- Collections User Guide

- Maintenance for Collections

- Arrangement Decisioning Maintenance

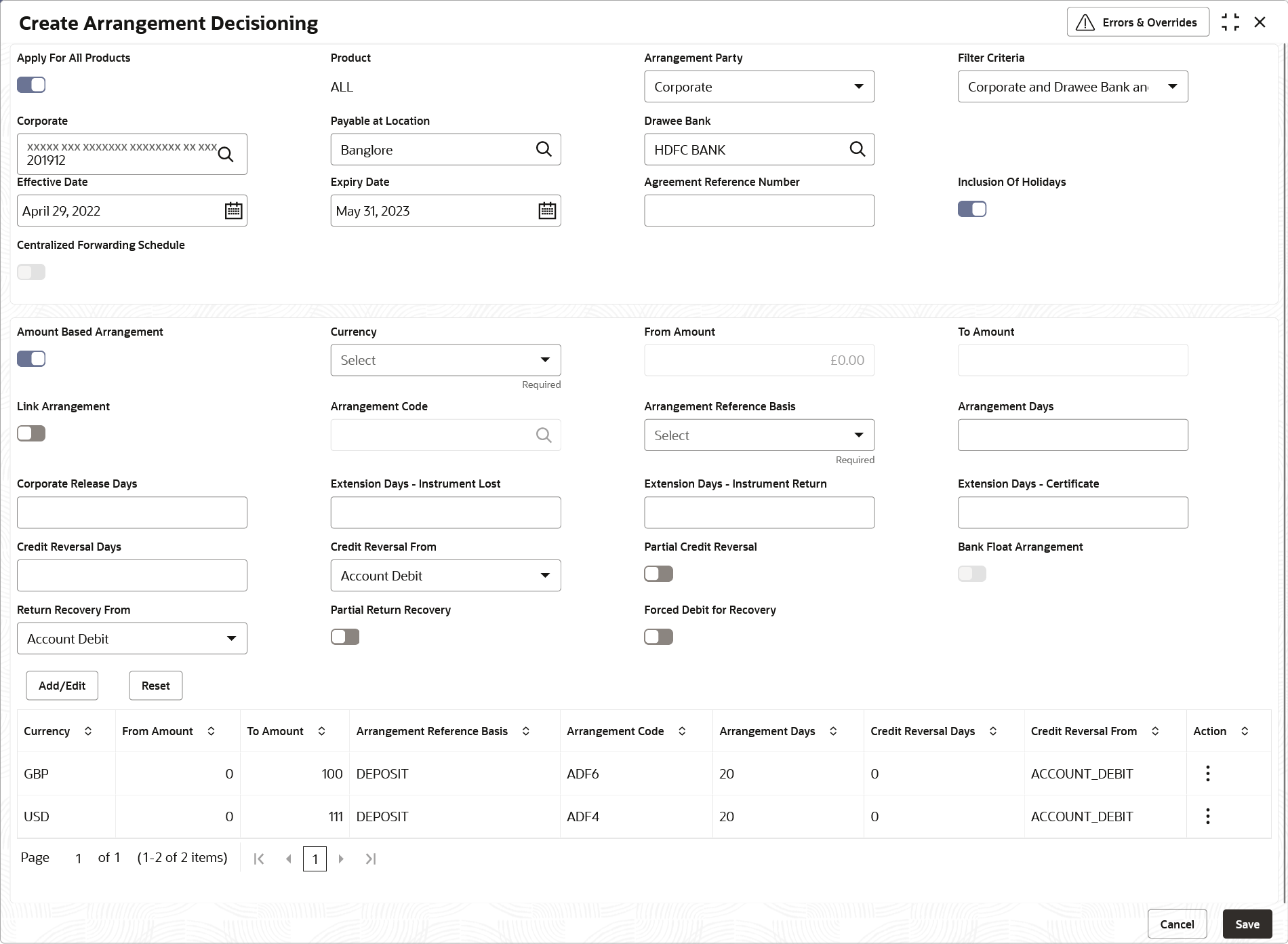

- Create Arrangement Decisioning

3.3.1 Create Arrangement Decisioning

This topic describes the systematic instruction to link the existing arrangement codes with the arrangement party (Corporate/Correspondent bank) or define a new arrangement.

