- Loan Syndication

- Processing Charges and Fees

- Maintaining Fee Rule Details

- Maintaining a Fee Class

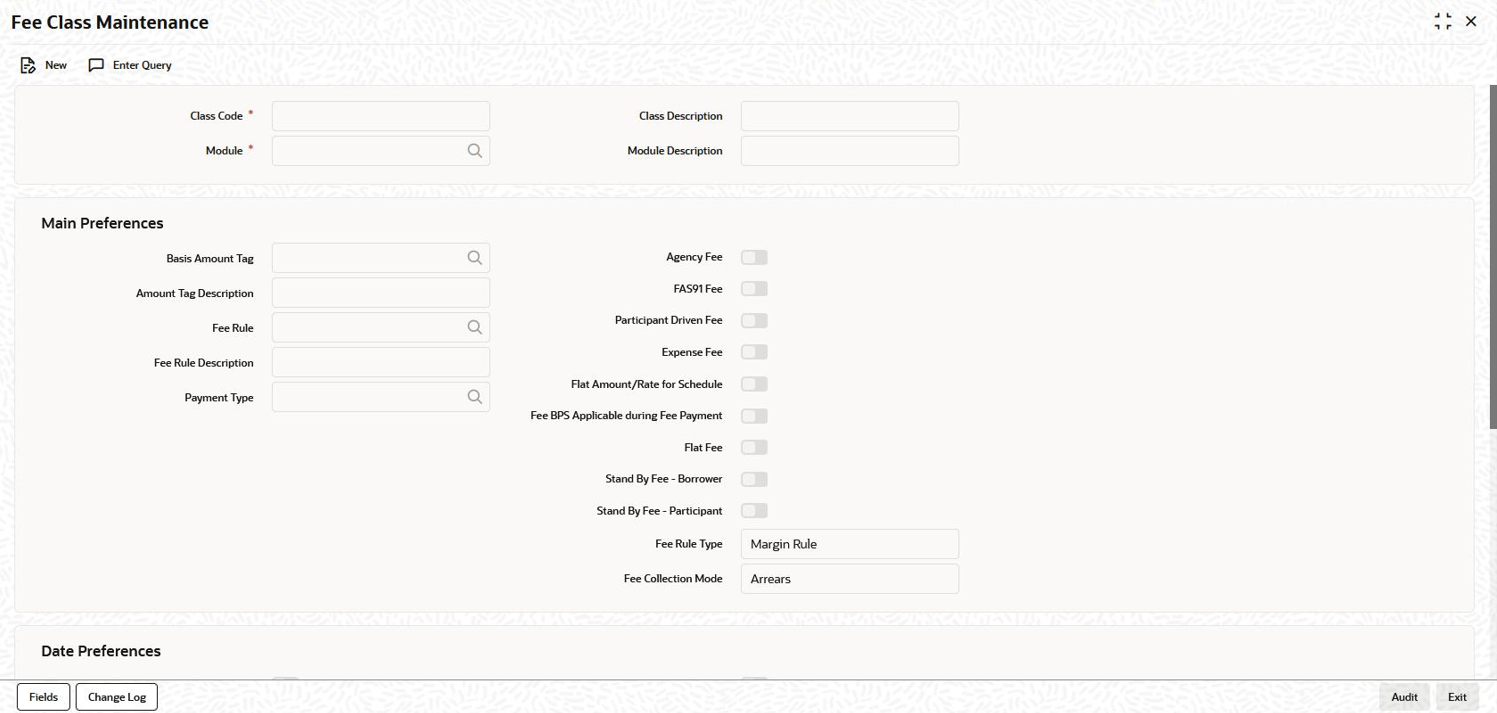

7.3.3 Maintaining a Fee Class

If you do not define a Fee Class, you have the option of attaching a Fee Rule to a product. In this case, however, you have to specify the fee preferences for the product at the time you associate the product with the rule.

- On the Homepage, type LFDFEECL and click next

arrow.The Fee Class Maintenance screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can specify the basic details of the fee class in this screen. For

information on fields, refer to field description table.

Table 7-3 Basic Details of the Fee Class

Fields Description Class Code When defining a fee class, identify it with a unique code. The code helps you identifying the fee class in the system. You can devise a code consisting of a maximum of 10-alphanumeric characters. Description Briefly describe the fee class you are creating to facilitate identification of the same. The description can consist of a maximum of 30-alphanumeric characters. Module You have to select the module for which the fee class details are being maintained. Choose LB to indicate that the details are specific to the Loans Syndication (LB) module. When you select the module, the description associated with it is displayed alongside.

