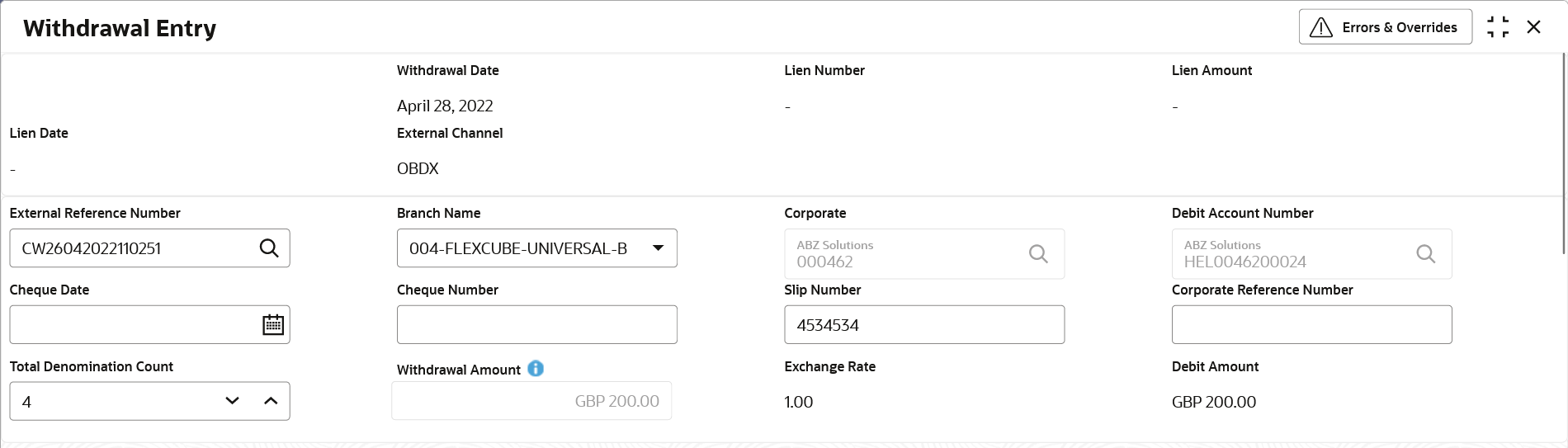

5.2 Withdrawal Entry

This topic describes the systematic instruction to capture cash withdrawal details.

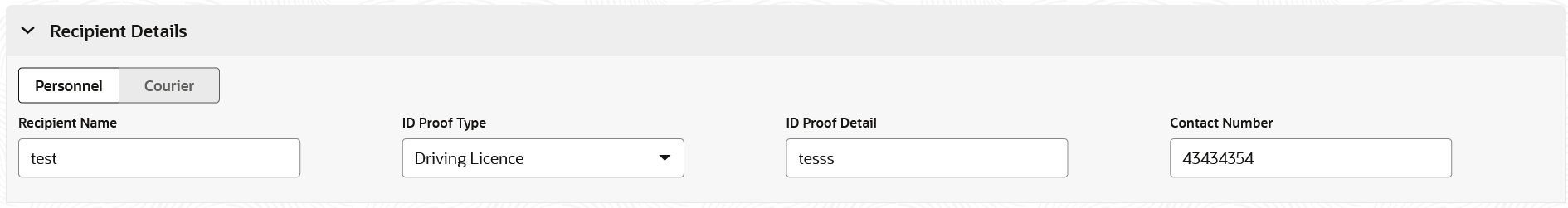

- Corporate: On the withdrawal date, the cash is directly collected by the corporate. The bank user captures the cash withdrawal request.

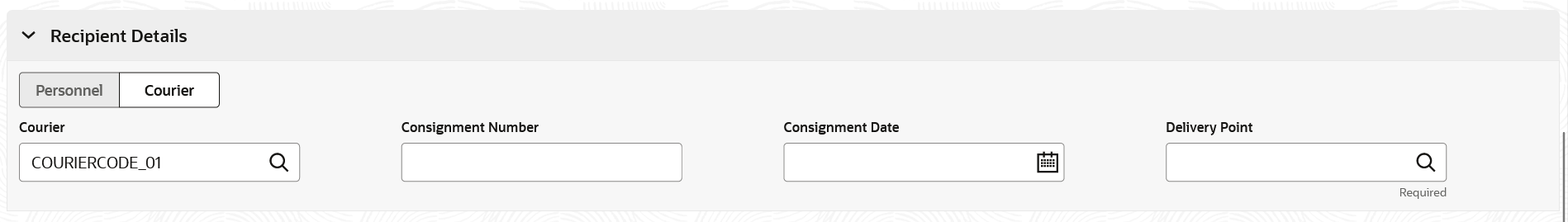

- Courier: On the withdrawal date, the courier agency having tie-up for cash delivery, collects the cash from the branch and delivers it at the Corporate Delivery point specified in the withdrawal request.

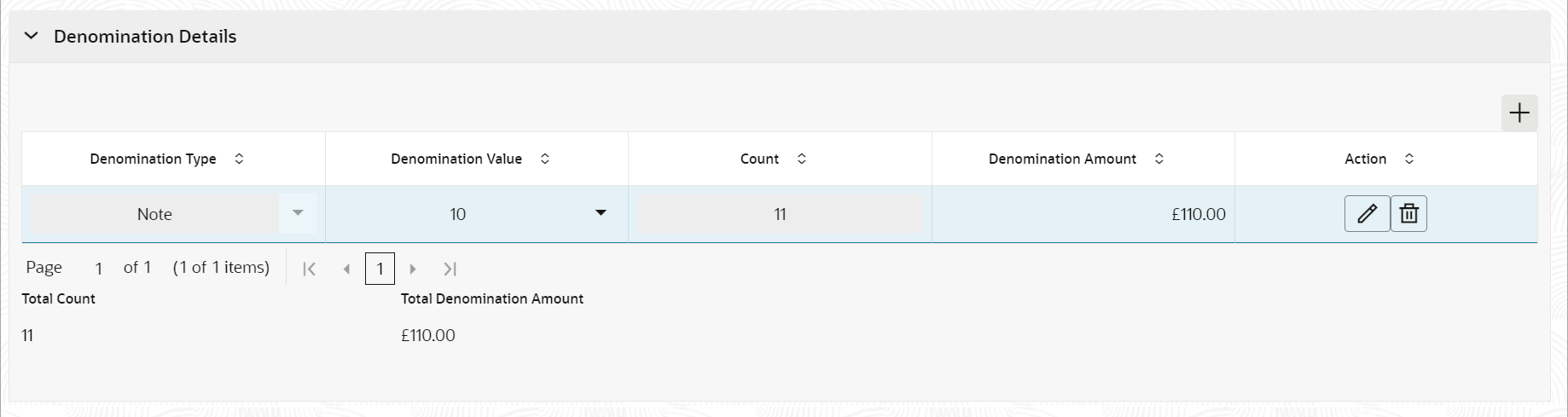

When a cash withdrawal request is submitted by the bank user, a lien marking request is processed and a lien is marked in the debit account for the requested amount. In case the cash withdrawal request is edited again and submitted, then the existing lien number is canceled, and a new lien marking request is sent. Similarly, if a cash withdrawal request is received from an external channel, a lien marking request is sent by the Oracle Banking Cash Management module to the bank’s core system, only if the system parameter flag (Block Amount) is set to ‘Y’. Upon validation of corporate details, the lien is marked in the debit account for the requested amount, till the withdrawal date. On the withdrawal date, the lien marking can be canceled and a new one created, if there is a change in the exchange rate (between requested amount and account currencies) or if the withdrawal entry is edited and submitted by the bank user. Once the requested is authorized, the earn marking is released and the Cash Withdrawal accounting entry is posted for the lien amount. Liens that are not released on the withdrawal date, are released as part of an EOD batch job.

Parent topic: Cash Transactions