1 Overview of Collections

This topic describes the information on the overview, benefits and functionalities of Collections module.

Overview

Oracle Banking Cash Management services enable a financial institution to manage the account receivables and account payables of their corporate customers. Oracle Banking Cash Management provides a technology platform capable of capturing account receivables and account payables of corporates across disparate accounts and locations. It also has a comprehensive Collections feature for managing the collection of cash, and cheques, which can include local, up-country, and correspondent bank cheques. This feature aims at minimizing float time, thus enabling better management of working capital for the corporates.

Benefits

- Cost Reduction – The increased visibility of transactions and easy reconciliation helps corporates manage and control their cash flow and reduce costs.

- Integrated Payables & Receivables – The platform facilitates efficient receivables and payables management through enhanced automation and straight-through processing of key processes.

- Early Credit – The Arrangement Credit feature enables financial institutions to provide cheque collection credit to corporates before realization of the cheque.

- Accurate Forecasting – Enables financial institutions to maintain accurate cash flow forecasting of corporates, by consolidating forecast collection inputs through seamless integration with internal systems.

- Regulatory Environment – The platform leverages flexible configuration to launch quickly, respond to regulatory changes and expand into new geographies.

Functionality

- Dashboard

- Collections

- Paper Based Collections

- Pricing

Home: Dashboard

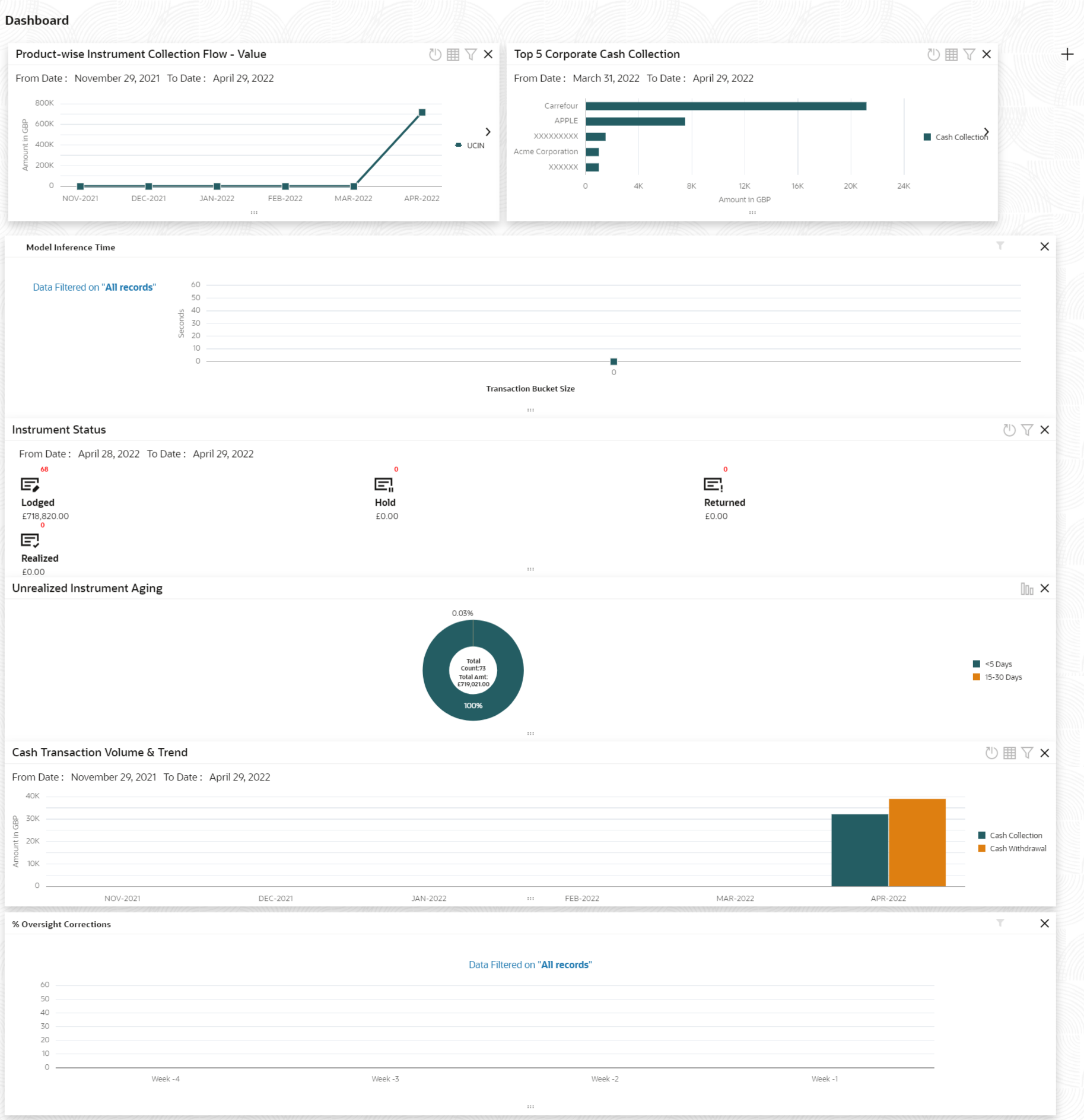

Successfully signing into the application displays the Dashboard as your home screen. Dashboard displays a gist/summary that is internal to the bank. It is a collection of various portlets that are displayed based on your role and access rights. The Dashboard enables you to perform various analytical functions. You can drag and move different portlets, resize/auto adjust the size, and expand/collapse the portlets.

