1.4 Processing Tax on a Contract

The taxes that apply on a contract can be of two types:

Expense and Withholding. The tax that

is borne by your bank is referred to as an Expense type of tax.

This tax is booked to a Tax Expense account. The tax that is

borne by counter party of a contract is referred to as a withholding tax, whereby you

debit the counter party’s account, and credit the tax component into a tax payable

account (to be paid to the government on the counter party’s

behalf).

Example

A tax on a Letter of Credit (LC) can

be levied either on the:

- Outstanding LC amount.

- On the commissions and charges that you earn to process the LC.

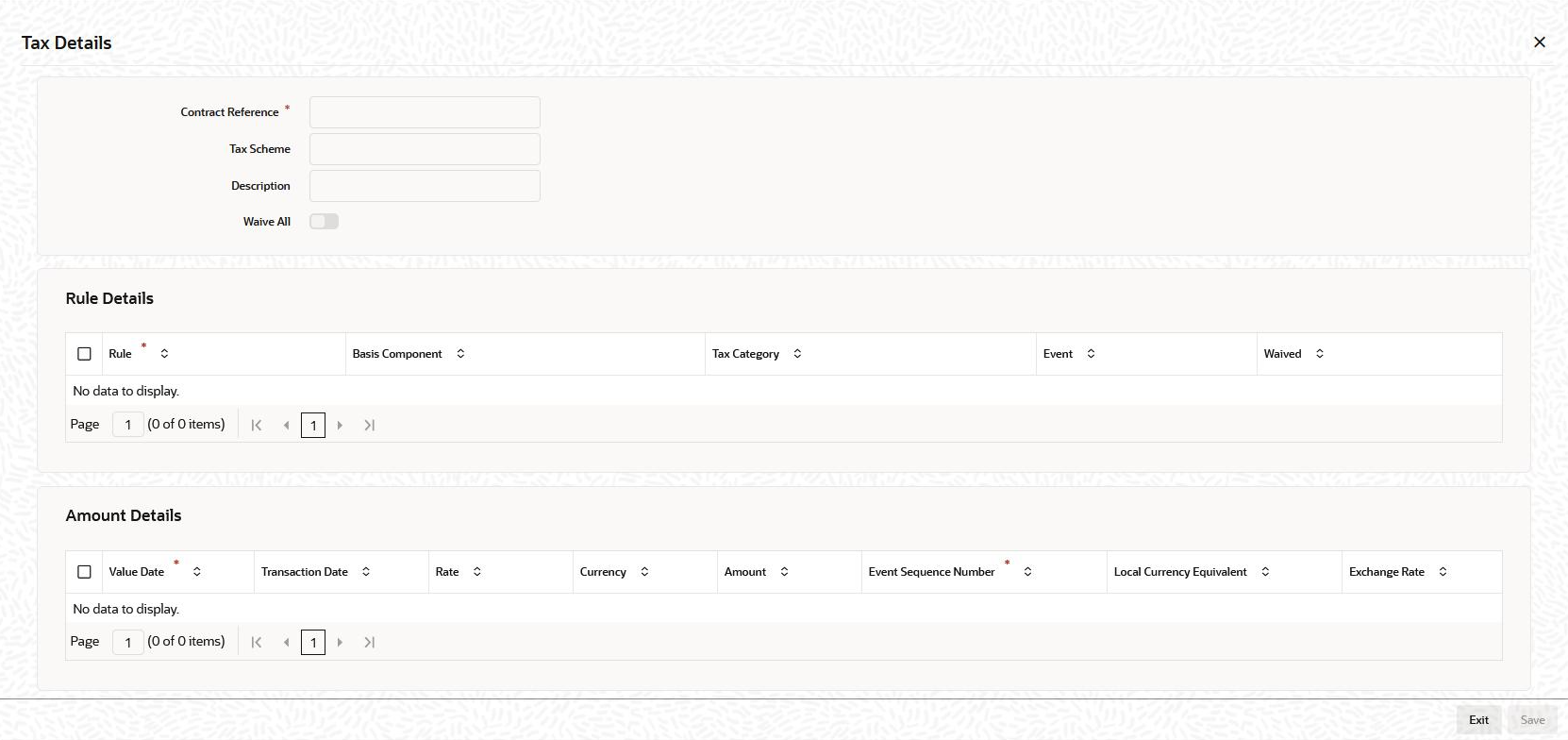

To capture details of tax details screen

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Loan and Commitment-Contract Input screen (OLDTRONL).

Parent topic: Building Tax Components