- Loan Syndication

- Rolling over a Drawdown

- Specifying Contract Rollover Details

- Specifying Details for Split Rollover

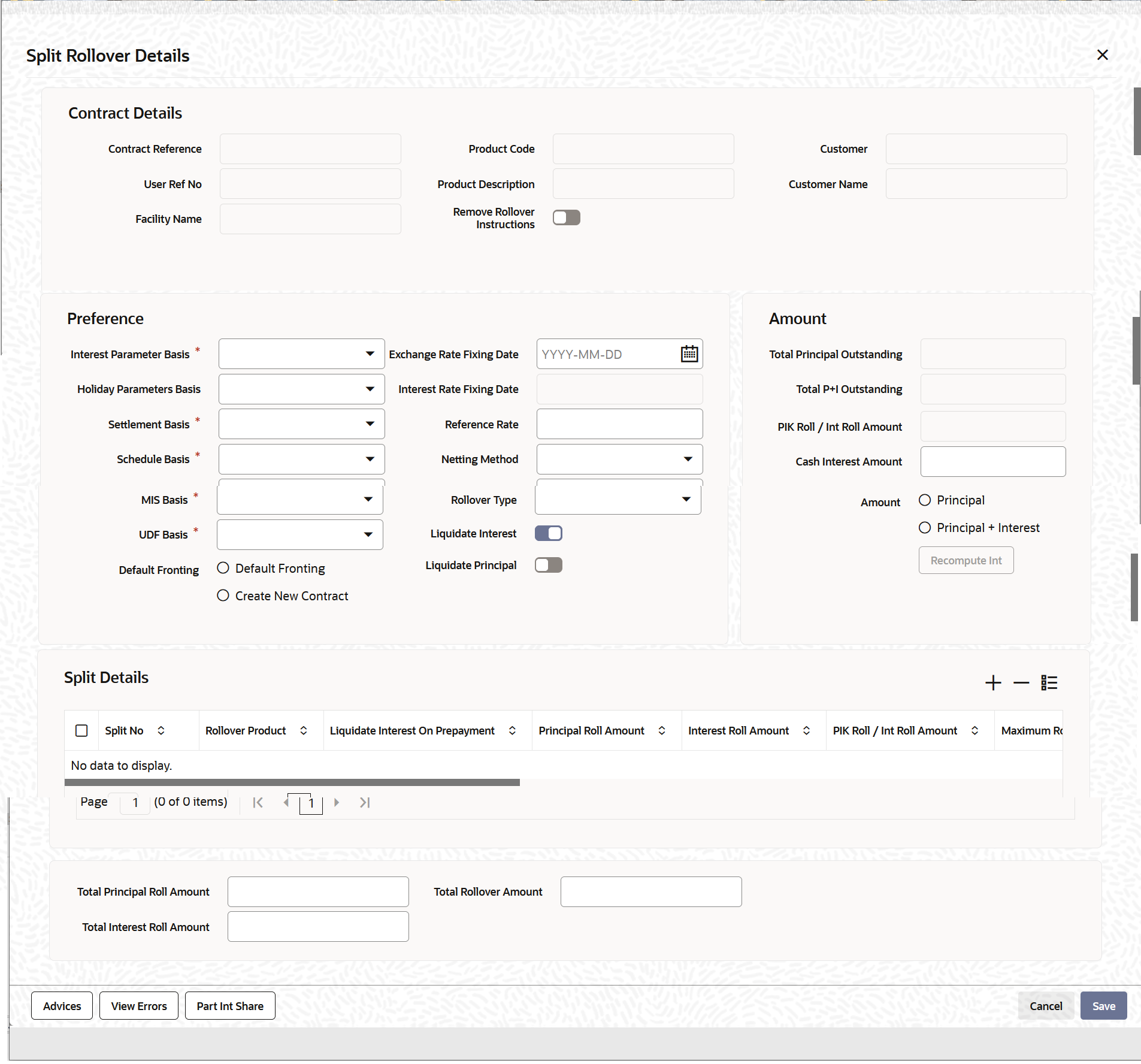

8.3.7 Specifying Details for Split Rollover

- From the Homepage, navigate to Drawdown Contract Online screen.

