account/Ledger Displays the account or ledger number along with account name or description. Branch Displays the branch code and name. Currency Displays the settlement currency. Verify Funds Displays whether to verify funds or not. Default Credit Account This section displays the default credit account details. Component Displays the name of the component. Type Displays the type as Account, GL, or External Account. Account/Ledger Displays the account or ledger number along with account name or description. Branch Displays the branch code and name. Currency Displays the settlement currency. - Other Financial Details

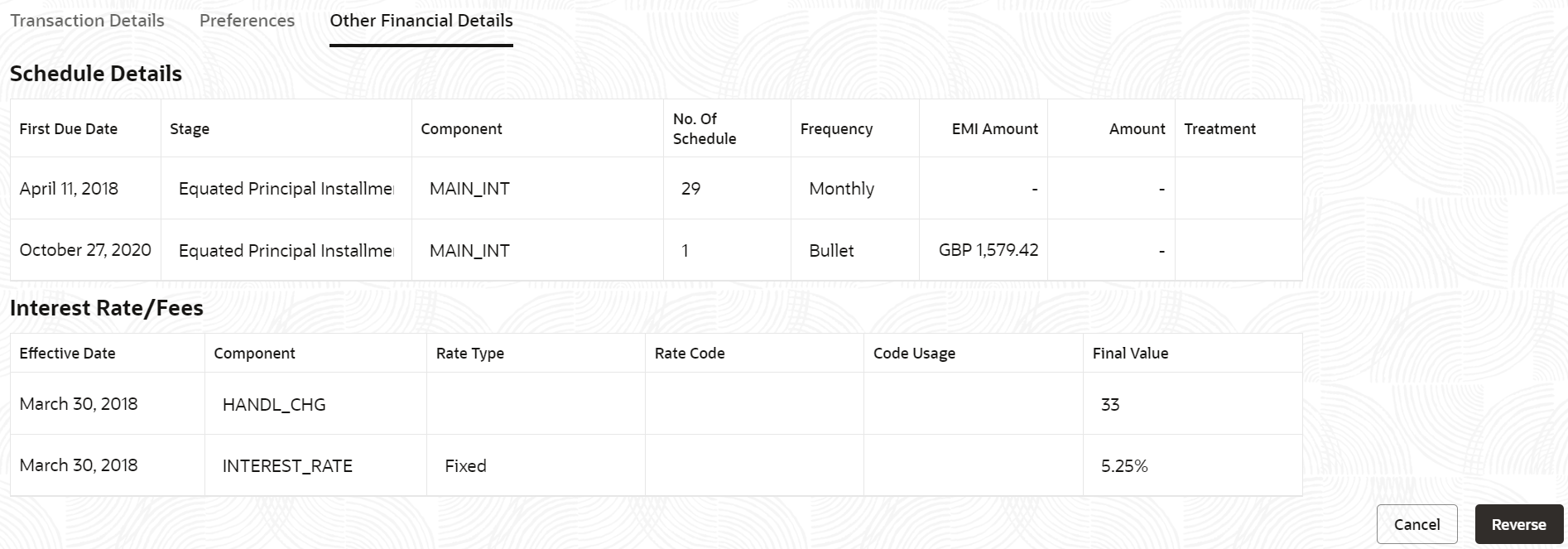

Description of the illustration transaction-view-and-reversal_other-financial-details.pngTable 2-39 Other Financial Details - Field Description

Field Description Collateral Linkage This section displays the collateral linkages detail. Note:

This section displays if a collateral is linked to the account.Linkage Order Displays the order of collateral linkage. Limit Displays the Limit Value Displays the value of the limit. Linked Amount Displays the amount linked to the collateral. Schedule Details This section displays the schedule details of the account. First Due Date Displays the first due date of the schedule. Stage Displays the stage of the schedule. Component Displays the name of the component. No. Of Schedule Displays the number of schedules for the stage or components. Frequency Displays the frequency of the schedule. EMI Amount Displays the user defined EMI amount. Amount Displays the schedule amount. Treatment Displays the schedule treatment as Waive or Capitalize. Interest Rate Revision This section displays the interest rate revision details of the loan. Note:

This section is displayed if interest rate revision schedule is set up for the selected loan account.First Due Date Displays the first due date of the schedule. Component Displays the name of the component. No. Of Schedule Displays the number of schedules for the stage or components. Frequency Displays the frequency of the schedule. Interest Rate/Fees This section displays the user defined elements or value. Effective Date Displays the effective date of the element. Component Displays the name of the component. Rate Type Displays the type of rate as Fixed or Variable. Rate Code Displays the rate code, if the Rate Type is Variable. Code Usage Displays the rate code usage as Automatic or Periodic. Final Value Displays the final value of the component.

- Transaction Details

- Click Reversal.The screen is successfully submitted for authorization.

Note:

If you click Cancel, then Transaction View & Reversal screen is displayed again.

Parent topic: Transaction View & Reversal