The Arrangement Decisioning is driven by a combination of the following fields:

- Product

- Effective Date

- Arrangement Party

- Corporate/Drawee bank/Correspondent bank

- Payable at Location (if available)

Newly created mapping takes effect once authorized and cannot be modified thereafter.

- On Home screen, click Cash Management. Under Cash Management, click Collections.

- Under Collections, click Maintenance. Under Maintenance, click Arrangement Decisioning.

- Under Arrangement Decisioning, click Create Arrangement Decisioning.The Create Arrangement Decisioning screen displays.

Figure 3-11 Create Arrangement Decisioning

- Specify the fields on Create Arrangement Decisioning screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 3-6 Create Arrangement Decisioning - Field Description

Field Description Apply for All Products Switch the toggle ON to apply the arrangement decisioning to all products. Product Select the product to apply the arrangement decisioning to. Arrangement Party Select the arrangement party (Corporate/Correspondent Bank) to link the existing arrangement to or to define a new arrangement for. This field cannot be modified once authorized. Filter Criteria Select a value which indicates whether the setup is done for the Corporate/Correspondent Bank at broad level or with a combination of different parameters along with the arrangement party. For example: If the Arrangement Party is selected as Corporate, then the available options are:

- Corporate

- Corporate and Payable At Location

- Corporate and Drawee Bank

- Drawee Bank and Payable At Location

- Corporate and Drawee Bank and Payable At Location

- Default

If the Arrangement Party is selected as Correspondent Bank, then the available options are:

- Correspondent Bank

- Correspondent Bank and Payable At Location

- Correspondent Bank and Drawee Bank and Payable At Location

- Default

Based on the selected value, the relevant additional fields gets displayed on the screen.

For example: In case, the ‘Corporate and Payable At Location’ value is selected from the Filter Criteria list, an additional field is displayed for selecting the location.

The filter criteria cannot be modified once authorized.

Payable at Location Click the search icon to select the location from where an amount can be paid. This field is displayed only if the Filter Criteria is selected as Payable At Location.

Drawee Bank Click the search icon to select the bank on which the cheque is drawn. This field is enabled only for the below filter criteria:

- Corporate and Drawee Bank

- Corporate and Drawee Bank and Payable at Location

- Drawee Bank and Payable at Location

- Correspondent Bank and Drawee Bank and Payable at Location

Corporate / Correspondent Bank Click the Search icon to select name of the corporate or the correspondent bank. This field cannot be modified once authorized. Effective Date Click the Calendar icon and select the date from which the arrangement will be effective. By default, the branch date is selected. This field cannot be modified once authorized. Expiry Date Click the calendar icon and select the date on which the arrangement expires. In case the expiry date is same as the branch date then on that day’s EOD, the arrangement decisioning status is marked as Close. Agreement Reference Number Specify the alphanumeric agreement reference number. This number is stored as a placeholder only. Inclusion of Holidays Switch the toggle ON to include holidays in the calculation of expected clearing date during transaction entry for Corporates/Correspondent bank/Drawee bank. This field cannot be modified once authorized. Centralized Forwarding Schedule Switch the toggle ON or OFF to enable or disable the centralized forwarding schedule. If the switch is enabled for a correspondent bank as an arrangement party, the workflow process of centralized forwarding schedule is followed by the system for all the cheques payable at selected correspondent bank in Oracle Banking Cash Management. This field is enabled only if the Arrangement Party is selected as Correspondent Bank.

Amount Based Arrangement Switch the toggle ON, if the arrangement party (Corporate/Correspondent bank) requires an arrangement on the basis of a cheque amount range. Enabling this field displays the grid to specify values for the amount range, arrangement code, and so on. This field cannot be modified once authorized.

Currency Select the currency of the amount. This field is displayed only if the Amount Based Arrangement field is enabled. From Amount Specify the value to specify the start value of the amount range. The amount can contain up to two decimal places. For example: $34,234,235,252,532,430,000,000,000.00.