Specifying Class Preferences

In the Main Preferences section of the screen, you have to specify the following:The following table illustrates the amount tags used at the facility, tranche, and drawdown levels.Table 7-4 Class Preferences

Fields Description Agency Fee You may select this option to indicate that the fee income received on a contract is meant for the leading agent alone. It does not get propagated to the other participants of the syndication contract. If you select this option, you are not allowed to select the Participant Propagation Required option.

FAS91 Select this check box to perform FAS91 computations. System validates if: - The Agency Fee check box is selected.

- The Basis Amount Tag is maintained as USER INPUT.

- The Fee Collection Mode is ADVANCE.

- The Accrual Required box is selected.

Participant Driven Fee If you select this check box, system allows you to define an individual fee amount for each participant. Note:

- If you select this option, you are not allowed to select the Agency Fee option.

- System performs the following validations on

selecting the Participant Driven

Fee box:

- The Basis Amount Tag is maintained as USER INPUT.

- The Fee Collection Mode is ADVANCE.

Expense Fee Select this check box to enable the expense fees. The fees can be accrued or amortized. The expenses may be flat amounts (such as Legal Fee) or rate based on a specific basis amount (such as fee paid to credit guarantor).

These are expenses incurred against a contract which the bank does not directly recover from the borrower. These expenses can be one-time expenses or periodic expenses or paid in advance or in arrears. They may be incurred at the Facility/Tranche/ Drawdown levels.In expense the fee calculation happens only within the schedule period of the contract whereas in normal arrears the fee calculation happens from the start of the contract till the schedule end date and for advance from the start of the schedule till the end of the maturity date.

For more information refer, to Expense Fee section in this User Manual.Stand By Fee - Borrower Select this check box if you want enable stand by fees for borrower. Stand by fee rate is determined by overall borrower drawdown level of total facility and applied to all undrawn amounts, using one single rate for all participants’ undrawn amounts. Stand By Fee - Participant Select this check box if you want enable stand by fees for participant. Each participant’s standby fee rate is determined on specific drawdown level. Note:

- Stand By Fee Rule is only applicable for FC module

- Stand By Fee - Borrower/Participant is defined at Fee Class Maintenance screen (LFDFEECL). Not modifiable at Facility Product or Facility Contract.

- Fee Collection Mode for Stand By Fee is always Arrears Fee.

- Fee Rule Type for Stand By Fee is always Margin

- Accrual Required and Participant Propagation is mandatory in case of Stand By Fee.

Fee Rule Type While defining a class, you can specify the rule type for the fee component. The available options are: - Margin Rule

- ICCF Rule

Fee Rule Select the applicable fee rule from the option list. The option list includes the rules that you have maintained through the Fee Rule – Definition screen. When you select the rule, the description of the rule is also displayed. Fee Collection Mode Select the mode of collecting the fee. The available options are: - Advance: Typically, an advance fee component is collected on the value date of the contract. However, you can define a schedule for the component if the whole amount is not liquidated upfront. An advance fee component with bullet schedule can have multiple instances ( that is,. you can use the same component multiple times to collect the fee). If the advance component has predefined schedules, you cannot reuse the component.

- Arrears: An arrear fee component cannot have schedules with Start Date equal to the Value Date of the contract.

Note:

Fee rate maintenance is done for Advance and Arrear fee components.Basis Amount Tag When defining a fee class, select the basis amount tag on which the fee amount should be calculated. The applicable amount tags are displayed in the option list provided. The description of the tag is displayed when you select the amount tag. System computes a fee for issuing a letter of credit. This amount is paid only to the banks that have issued the LC. You can define a maximum of 10 such issuer fee components for 10 different issuers. You can associate each fee component with the corresponding basis amount tag.

Basis Amount Tag Facility Tranche Drawdown Utilized No Yes No UNUTIL No Yes No DD count No Yes No User input Yes Yes Yes Principal No No No Principal-Outstanding No No No Tranche-Current-Limit No Yes No Tranche Outstanding No Yes No ISSUER1_LCOS No Yes No SSUER2_LCOS No Yes No ISSUER3_LCOS No Yes No ISSUER4_LCOS No Yes No ISSUER5_LCOS No Yes No ISSUER6_LCOS No Yes No ISSUER7_LCOS No Yes No ISSUER8_LCOS No Yes No ISSUER9_LCOS No Yes No ISSUER10_LCOS No Yes No COMMERCIAL_LCOS No Yes No STANDBY_LCOS No Yes No COMPONENT_AMOT No Yes No COMPONENT_SPLT No Yes No TRANSFER_AVL No Yes No OUTSTANDING No Yes No AVAILABLE No Yes No Example

For an Advance fee component, the following amount tags can be used:- USERINPUT

- TRANSFER_AVL

- OUTSTANDING

- COMMERCIAL_LCOS

- STANDBY_LCOS

- AVAILABLE

- UNUTIL

- UTILIZED

Parent topic: Maintaining Fee Rule Details