- Loan Syndication

- FpML Messaging

- Viewing the Markit Agency Interface Browser

- Rollover Processing

14.17.13 Rollover Processing

Specify the User ID and Password, logim to Homepage.

From the Homepage, navigate to Markit Incoming Interface Browser screen.

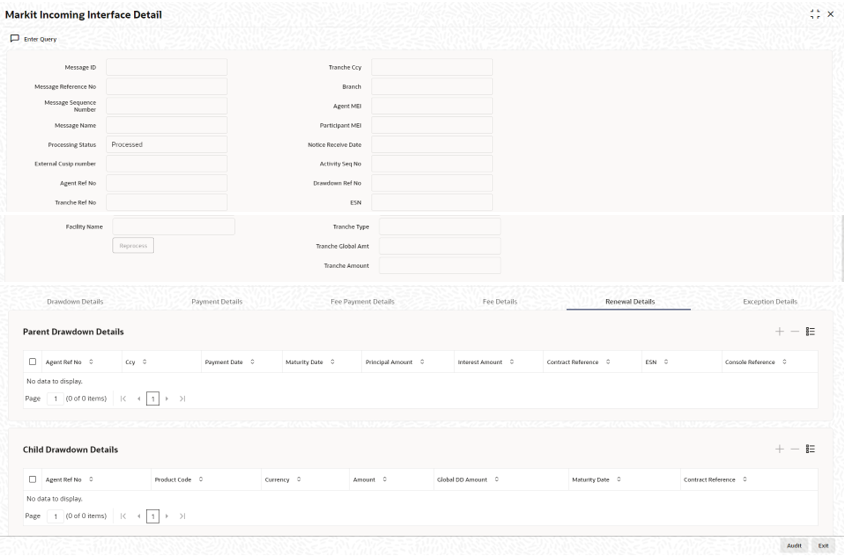

- From the Markit Incoming Interface Browser screen, click

Renewal Details.The Renewal Details screen is displayed.

- If the External CUSIP/ ISIN in the message is an active Borrower Tranche, the

fields in the Incoming Browser are populated with data from the message/tranche

contract. Based on the Agent Ref No system identifies the drawdown contract and

if the event date is the same as application date, system checks the

following:

- System then checks the drawdown products allowed for the tranche and if there is more than one product resolved for a message or there is no drawdown product for the floating Rate Index, Processing Status is marked as Enrich and exception ‘Product code resolution is failed is logged.

If rollover value date (payment date) and parent drawdown Maturity Date(Maturity Date) are same but are greater than event date, then the system processes the rollover instruction and create an uninitiated child contract, once the rollover interest rate fixing details and exchange rate fixing details (if drawdown currency is different from tranche currency) are available. The processing Status of the message is marked as Processed.

If rollover value date (payment date) is earlier than parent drawdown Maturity Date(Maturity Date), system considers the message as a re-price instruction.System checks the count of maturing drawdowns as per the message.System checks the count of new drawdowns as per the message.- If there is more than one maturing drawdown then system processes the message as a consolidated rollover.

- If there is one or more than one maturing drawdown and the child drawdown received in the message is already existing in the system, then it processes the message as a merge reprice.

- Agent Ref Nos. Of each maturing loan contract is matched with an active drawdown contract reference number.

- In case of consolidated rollover/ merge reprice, system considers the drawdown with highest rollover/re-price amount as the driver/re-priced contract.

- If there is one or more than one such contract and one maturing drawdown then system considers the message as a split rollover / split reprice instruction.

- Agent Ref No. of the maturing loan contract is matched with an active drawdown contract reference number.

System takes the outstanding principal amount as the rollover amount and fires ROLL event for the borrower and participant contracts.

System checks if the count of maturing Loan Contracts and new Loan Contracts are more than one then system considers it as Consol+Split rollover.The following fields can be enriched by clicking on the Enrich button.System logs the following exceptions during processing.- Payment Date

- Child contract Product code

- Child contract Maturity date

- Child contract Interest rate effective Start date

- Child contract Interest rate effective End date

- Child contract Exchange rate effective start date

- Child contract Exchange rate effective end date

- If Interest rate fixing details and Exchange Rate fixing rate details are not available then rollover fails with the relevant exception.

- If Agent Ref No. of any maturing loan contract is not found, system marks the Processing Status as Failed by logging an exception -Drawdown is not available.

- Re-price is applicable only if the parent drawdown product is of type floating else system marks the Processing status as Failed by logging an exception.

- If the child contract reference number, value date / maturity date is not within the tranche validity dates, system marks the Processing status as Failed by logging exception - Drawdown value / maturity is not within the tranche value/maturity date.

- If the rollover increase amount is more than tranche availability system marks the Processing status as Failed by logging an exception-Additional Rollover Amount is greater than Tranche Available Amount.

- If rollover value date (payment date) and parent drawdown Maturity Date(Maturity Date) are the same as event date but the event date is greater than application date, system considers this as a rollover instruction but marks the Processing Status as Hold till event date. System retains the message in the Incoming Browser till the event date. On event date during batch the system updates the Processing Status as Pending so that message can be picked for re-processing.

- If interest rate fixing details / exchange rate fixing details are not available during processing, (where drawdown currency is different from tranche currency), system marks the Processing Status as Failed and logs an exception- rate fixing details are not available

Parent topic: Viewing the Markit Agency Interface Browser