4.2.29 Interpolation

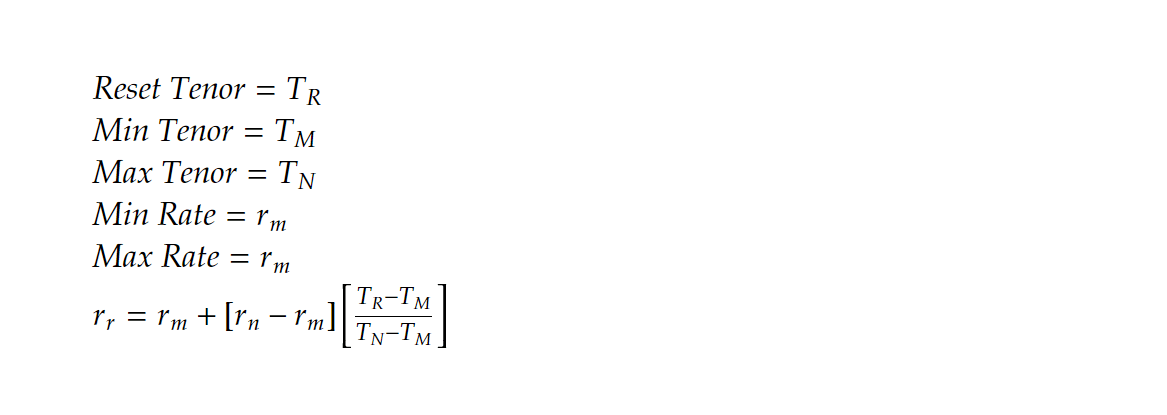

Interpolation is used to determine interest rates for a period of time that are not available.

In this scenario, the interest rate is the dependent variable, and the length of time is the independent variable. To find an interest rate through interpolation, you must have the interest rate for both a shorter period of time and a longer period of time.

In Corporate Lending, the standard interpolation formula is modified so that the system selects the actual number of days in a month rather that directly selecting the tenor shown in the Floating Maintenance screen.

When the Rate Calculation Type is set to Interpolate, the system calculates the rate based on the rates of shorter and longer tenors. The periods used for interpolation are determined by the loan parameter INTERPOLATE_WITH_ACTUALDAYS, which defaults to Y.

- When this field is set to Y (Default), the system calculates interpolation based on the actual number of days in each month within the reset tenor. For example, if the reset tenor spans of one month has 30 days and another month has 31 days, the system will use actual calender days, which has 30 and 31 days in its interpolation calculation.

- When this field is set to N, the system uses the predefined tenor slabs from Floating Rate Maintenance (CFDFLTRI) screen rather than the actual calendar days, even when the tenor days are multiples of 30.

Figure 4-7 Interpolation Formula

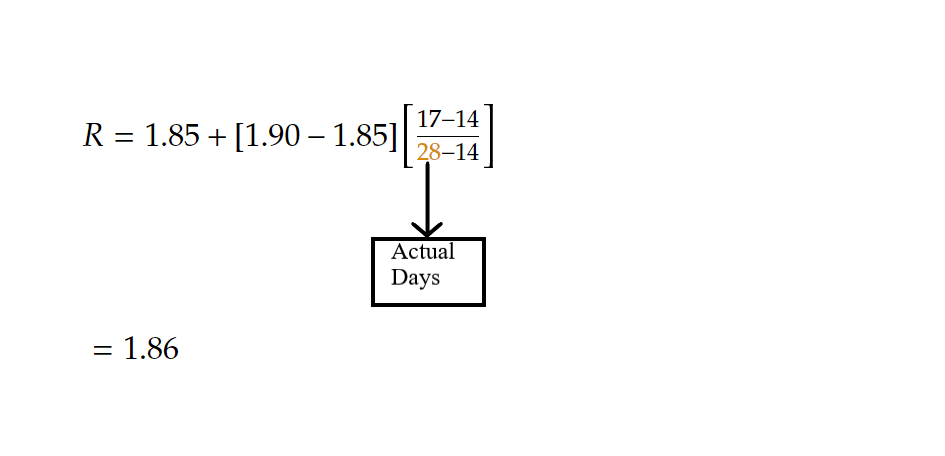

For example

Floating rates are maintained in the following format.

Currency - USD

| Tenor | Rate |

|---|---|

| 0 | 2.1 |

| 7 | 1.78 |

| 14 | 1.85 |

| 30 | 1.90 |

| 60 | 2.1 |

| 90 | 2.03 |

| 180 | 1.85 |

| 360 | 1.7 |

| 999 | 1.89 |

Schedule Date is 4-2-2015 and reset tenor is 17.

Parent topic: Loan Disbursement Details