7.4.3.1 Processing Adhoc Expense Fees

- You can capture and collect adhoc expenses on Tranche and Drawdown contracts.

- You can collect income and expense fees at the same time on Accrual Fee Details screen.

- The amount is expected to be calculated manually and input as a flat amount in fee amount field component wise.

- You can collect such fee with current date, back value date and future value date as well. For future dated fees there is a provision to amend/cancel the fee before the value date.

- You are allowed to select if amortization/accrual of the fees is to be applied or not. If the fee is to be amortized/accrued, then you should be able to input the start and end dates during which such fee component should be amortized/ accrued.

- In case the fee is applied on tranche or drawdown, amortization/accrual is allowed only to the own share of the contract only.

- On authorization of the adhoc expense, the system triggers the necessary events and post accounting entries based on the product set up.

- In case of current and back value dated fees, the accounting entries gets posted immediately. In case of future value dated fees the accounting entries gets posted on the future value date. In case of future value dated entries, the standard holiday handling process for future dated events is applied.

- Since this is an adhoc expense, billing notice generation in advance is not be applicable.

- The system allows the same adhoc expense component to be collected on different dates. For example, the adhoc expense - Credit Agreement Amendment fee may be collected on 10-Aug-19 and 25-Sep-20. The system allows to input of the same fee component to be collected on these two different dates.

Limitations

- Reversal for Ad-hoc Expense fee does not propagate to OL from LB for self-participant. You have to manually reverse on OL side.

- For recurring Adhoc Expense overlapping of the schedules are not allowed.

- In single transaction different fee collection modes (Arrear and Advance) are not allowed.

Accrual Fee Class Maintenance

Specify the User ID and Password, and login to Homepage.

- On the homepage, type LFDACFCL and click next arrow.

The Accrual Fee Class Maintenance screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields.

- Class Code and Module

An adhoc expense fee class is created by providing a unique combination of Class Code and Module. You can enter the class code and select the module from the adjoining drop- down list.

- Class Description

A brief description of the class code

- Fee Type

Select the fee type as Expense for defining adhoc expense fee class.

Linking Adhoc Expense Fee Class to Syndication Loan Products

The fee that is linked on a contract processed under the product. You can link syndication loan product using the Loans Syndication - Facility Product Definition (FCDPRMNT) and Loans Syndication - Borrower Product Definition (LBDPRMNT) screens. You need to click Accrual Fee Details tab in these screens. To define adhoc expense fee, select the Fee Type as Expense.

Mapping LB and OL Products and Components

The components of LB product are mapped to corresponding components of OL product.The accrual fee component of LB products are mapped to corresponding accrual fee component of OL products. That is, Agency Component of LB product is mapped with OL Component of OL product. This mapping is done in LB OL Product and Component Mapping screen.

You can invoke the LB OL Product and Component Mapping screen by typing LBDPCMAP in the field at the top right corner of the Application tool bar and clicking the adjoining arrow button.Amortization Fee Details

You can maintain adhoc expense fee details for a product. These values get defaulted to Amortization Fee Details (LFDACFIN) screen.

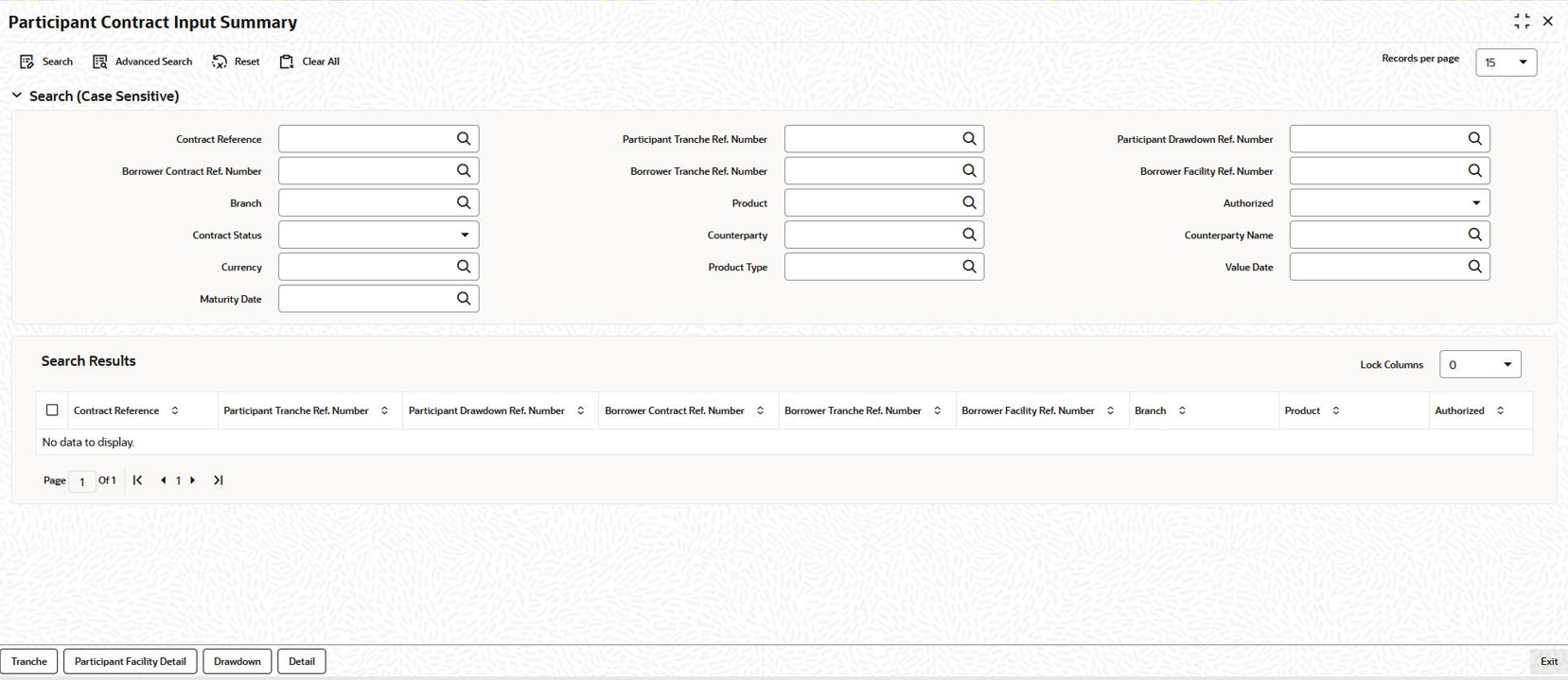

Participant Summary Screen

Participant accounting details can be viewed in Participant Summary screen.

- You can click Participant Summary tab from

Amortization Fee Details screen. You can check the

expense liquidation/ accrual details.

Figure 7-20 Participant Contract Input Summary

- After capturing the all the details, FELR event is fired for the contract on value date.

- If given value date is future date then FELB event is fired and FELR is fired on value date.

- On unlock/modification of the captured details FELA event is fired for the contract on application date.

- On reversal of the adhoc (FELR, FELA) fee FREV event is fired for the contract. In addition, FERB event is fired for reverse FELB event.

- FELA event contains accounting details on participant side but not on the borrower side.

Parent topic: Adhoc Expense Fees