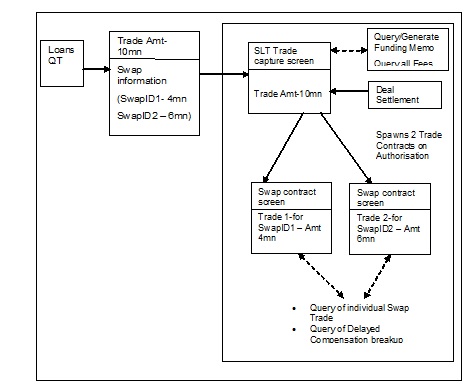

4.28 Processing Swap Deals

A swap is an agreement between two parties to exchange sequences of cash flows for a set period of time. Total return swap is a swap agreement in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based on the return of an underlying asset, which includes both the income it generates and any capital gains.

You can capture the trade details for swap trade also in the Draft Trade screen, like normal trade deals. The Swap details for the trade can be captured in the Draft Swap Details screen.

To capture details of swap details screen

- From the Homepage, navigate to Draft Trade screen.

- From the Draft Trade screen, click

Swap.

The Draft Swap Details screen is displayed.

- Contract reference number and user reference number

- Branch, desk and expense code

- Portfolio details

- CUSIP

- Ticket ID

You can enter the following details in Draft Swap Details screen. For information on fields, refer to the field description table.

Table 4-41 Draft Swap Details

| Field | Description |

|---|---|

| Swap ID | Specify the swap ID to be used to generate the swap contract. |

| Swap Counterparty | Specify the counterparty associated with the swap trade being performed. |

| Amount | Specify the amount associated with the swap trade.

The sum of the amounts allocated for all swap trades should be equal to the total trade amount. |

| Oasys Id | For swap trades originating in Loans QT, Oasys Id associated with the trade gets uploaded from Loans QT. For swap trades that are being captured in SLT, you need to specify the Oasys Id to be associated with the trade. |

| Swap Reference No. | The system automatically creates contracts for the Swap Ids specified here. The contract reference numbers of these swap level contracts get displayed here. |

Like normal contracts, you can view the swap trade contract details also in the Trade Online screen.

You can only view the details of the swap contract in this screen. The Parent reference number in this screen refers to the parent trade contract associated with this swap contract. System also defaults the Markit details (Trade Id and Allocation Id) in this screen.

During upload of data from Loans QT, the system checks if the corresponding desk is a Swap desk. If the desk is of Swap type then during booking as well as amendment of the contract, either the complete swap details need to be sent or no swap details should be sent. You cannot send the swap details partially.

If no swap details are sent initially, the system uses UNIDENTIFIED as the default swap Id with 100% allocation and tracks the position under this swap Id. The actual swap contracts are created under the parent trade, when the allocation details are sent by Loans QT.

The processing of swap trade contracts is carried out in a similar way as normal trades, except that most of the activities are performed at the parent trade contract level. The corresponding accounting entries are passed on, appropriately, to the swap contracts involved. All accounting entries corresponding to swap trades are posted at the swap Id level.

- You can amend the swap details, if required, before the trade is settled. But the amendment is possible only for the parent contract and not for the swap contracts. A pro-rata share of the trade amendment is passed on to the swap contracts based on the swap allocation.

- The system maintains the unsettled position for a combination of branch, desk, expense code and swap Id, when a swap trade is booked. On trade settlement or during trade amendments for the parent contract, the settled and unsettled positions are updated for each swap contract under the parent contract.

- While calculating realized PnL during the booking of a trade, the PnL entries are posted for each swap contract associated with the parent contract.

- Funding memo generation, as part of trade settlement, can happen only at the parent trade contract level.

- The settlement for the swap deals are handled at the parent trade contract level, as in the case of normal trade deals. The actual settlement entries are passed for each swap contract and the settlement amount is arrived at by apportioning the trade settlement amount according to the swap allocation. Payment messages are not generated for swap trades.

- Fees applicable for normal trades are applicable for swap trades also. The fee amount at trade level gets apportioned to individual swap level contracts based on the swap allocation. You cannot amend the fee details for individual swap contracts.

This topic contains following sub-topic: