1 Introduction

Individual currency’s future provisioned transactions are the basis for cash position projections.

In real life, timely settlements are seldom expected, resulting in a widening variance between actual and projected cash positions based on this approach.

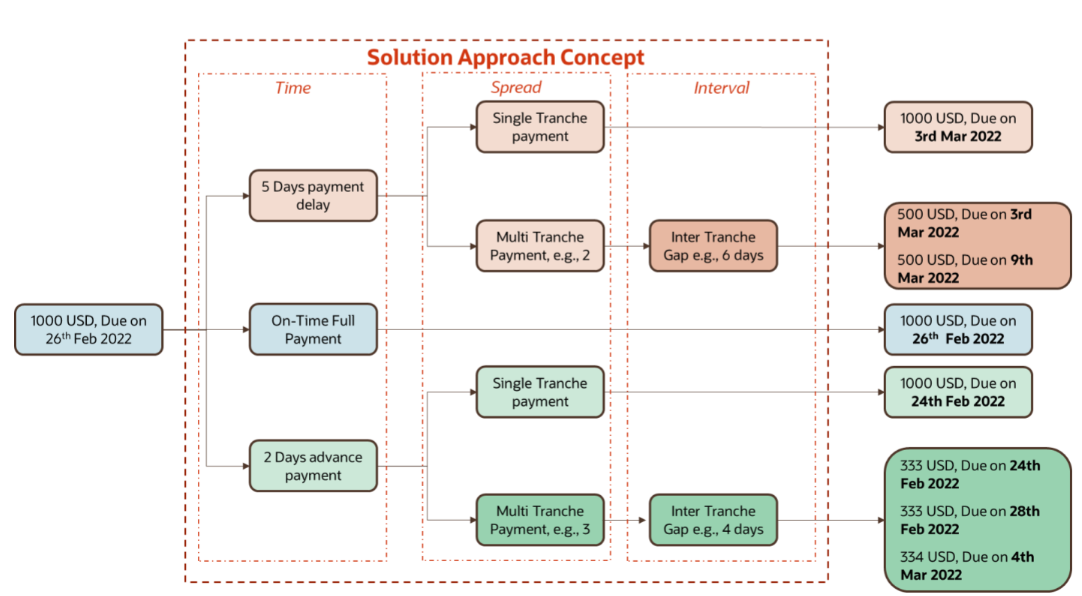

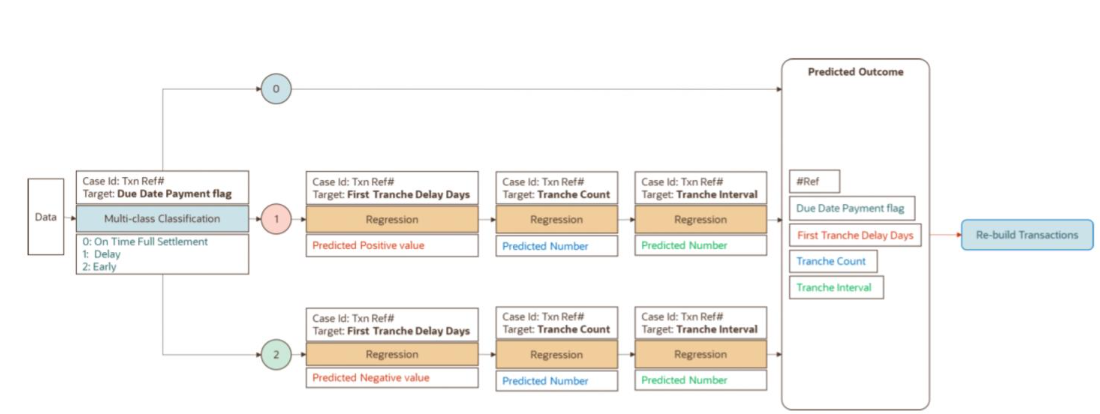

We model our solution on a transaction-based approach, which involves rebuilding individual transactions, based on the pivots of time delay, spread as in single/multiple tranches, and tranche intervals.

Example,

Basic Individual Transaction: 1000 USD, expected payment date on 26th May 2024

Assumption: Availability of sufficient transactions with varying payment patterns, for models to get trained ~ 2000

- 2 days advance payment for the first tranche

- Spread 3, i.e. multi-tranche payment.

- Tranche interval of 4 days

- 333 USD, 24th May 2024

- 333 USD, 29th May 2024

- 334 USD, 3rd June 2024

We aggregate the new transaction breakup, re-built over date and across currencies, to build the projections of final cash flow and cash positions.