- Teller User Guide

- Miscellaneous Transactions

- Miscellaneous Customer Credit

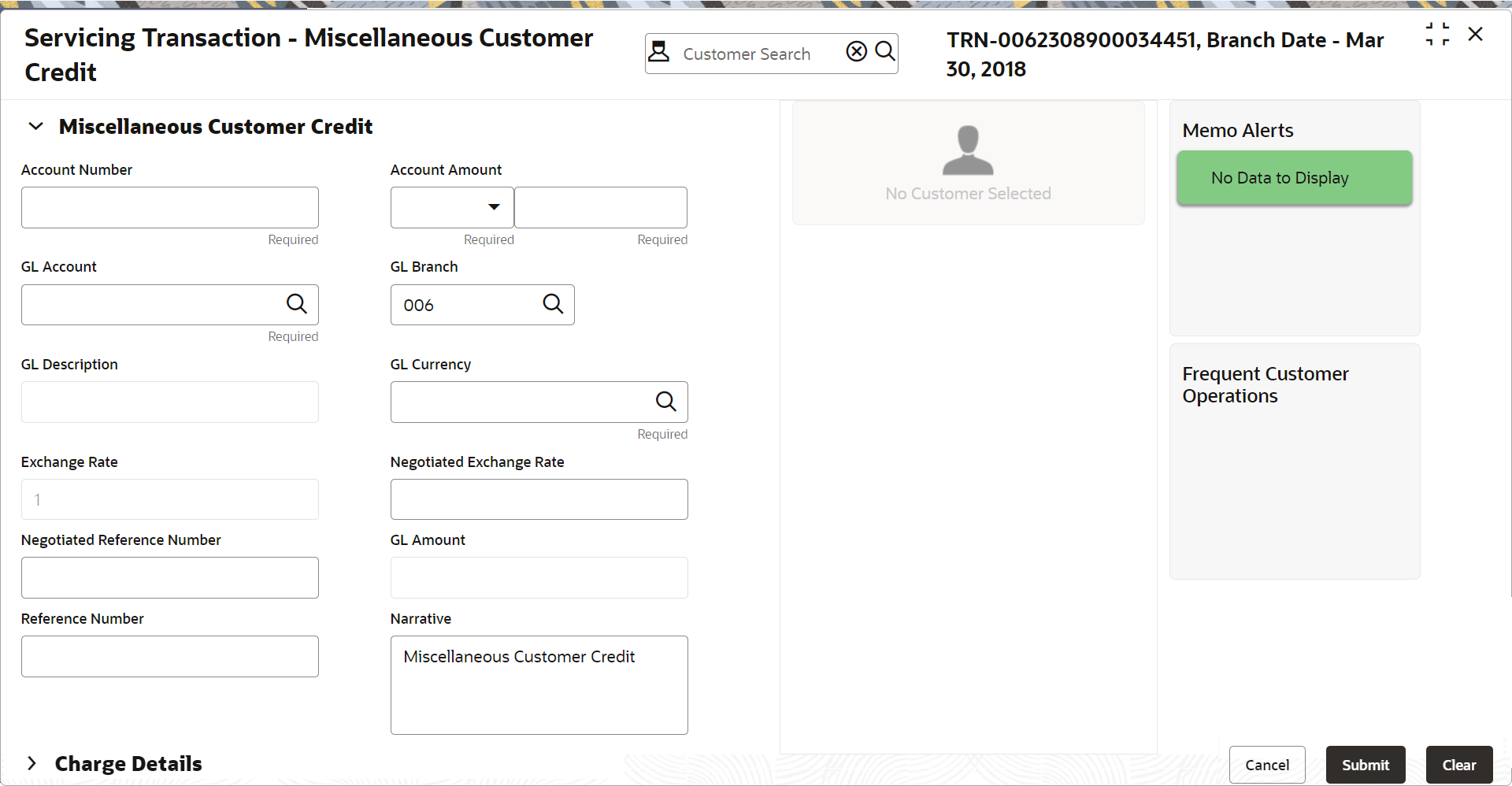

5.2 Miscellaneous Customer Credit

The Miscellaneous Customer Credit screen is used to transfer funds from GL to the customer account.

The customer account can be credited for various reasons, with the corresponding debit to a GL belonging to the transaction branch.

To perform the miscellaneous customer credit:

- On the Homepage, from Teller mega menu, under

Miscellaneous, click Misc Customer

Credit or specify Misc Customer Credit in

the search icon bar and select the screen.The Miscellaneous Customer Credit screen is displayed.

- On the Miscellaneous Customer Credit screen, specify the

fields. For more information on fields, refer to the field description

table.

Note:

The fields marked as Required are mandatory.Table 5-2 Miscellaneous Customer Credit - Field Description

Field Description Account Number

Specify the account number from which the funds need to be credited. Note:

In addition, you can use Oracle Banking Virtual Accounts. These Virtual Accounts are used as a routing account to credit the underlying physical account.The system displays an override or error message on the tab out of Account Number based on the account dormancy parameters.

Account Amount

Displays the account currency based on the account number specified. Specify the amount to be credited from the account currency.

GL Account

Specify the GL account from which the funds need to be debited.Note:

You can also select the appropriate GL account from the list of values that displays all the valid GL accounts.GL Branch

Displays the branch code of the transaction branch and allows to modify.

GL Description

Displays the description of the selected GL account number.

GL Currency

By default, the account currency is displayed, and it can be modified.

Exchange Rate

Displays the exchange rate used to convert the transaction currency into GL currency, and it can be modified.Note:

If the transaction currency is the same as the account currency, the system displays the exchange rate as 1. This field is displayed only ifMulti-Currency Configurationat Function Code Indicator level is set as Y.Negotiated Exchange Rate

Specify the negotiated exchange rate that should be used for foreign currency transactions between the treasury and the branch. You need to specify the negotiated exchange rate only when the currencies involved in the transaction are different.Note:

This field is applicable only if the transaction involves cross currency and only if cross currency enabled andNegotiated_Rate_Enabled Configurationat Function Code Indicator level is set as Y.Negotiated Reference Number

Specify the unique reference number that should be used for negotiation of cost rate, in foreign currency transaction. If you have specified the negotiated cost rate, then you need to specify the negotiated reference number also.Note:

Accounting system books the online revaluation entries based on the difference in exchange rate between the negotiated exchange rate and transaction rate.GL Amount

Displays the amount in terms of GL currency.Note:

This field is displayed only ifMulti-Currency Configurationat Function Code Indicator level is set as Y.Reference Number

Specify the reference number for the transaction, which is the original transaction reference or any invoice number.

Narrative

Displays the narrative as Miscellaneous Customer Credit, and it can be modified.

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Charge Details.

- Click Submit.A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any approval warning raised when the transaction saves. On transaction completion, the GL account is debited, and the customer account is credited to the extent of the Account Amount.

Parent topic: Miscellaneous Transactions