4.2 A Borrower Facility Contract under Syndication Agreement

A facility contract is reached between a borrowing customer and a bank (or financial institution), which arranges or provides facility for the syndication. The arranger bank identifies one or more participants who pool funds to meet the borrowing requirements. The arranger bank disburses the loan, after receiving the contributions of the other participants. The participants share the interest and other income accruing from the loan, in the ratio of their participation that was agreed upon at the time of entering the tranche.

The syndication agreement with the borrowing customer is known as a borrower facility contract.

In a borrower facility contract, the borrowing customers receive loans from any of the arms or tranches. Each of the arms would have a set of participants, who would pool in their contributions toward the borrowing requirement in a mutually agreed ratio. The borrowing customer could receive loans towards the borrowing requirement as drawdowns from a tranche. Therefore, a single tranche would have a specified number of drawdowns.

Each of the players in a tranche (that is, the borrowing customer and the participants) enters into a commitment contract. The individual loans (drawdowns) under each tranche are loan contracts.

- The main borrower facility contract between the borrowing customers and the facilitating bank. The contract officialises the agreement and makes the terms binding by law on all parties entering into it. (For the main borrower facility contract, contracts are drawn up for each of the participants to mirror the borrower facility contract).

- The commitment contracts at the level of a tranche opened under the main borrower facility contract, for each of the entities – the borrower and the participants.

- The actual loans disbursed to the borrowing customer as drawdowns under a tranche of the main borrower facility contract

- The main syndication facility contract

One of your customers, Mr. Robert Carr, has approached you for a loan of 100000 USD on 1st January 2000. You enter into a syndicated contract with him on the same date, with a view to meeting his funding requirement by identifying other banks or institutions that can share the load of funding. The agreement is booked on 1st January 2000, and the end date, by which all components of the borrowed amount are repaid, to be 1st January 2001.

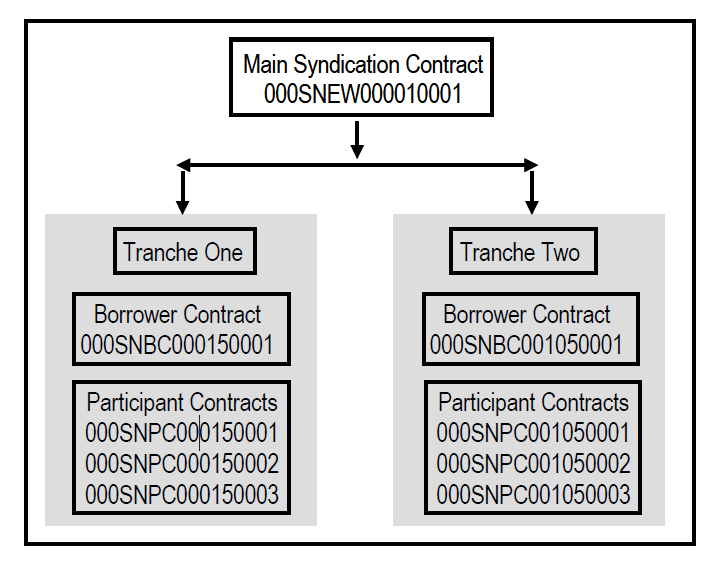

The main borrower facility contract is the one under which all subsequent tranche / drawdown contracts will be processed. When you enter this contract (with Mr. Robert Carr) into the system, it saves the contract and generates a unique identifier for it, known as the Facility Contract Reference Number. (that is, the Contract Reference Number of the main borrower facility contract). Let us suppose the Facility Contract Reference Number assigned to this contract is 000SNEW000010001. Whenever you enter a tranche or drawdown contract against this main borrower facility contract, you have to specify this number as reference information.Getting back to Mr. Robert Carr’s borrowing requirement, let us suppose that he wants to avail of the total loan principal in the following manner:- Total syndicated loan principal: 100000 USD, in two tranches, with a total tenor of six months.

- Portion of loan desired in the first tranche: 50000 USD. Mr. Carr

desires to completely avail of this amount in this first tranche in

the following drawdown pattern:

- 20000 USD on 30th January

- 15000 USD on 29th February

- 15000 USD on 31st March

- Portion of loan desired in the second tranche: 50000 USD. Mr. Carr

desires to completely avail of this amount in the second tranche in

the following drawdown pattern:

- 20000 USD on 30th April

- 15000 USD on 31st May

- 15000 USD on 30th June

- Tranche contracts

Mr. Robert Carr’s total syndicated loan principal is therefore required to be disbursed in two different sets of tranches, as seen above.