- Specify User Name and Password to access the application.

- Click Sign In to log into the application.

The Dashboard screen displays.

- Unrealized Instrument Aging: Unrealized Instrument Aging graph displays the doughnut chart with the number of cheques/instruments, which are unrealized for aging bucket (number of day). You can click on the bar graph icon at the top-right of the portlet to change the view from doughnut (default) to bar graph. The landing page displays the number of unrealized cheques/instruments split as per configurable aging buckets. A maximum of seven ranges can be defined.

- Cash Transaction Volume and Trend: This portlet displays a bar graph depicting the amounts in branch currency that have been collected and withdrawn every month, within the specified time frame. The Cash Withdrawal and Cash Collection bars are color-coded for aiding quick visual analysis. You can alter the ‘From Date’ and ‘To Date’ by clicking the Filter icon, and selecting the required dates.

- Instrument Status: The Instrument Status portlet displays the status-wise total count and the total value of the instruments for the period selected between From Date and To Date (Deposit from and To Date). By default, the date period is from ‘current date-1’ to ‘current date’. The statuses displayed in the portlet are Lodged, Hold, Return, and Realized.

- Top 5 Corporates: This portlet displays information in the form of a jet-bar chart of the top five corporate customers for their total Receivables and Payables. The data can be viewed in a tabular format as well, by clicking the table icon at the top right corner.

- Top 5 Corporate Cash Collection/Withdrawal: This portlet displays a jet-bar chart with the top 5 corporate parties with high-value cash collection in branch currency, within the specified time frame. You can alter the ‘From Date’ and ‘To Date’ by clicking the Filter icon, and selecting the required dates. Flip the portlet using the arrow on the side to view the top 5 corporates high-value cash withdrawals in branch currency, within the specified time frame.

- Aging of Invoices: The aging graph displays invoice aging information in the form of doughnuts. There are two views of the graph, 2nd view can be navigated by flipping the portlet, and clicking the graph on the top-right corner to change the view from doughnut (default) to bar chart. The front view of the graph display the invoice amount volume split as per aging buckets which are configurable at the time of implementation i.e. 0-30 days; 30-60 days etc. Range criteria can be defined with a maximum of 6 ranges. On clicking any of the range buckets, the graph displays the list of corporates whose invoices are due for that aging bucket. Clicking on the ‘+’ (expand) icon against each corporate; launches invoice details about information of that specific corporate such as supplier name, ‘Invoice Due Date From’, and ‘Invoice Due Date To’.

- Product-wise Instrument Collection Flow – Value/Volume: This portlet displays a line graph representing the monthly instrument-collection amount in branch currency, for each product that is associated with ‘paper-based’ category. Each product has a specific color code. You can alter the ‘From Date’ and ‘To Date’ by clicking the Filter icon, and selecting the required dates. Flip the portlet using the arrow on the side to view the ‘Product-wise Instrument Collection – Volume’ graph, which displays the count of instruments for each product, for the specified time frame. Click to view the details in a tabular format.

- Top Defaulters: Top defaulters widget shows the list of top defaulters for the previous and current month.

- Invoices Raised: This portlet displays the data for Invoices on monthly basis as a bar graph. On clicking the table icon on the top-right corner, the same data is displayed in tabular format with invoices grouped into monthly buckets. On clicking the bar graph, the screen will pop up with the corporate name and aggregated invoice amount and further clicking on the ‘+’ (expand) icon beside the corporate name launches the Invoice Inquiry screen with data of supplier name; ‘To Date’ and ‘From Date’ as per the selected date.

- Business Volume Trend: This chart displays the business trends of the previous six months including the current month based on historic data. The trend line is plotted based on the highs/peak.

- Reconciliation Details: This widget provides a snapshot of reconciliation details of payments against the entity selected, i.e. invoice, cashflow, or allocation. There is an option to view these details as a doughnut or in a line graph. The filter option allows the user to select a specific customer and/or modify the date range.

- To add more portlets, click Add icon located at the top-right corner of the Dashboard.

- To remove a portlet, click Remove icon located at the portlet’s top-right corner.

- To configure the portlet, click the Configure Tile icon located at the portlet’s top-left corner.

- To flip the portlet view, click Flip Forward or Flip Back icon.

- To change the portlet’s position, click and hold the ‘Drag to reorder’ (…..) icon at the portlet’s bottom-center and then move the portlet to the desired position.

- To apply filters on the portlet’s data, click Filter icon to view the pop-up to select the filter values.