- From the Drawdown Contract Online screen, click

Split Rollover.The Split Rollover Details screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - When you indicate the rollover method as Split, the

system creates multiple drawdowns out of the original drawdown. For each rolled

over contract, the system generates a split number. After specifying the details

for the first split drawdown, click Add Row button to

specify details for the next drawdown.The defaulted value for the Netting option is No Netting.

Note:

This section explains only those features that are specific to split rollover. The preference applicable for Normal rollover is applicable for Split rollover as well.Table 8-3 Split Rollover Details

Fields Description Default Fronting Indicate if the fronting detail has to be defaulted for the increase in amount during rollover / reprice. You can select one of the following options: - Default Fronting - select this option to default the front/fund details from the latest disbursement.

- Create New Contract – select this option to create a new contract for the increase in amount without the default front/fund details.

On selecting the Create New Contract option, the system defaults the front/fund details to the new disbursement event (VAMB/VAMI) which is triggered as part of rollover processing, but the BPMT event will not be fired based on these default options. Further, as part of Rollover processing, one of the child contracts are created for the increase in amount without any default fronting/funding options. In the split child contract, for the increased amount, the funding details are captured and borrower payment is also sent from this child contract.

Amount You have to specify the amount that can be rolled over to create each of the multiple drawdowns as part of the rollover split. This amount depends on the Rollover Amount Type you select. The rollover amount type can be any one of the following: - Principal - In this case, the system rolls over the outstanding principal as displayed in the Total Outstanding Amount field. In addition, the system also allows you to amend the outstanding amount. You can specify the amended amount in the Principal Roll Amt field (by default, the outstanding amount is displayed here). This amount can be either greater than or lesser than the outstanding principal amount. This is treated as a special amount rollover.

- Principal + Interest – In this case, the system rolls over the outstanding principal along with the interest component. The Total Outstanding Amount displays the sum of outstanding principal and interest. The system also displays the interest amount to be capitalized in the Interest Rollover Amount field. If you amend the outstanding principal amount in the Principal Roll Amt field, the system adds the interest to the principal rollover amount to arrive at the total amount to be rolled over and displays the same in the Total Roll Amt field.

PIK Roll amount gets updated if the PIK Rollover with capitalization is selected for parent contract.Note:

In the case of split renewals, the system apportions the interest amount against each split contract in the same ratio as the principal split break up.Liquidate Principal By default, the system selects this box. It instructs the system to liquidate the outstanding principal on rollover. If you have chosen the automatic mode of liquidation, the system does not allow you to deselect this check box. You can amend this option only if the following criteria are met: - If liquidation mode is defined as Manual and

- If residual principal component is due for liquidation

Liquidate Interest By default, this check box is deselected. If you select this box, the system liquidates the outstanding interest on rollover. If you have chosen the automatic mode of liquidation, the system automatically selects this box and does not allow you to change this preference. You can amend it only if: - If the liquidation mode defined as Manual.

- If residual interest component is due

for liquidation.

Note:

A separate LIQD event is posted for generating accounting entries for the components liquidated during rollover.

Rollover Netting You have to specify the rollover netting indicating parameter here. The options are:If any of the netting option is selected, then the Liquidate Principal and Liquidate Interest boxes are selected and disabled.- No Netting

- Principal Increase + Interest

Rollover Product Oracle Banking Corporate Lending allows you to select a product for the new rolled-over/child contract. The option-list displays the drawdown products defined in the linked tranche (under which the drawdown being rolled over is booked). As mentioned above, if the product you select is a Prime Loan product, you have the option to select Liquidate Interest on Prepayment box. If selected, whenever your customer makes a prepayment towards the rolled over loan, the system also liquidates the interest on the amount prepaid. Schedule Basis You have to specify the basis on which the system should compute the repayment schedules for the rolled over drawdown. The options are: - Product: The repayment schedules defined for the product l becomes applicable to the rolled over drawdown.

- Contract: The repayment schedule specified for the original drawdown is applicable to the rolled over drawdown.

- Auto: The system defines the repayment schedules based on the reduction schedule defined for the tranche under which the drawdown is rolled over.