The tranche involves a commitment from Mr. Robert Carr as the borrowing customer, as well as a commitment from your bank, as the arranger bank in the contract, to disburse the loan after pooling together resources from any willing participants. Each of the participants enters into a commitment contract, committing to provide the funds as agreed.For the first tranche, wherein a principal of 50000 USD is to be disbursed, your bank has now identified Brinsley Bank and Dayton Commercial Bank as potential sources from whom funding may be obtained, to meet Mr. Carr’s borrowing requirement. The funding load is proposed to be shared in the following pattern, which is known as the ratio of participation:Let us suppose that the first tranche is booked on 15th January. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:- Your bank (Participant) : 10000 USD

- Brinsley Bank (Participant) : 20000 USD

- Dayton Commercial Bank (Participant): 20000 USD

- Borrower (Mr. Carr) Commitment: 000SNBC000150001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Commitment: 000SNPC000150001. This contract is created by the system when you the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

- Participant (Brinsley Bank) Commitment: 000SNPC000150001. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

- Participant (Dayton Commercial Bank) Commitment: 000SNPC000150002. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC000150001.

For the second tranche, wherein a principal of 50000 USD is to be disbursed, your bank has identified South American Overseas Bank and Banco Milan as funding partners. The ratio of participation is finalized as follows:- Your bank 10000 USD

- South American Overseas Bank 25000 USD

- Banco Milan 15000 USD

Let us suppose that the second tranche is booked on 15th April. Let us suppose that the following Contract Reference Numbers are generated by the system for the contracts:Therefore, the relationship of the tranche contracts under a main facility contract can be seen below, using our example:- Borrower (Mr. Carr) Commitment: 000SNBC001050001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the first tranche is being opened, which is 000SNEW000010001.

- Participant (Your Bank) Commitment: 000SNPC001050001. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

- Participant (South American Overseas Bank) Commitment: 000SNPC001050002. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

- Participant (Banco Milan) Commitment: 000SNPC001050003. This contract is created by the system when the BOOK event is triggered for the borrower commitment contract 000SNBC001050001.

- Drawdown Contracts

On any date including and following the 31st of January, Mr. Robert Carr can avail of his first drawdown loan of 20000 USD, under the first tranche. Similarly, on any date including and following the 30th of April, Mr. Robert Carr can avail of his first drawdown loan of 20000 USD, under the second tranche.

Accordingly, you have drawn up a drawdown schedule for disbursing the loans, where you have defined details such as the start date of the drawdown, the maturity date, currency, interest rate, and amount. These details are defaulted to the drawdown contract and you cannot change any of them when you enter a drawdown loan on the drawdown date. The drawdown loans are disbursed according to the drawdown schedule.You can enter each of Mr. Carr’s drawdown loans into the system. The system saves the loan contract with a unique reference number. When the BOOK event for each of the loans is triggered, the system initiates deposit contracts for the participants of the tranche, based on the drawdown loan reference number.

- Tranche One, First Drawdown Loan (31st January)

- Borrower (Mr. Carr) Drawdown Loan: 000SNBL000310001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main borrower facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the drawdown loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit: 000SNPD000310001. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

- Participant (Brinsley Bank) Deposit: 000SNPD000310002. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000310003. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000310001.

Therefore, the relationship of the drawdown contracts under the first tranche can be seen below, using our example:

Figure 4-2 Relationship of the drawdown contracts

The relationship of the drawdown contracts in each drawdown would be similar to the structure depicted above, with the appropriate tranche reference numbers and the drawdown contract numbers.

- Tranche One, Second Drawdown Loan (28th February)

- Borrower (Mr. Carr) Drawdown Loan: 000SNBL000590001. You enter this contract into the system after specifying the Facility Contract Reference Number of the main facility contract against which the tranche was being opened, which is 000SNEW000010001, as well as the Contract Reference Number of the borrower tranche contract against which the drawdown loan is being entered, which is 000SNBC000150001.

- Participant (Your Bank) Deposit: 000SNPD000590001. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

- Participant (Brinsley Bank) Deposit: 000SNPD000590002. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000590003. This contract is created by the system when the BOOK event is triggered for the drawdown loan contract 000SNBL000590001.

- Tranche One, Last Drawdown Loan (31st March)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL000900001 (As explained earlier)

- Participant (Your Bank) Deposit: 000SNPD000900001. (As explained earlier)

- Participant (Brinsley Bank) Deposit: 000SNPD000900002. (As explained earlier)

- Participant (Dayton Commercial Bank) Deposit: 000SNPD000900003. (As explained earlier)

- Tranche Two, First Drawdown Loan (30th April)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001200001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001200001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001200002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001200003. (As explained earlier)

- Tranche Two, Second Drawdown Loan (31st May)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001510001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001510001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001510002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001510003. (As explained earlier)

- Tranche Two, Last Drawdown Loan (30th June)

- Borrower (Mr. Carr) Drawdown Loan : 000SNBL001810001 (As explained earlier for tranche two)

- Participant (Your Bank) Deposit: 000SNPD001810001. (As explained earlier).

- Participant (South American Overseas Bank) Deposit: 000SNPD001810002. (As explained earlier)

- Participant (Banco Milan) Deposit: 000SNPD001810003. (As explained earlier)

Parent topic: Loan Syndication Contracts - Part 1