5.2.14.4 Fix Interest Rate for Drawdown

Just as you fix the exchange rate for the drawdown currency, you can also fix the interest rate for a predefined period. The Interest rate fixing days refers to the number of business days before the value date of the drawdown or the new rate fix period. Interest rate fixing for the new drawdown or the new rate fix period is done on this day.

Note:

- You can fix interest rates ONLY if you have checked the Rate Fixing

Required option for the interest component at the drawdown

product level (in the Interest Definition screen).

Further, rate fixing is applicable for an interest component with the following

attributes:

- Rate Type: Fixed

- Fixed Rate type: User input

- If the UDF RATE-VARIANCE is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required for rate changes for fixed rate contracts.

Note:

For main interest component if Rate Type is Fixed, then you can enter rate fixing details in Rate Fixing screen. In addition, you can enter the Spread and Margin Details.For more details regarding dual authorization, refer the heading titled Authorizing Overrides in the chapter titled Loan Syndication Contracts - Part 1 of this User Guide.

The system arrives at the Interest rate fixing date for the drawdown currency based on the Interest rate fixing days maintained at the tranche level and the holiday validation currencies specified for the drawdown currency.

For more details, refer the heading Specifying currency details for the tranche in this chapter.

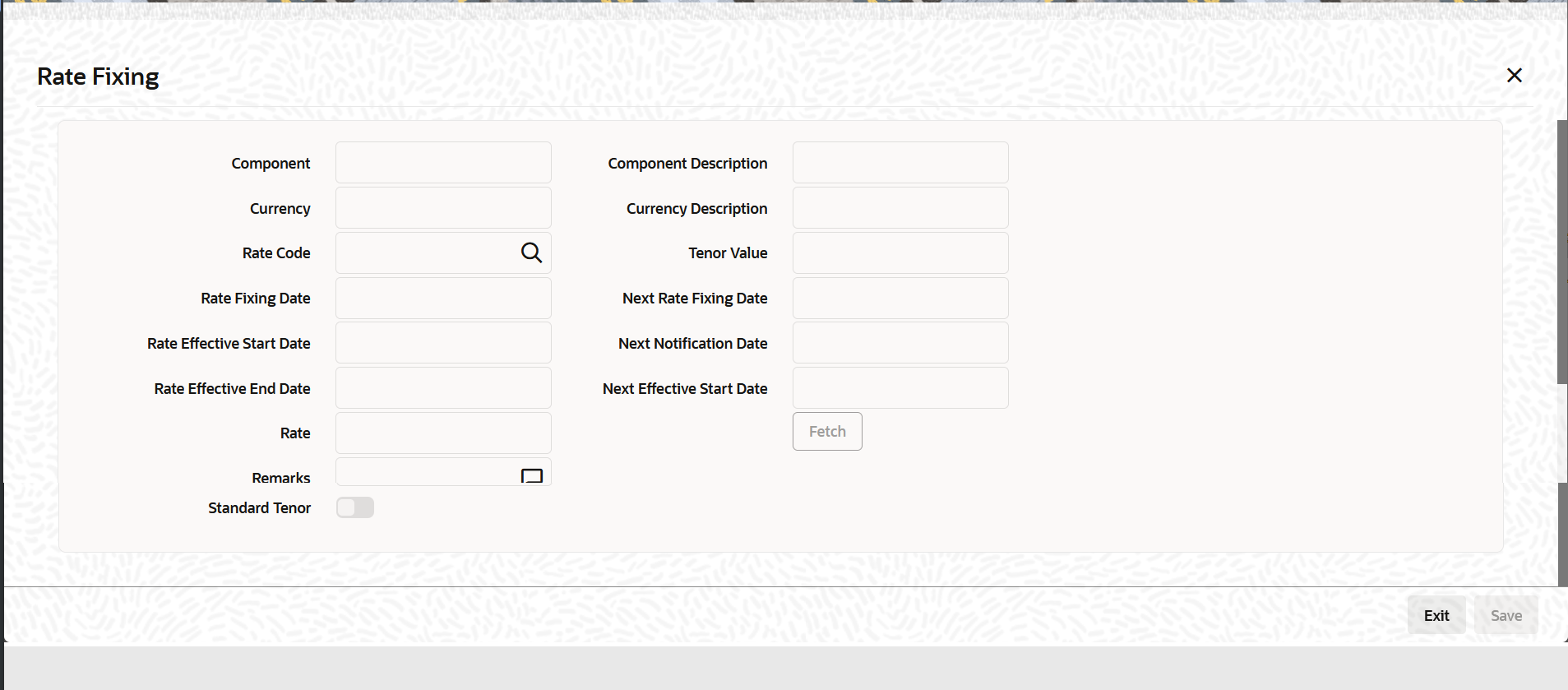

Rate Fixing Details screen

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Drawdown Contract Detail screen.

- The ICCF Details screen is displayed.

- The Rate Fixing screen is displayed.

Table 5-10 Rate Fixing Details

| Fields | Description |

|---|---|

| Rate Code | You have to specify the floating rate code based on which you can specify the interest rate fixing tenor and the default fixing rate. |

| Tenor Value | You can specify the rate fixing period by specifying a Tenor Value or the Rate Effective End Date. If you are specifying a tenor, you can select a value from the option list which displays the tenor values associated with the rate code you select. This is based on your maintenance in the Floating Rate Code Definition screen. Upon choosing a value, the following details are also displayed:

|

| Rate Effective End Date | If you do not want to specify a Tenor Value, you have the option to capture the end date of the rate fixing period. This date should not be less than or equal to the Rate Effective Start Date. The system displays the following after you specify the end date:

|

| Rate | The system defaults the interest rate based on the rate code and the tenor value/effective end date you specify for the drawdown. You can change the default rate, if required.

If the base rate is changed or new rate is added or the floating rate codes are changed, the system recalculates the interest. Note that it considers the margin rates maintained for the participants while recalculating the interest due for the participants. For more details on negative rate processing, refer the title Maintaining Loans Parameters Details in the chapter Bank Parameters in Core Services User Guide. |

| Remarks | You can also capture additional information, if required. This is used only for information purposes.

Click the Ok button to save and exit the screen. |

Note:

- You have to fix the tenor and rate for the next tenor before the end of the current rate fix period. In case you fail to fix the rate for the next period, system applies zero interest rate for the rest of the period until rate fixing happens.

- Interest Rate fixing occurs on the Interest Rate Fixing date after considering the holiday preferences and the number of Interest Rate fixing days from the start of the new fixing period.

- For the first time, you can fix the interest rate as part of drawdown booking. Subsequent rate fixing should be performed through the LB Interest Rate Fixing screen.

Capturing the Value date

On click of unlock button you are allowed to capture the value date by altering the rate effective start date.Note:

- The IRAM event is registered individually for each amendment.

- After save, you are allowed to view the interest rate for both the periods, to verify the interest rate.

- You have to manually authorize both the IRAM events individually.

- If there is no value date (end date) captured or you can click the cancel button in the value date screen. The End date is disabled and you are allowed to amend only the interest rate.

- If user fixes interest rate for the new period from Interest Rate Fixing Screen, IRFX event is registered.

For details on the LB Interest Rate Fixing screen, refer the heading Fixing Interest Rate after drawdown booking in this chapter.

Parent topic: Specifying Drawdown Interest Details