Interest Parameter Basis Specify the basis on which the interest components should be applied for the rolled over drawdown. The options are: - Product

- Contract

MIS Basis Here, you have to specify whether the MIS details for the rolled over drawdown should default from the product level or applied from the original drawdown. UDF Basis In this field, you can indicate whether user-defined fields (UDFs) for the rolled over drawdown must default from the drawdown product or the original drawdown that is being rolled over. Settlement Basis In this field, you can indicate the basis on which the system should pick up the settlement details for the rolled over drawdown. The options are: - Product

- Contract

Holiday Parameter Basis You have to specify the basis for holiday processing if schedules, value date and maturity date of the rolled over drawdown fall due on holidays. The options are: - Product: Holidays are processed based on the parameters defined for the drawdown product.

- Contract: The holiday processing rules maintained for the original drawdown becomes applicable to the rolled over drawdown.

PIK Rollover Amount If the product you have selected has an associated PIK component, then the calculated PIK margin amount for that contract gets displayed here. - If the selected product has no associated PIK component, then the field name will be displayed as Interest Rollover Amount instead of PIK Rollover Amount.

- There can not be any additional tranche utilization due to the capitalization of the PIK amount.

- When a child contract is rolled over, only the PIK margin calculated for the child contract gets displayed in this field.

- While capturing the rollover instructions for a parent contract with PIK margin, only drawdown products with PIK margin component are available for selection.

Cash Interest Amount Specify the interest amount to be liquidated for the borrower which should be lesser than or equal to the outstanding interest of parent drawdown. This field is disabled during Principal+Interest Rollover (P+I) and enabled only for drawdown contracts under prorata non-lead tranches and the propagation value for the drawdown should be Cash. Maturity Date.

You can capture the maturity date of the rolled over drawdown here. If you do not specify the maturity date, the system will arrive at the maturity date based on the Roll By value and the Maturity Days specified for the drawdown.If you do not select any options here, system will display the maturity date based on the Maturity Date Basis maintained at the product level (in the Rollover Details screen).

Maturity Days You have to specify the number of days that is to be added to the value date of the new split drawdown to arrive at the maturity date of the drawdown. Roll By Indicate the tenor basis upon which the maturity days specified for the rolled-over contract is reckoned. The options are: - Days

- Months

- Quarters

- Semi-annuals

- Years

Note:

- Rate fixing and exchange rate fixing are applicable as per the explanation provided for normal rollover.

- For products with associated PIK component, the calculated PIK margin amount gets displayed in PIK Rollover Amount.

Consider for Split Select this check box to specify the split that should be considered for the new contract created for the increase in amount without the default front/fund details. It is mandatory to select this option for one of the splits if Create new contract option is selected.

Note:

On selecting the Default Fronting option, the Consider for Split is disabled.Example

Case 1: Split rollover instruction is captured as follows:On completing the rollover processing, it is as follows:Split No Rollover Amount Consider for Split 1 12M Y The split for 12M is internally split into 2M (increase in amount) and 10M (12M-2M). Child contracts C2 and C3 are created for 2M and 10M, respectively. For C3, all the participants are treated as fronting (defaulted from parent contract C1). For C2, there is no default fronting. User have to capture the fronting values manually using the payment processing browser.Split No Rollover Amount Consider for Split Child Contract 1 2M Y C2 2 10M N C3 Case 2: Split rollover instruction is captured as follows:On completing the rollover processing, it is as follows:Split No Rollover Amount Consider for Split 1 10M N 2 2M Y Child contracts C2 and C3 are created for 10M and 2M respectively. For C2, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is no default fronting. User have to capture the fronting values manually using the payment processing browser.Split No Rollover Amount Consider for Split Child Contract 1 10M N C2 2 2M Y C3 Case 3: Split rollover instruction is captured as follows:On completing the rollover processing, it is as follows:Split No Rollover Amount Consider for Split 1 7M N 2 5M Y The second split for 5M is internally split into 2M (increase in amount) and 3M (5M-2M). Child contracts C2, C3 and C4 are created for 7M, 2M and 3M respectively. For C2 and C4, all the participants are treated as fronting (defaulted from parent contract C1). For C3, there is no default fronting. User will have to capture the fronting values manually using the payment processing browser.Split No Rollover Amount Consider for Split Child Contract 1 7M N C2 2 2M Y C3 3 3M N C4 In case of rollover with capitalization of interest, and if Create New Contract option is selected, the split rollover amount (principal + interest rollover amount) captured for the split marked for Consider for split, should exactly match with the increase in amount.

This topic contains the following sub-topics: