- Collections User Guide

- Maintenance for Collections

- Arrangement Definition Maintenance

- Create Arrangement Definition

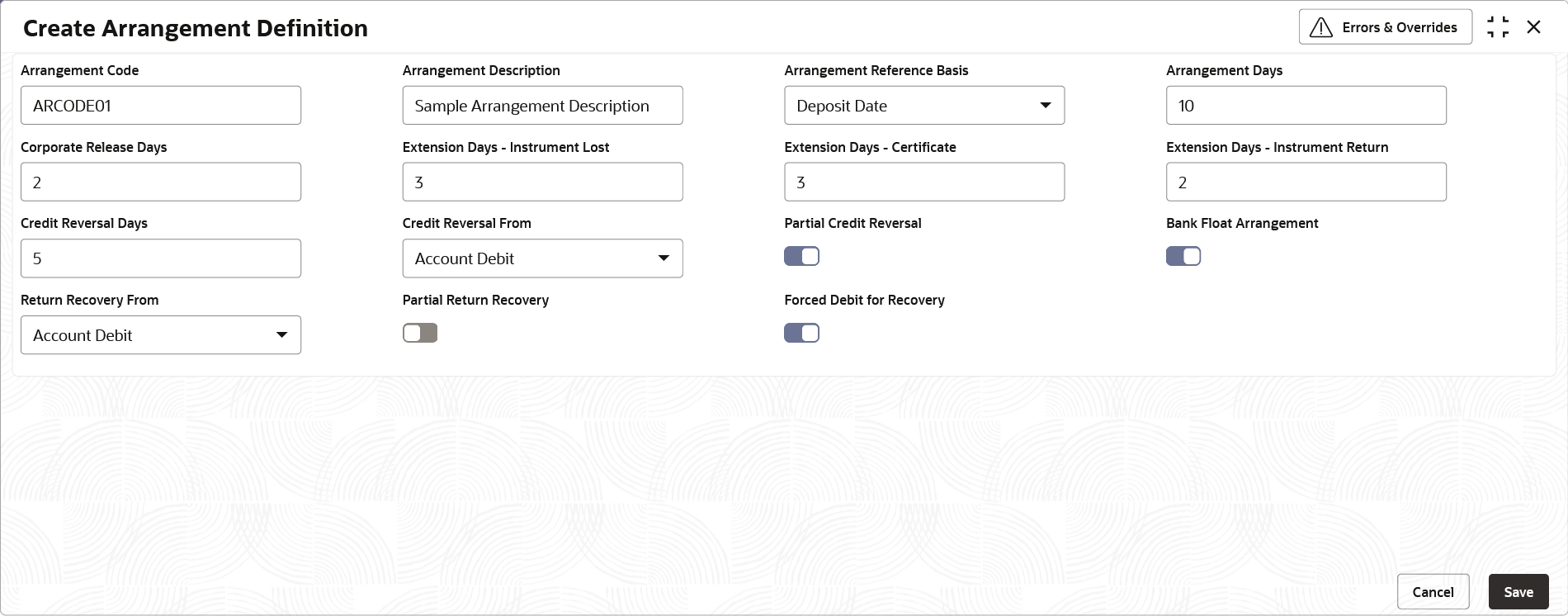

3.2.1 Create Arrangement Definition

This topic describes the systematic instruction to create arrangement codes.

- On Home screen, click Cash Management. Under Cash Management, click Collections.

- Under Collections, click Maintenance. Under Maintenance, click Arrangement Definition.

- Under Arrangement Definition, click Create Arrangement Definition.The Create Arrangement Definition screen displays.

- Specify the fields on Create Arrangement Definition screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 3-5 Create Arrangement Definition - Field Description

Field Description Arrangement Code Specify a unique alphanumeric code for the arrangement. This code cannot be modified once authorized.

Arrangement Description Specify a description for the arrangement. For example, for a corporate having an arrangement day on the deposit date, enter a description such as ‘On Deposit Arrangement’ and for a corporate having an arrangement day on the realization date, enter a description such as ‘On Realization Arrangement’.

Arrangement Reference Basis Select whether the arrangement should be set with reference to the deposit date or the realization date. Arrangement Days Specify the number of days on which the funds should be credited to the corporate on the basis of the selected arrangement reference. For example, If the ‘Arrangement Reference Basis’ field is set to ‘Deposit Date’ and Arrangement Day is set to 1, then the amount is credited to the corporate on the next day of the cheque deposit.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

Corporate Release Days Specify the number of days post funds release, that the corporate can withdraw/utilize the funds. Based on the arrangement, the corporate account will be credited. However, the amount will be blocked for the number of days entered in this field.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

Extension Days - Instrument Lost In case the cheque is lost in transit, Specify the number of days to be given as an extension to the corporate before their account is debited. Extension Days - Certificate Specify the number of days to extend the line of credit (tenor) given to the corporate. For example, when the instrument does not get cleared within the scheduled time, the corporate can get a certificate from the drawer’s bank. This is in the form of a letter stating that the drawer’s account balance is sufficient to make the payment to the corporate, or that the drawer’s account has already been debited, thus indicating that the instrument has been cleared. However the correspondent bank/drawer bank might not have conveyed the same information to the system bank. In such case, giving an extension will extend the line of credit (tenor) given to the corporate as defined in the ‘Certificate Extension Days’ field.

The maximum value that can be entered is 99. The default value is zero. Leaving this field blank considers the default value.

Extension Days - Instrument Return Specify the number of days to be given as an extension window for the corporate in case the cheque is returned. Credit Reversal Days Specify the number of days post which the pooling job should initiate reversal of credit from the corporate’s account. Credit Reversal From Select the value to specify from where the recovery can be done in case the clearing fate of the instrument is unknown. Partial Credit Reversal Switch the toggle ON if recovery can be done in tranches. In other words, even if the collections amount or the CASA account balance is less than the total amount to be reversed, multiple collections or multiple debits to the CASA will be performed, until such time that the credit amount is nullified. Else, credit reversal is done only if and when the next collection’s batch amount or CASA account balance is equal to or greater than the amount to be recovered. Bank Float Arrangement Switch the toggle ON to utilize the processed instruments that are realized before arrangement credit to the corporate. Return Recovery From Select the value to specify from where the recovery can be done in case of returned instrument. Partial Return Recovery Switch the toggle ON if recovery can be done in tranches. In other words,even if the collections amount or account balance is less than the total amount to be recovered, multiple collections or account debits to CASA will be performed until such time that the recovery amount is nullified. Else, credit reversal is done only if and when the next collection’s batch amount or CASA account balance is equal to or greater than the amount that needs to be recovered. Forced Debit for Recovery Switch the toggle ON to allow an entry with negative amount to be passed by core banking in case reversal or recovery should be done from a customer’s bank account that has insufficient balance. - Click Save to save the record and send it for authorization.

Parent topic: Arrangement Definition Maintenance