1.5 Maintaining Tax Categories for contracts

While maintaining customer information details you need to capture waiver

information for tax computation. All the tax categories you maintain here are displayed

at the product level, allowing you to link the tax category to the product.

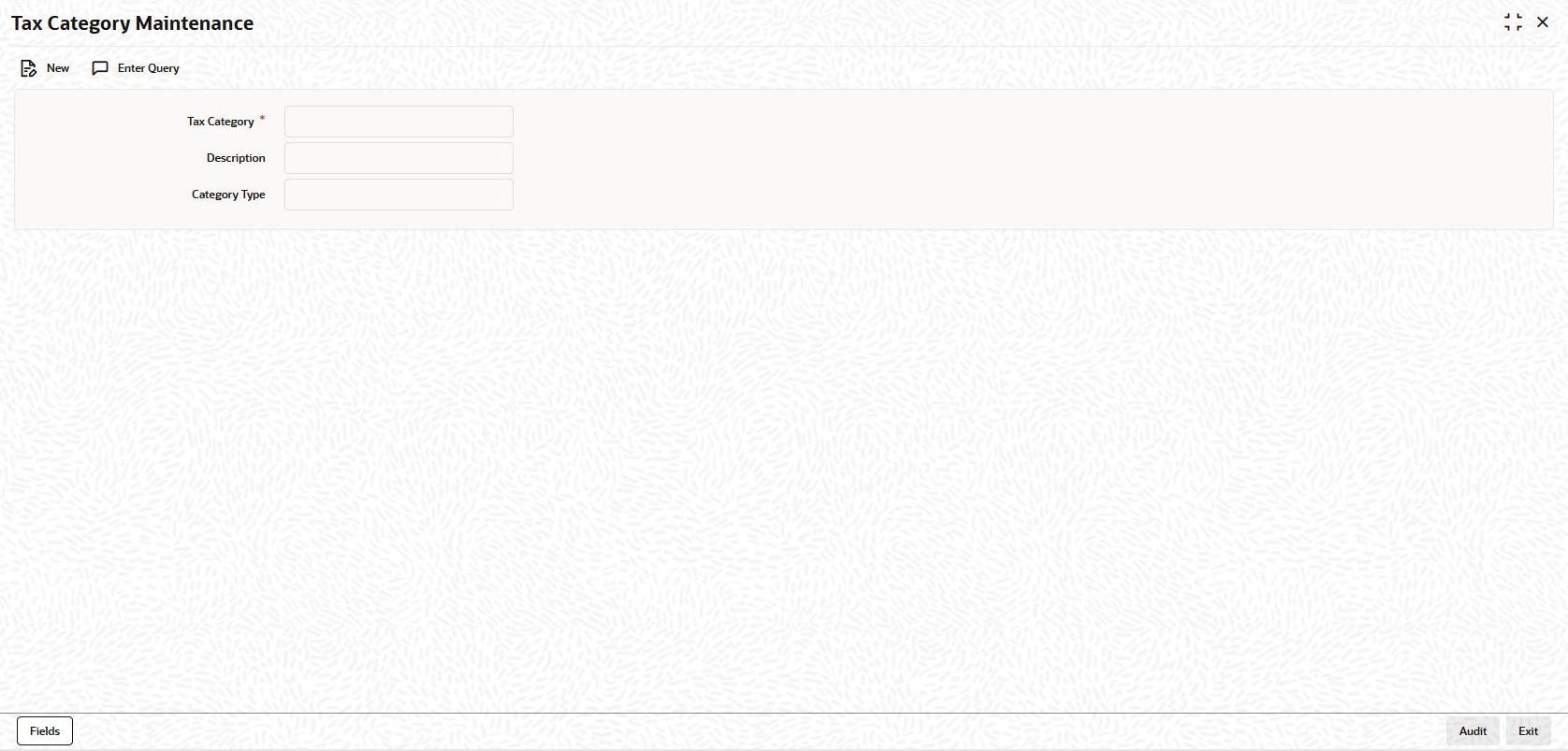

Tax categories, along with a brief description of the category can be maintained through the Tax Category Maintenance screen.

To capture details of tax category maintenance screen

Specify the User ID and Password,

and login to Homepage.

Parent topic: Building Tax Components