7.3.17 Refunding Tax for Interest and Fees

In the product tax linkage of Tranche and Facility maintenance, you can add tax

components for various Fee components. And the contract level, you can either withheld

or waive of the tax for these components. You can maintain tax rate for a combination of

individual tax component and a investor or for the combination of individual tax

component which is common for all investors.

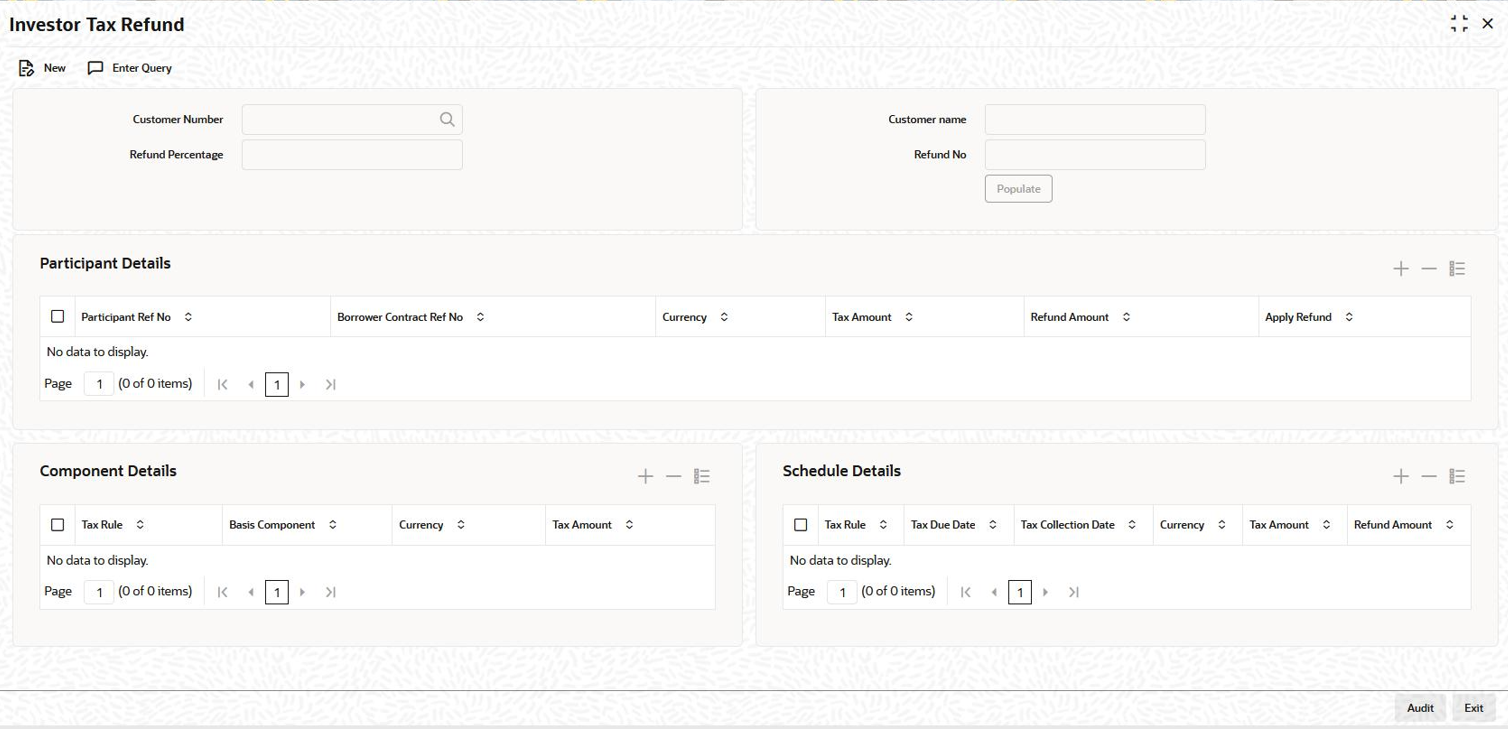

Oracle Banking Corporate Lending enables you to refund tax for a specific investor for all contracts or specific contract using Investor Tax Refund screen.

Specify the User ID and

Password, and login to Homepage.

Parent topic: Maintaining Fee Rule Details