The default value is zero. This field is displayed only if the Amount Based Arrangement toggle is enabled.

To Amount Specify the value to specify the final value of the amount range. The amount can contain up to two decimal places. For example: $34,234,235,252,532,430,000,000,000.00.

A blank field in the last row indicates that the amount range is infinite. The default value is zero. This field is displayed only if the Amount Based Arrangement field is enabled.

Link Arrangement Switch the toggle ON to select and link the existing arrangement code. On selecting the arrangement code, all its relevant fields are auto-populated and non-editable. This field cannot be modified once authorized. Arrangement Code Click the search icon to select the arrangement code. This field is displayed only if the Link Arrangement toggle is enabled. Arrangement Reference Basis This field cannot be modified if the Link Arrangement toggle is enabled. Otherwise, select the value to specify whether the arrangement is based on Liquidation or Deposit. Arrangement Days This field cannot be modified if the Link Arrangement toggle is enabled. Otherwise, Specify the number of days when the funds are channelized between banks, corporate, and so on.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

Corporate Release Days Specify the number of days post which the corporate can withdraw/utilize the funds, post the funds are released. The corporate account is credited, based on the arrangement. However, the amount remains blocked for the number of days entered in this field.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

This field cannot be modified if the Link Arrangement toggle is enabled.

Extension Days - Instrument Lost This field cannot be modified if the Link Arrangement toggle is enabled. Otherwise, Specify the number of days to be given as an extension to notify the corporate that the account will get debited, in case the cheque is lost in transit.

Extension Days - Instrument Return This field cannot be modified if the Link Arrangement toggle is enabled. Otherwise, Specify the number of days to be given as an extension window for the corporate in case the cheque is returned. Extension Days - Certificate Specify the number of days to extend the line of credit (tenor) given to the corporate. For example, when the instrument does not get cleared within the scheduled time, the corporate can get a certificate from the drawer’s bank. This is in the form of a letter stating that the drawer’s account balance is sufficient to make the payment to the corporate, or that the drawer’s account has already been debited, thus indicating that the instrument has been cleared. However the Correspondent bank/Drawer bank might not have conveyed the same information to the system bank. In such case, giving an extension will extend the line of credit (tenor) given to the corporate as defined in this field.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

Credit Reversal Days Specify the number of days post which the pooling job should initiate reversal of credit from the corporate’s account. Credit Reversal From Select the value to specify from where the recovery can be done in case the clearing fate of the instrument is unknown. Partial Credit Reversal Switch the toggle ON if recovery can be done in tranches. In other words, even if the collections amount or CASA account balance is less than the total amount to be reversed, multiple collections or multiple debits to CASA will be performed, until such time that the credit amount is nullified. Else, credit reversal is done only if and when the next collection’s batch amount or CASA account balance is equal to or greater than the amount to be recovered.

Bank Float Arrangement Switch the toggle ON to utilize the processed instruments that are realized before arrangement credit to the corporate. Return Recovery From Select the value to specify from where the recovery can be done in case of returned instrument. Partial Return Recovery Switch the toggle ON if recovery can be done in tranches. In other words,even if the collections amount or account balance is less than the total amount to be recovered, multiple collections or account debits to CASA will be performed until such time that the recovery amount is nullified. Else, credit reversal is done only if and when the next collection’s batch amount or CASA account balance is equal to or greater than the amount to be recovered.

Forced Debit for Recovery Switch the toggle ON to allow an entry with negative amount to be passed by core banking in case reversal or recovery needs to be done from a customer’s bank account that has insufficient balance. Location Name Click the search icon to select the location applicable to the corporate. This field cannot be modified once authorized. - Click Add/Edit to add the details to the grid.

- Click

icon in the Action column to edit or delete the row.

icon in the Action column to edit or delete the row.

- Click

- Click Reset to clear the selected values, if required.

- Click Save to save the record and send it for authorization.

Parent topic: Arrangement Decisioning Maintenance