3.5.7 Charges Commissions and Taxes

This topic provides the systematic instructions to capture the Charges Commissions and Taxes details in the application.

This tab defaults the charges details, if charges, commissions and taxes are available under the product. The user can select the account number from the demand deposit and corporate deposits account list that displays the account number along with the account name, account currency and account branch.

- Specify the Charges Commissions and Taxes details.

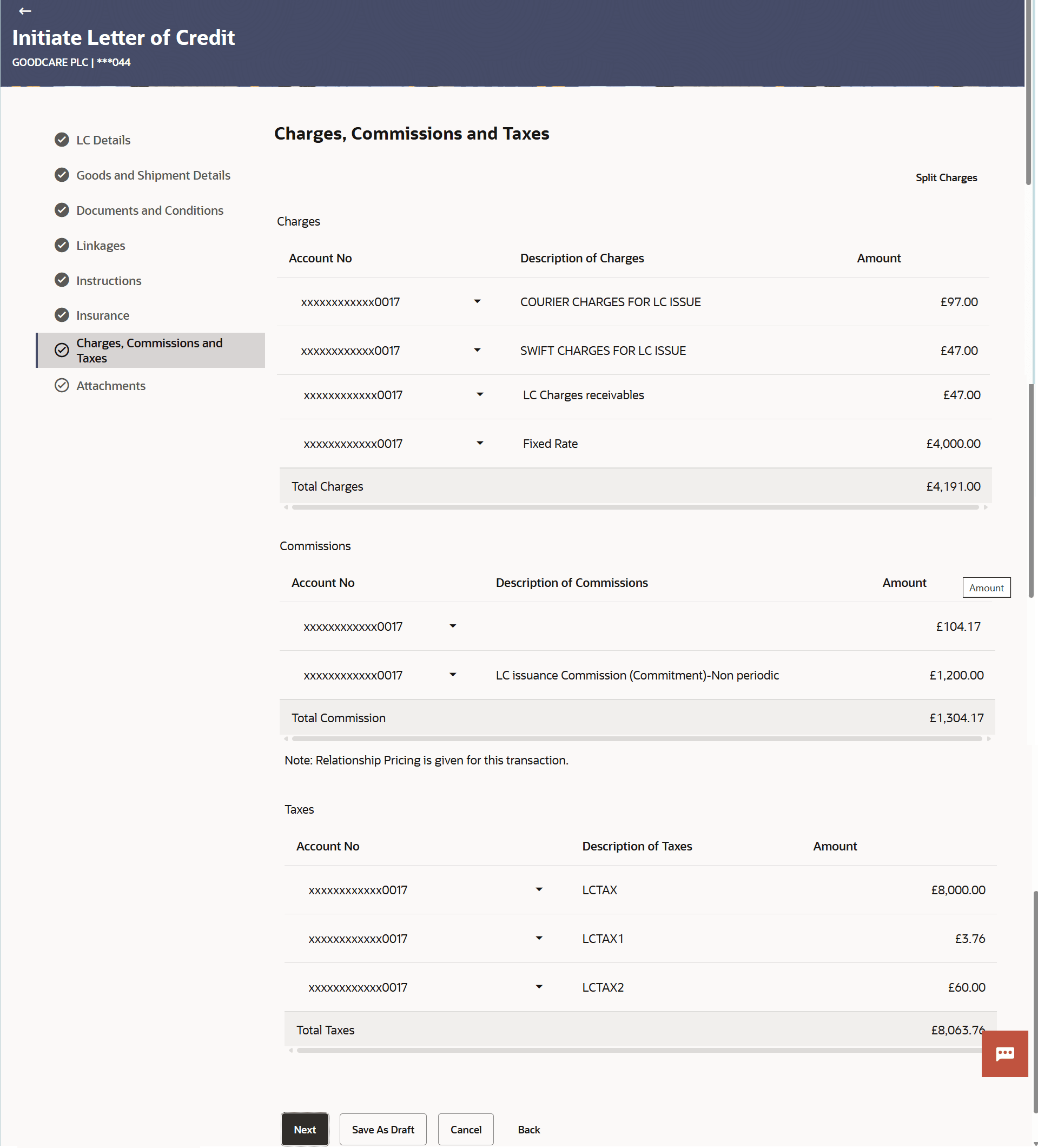

Figure 3-18 Initiate Letter of Credit - Charges Commissions and Taxes tab

Note:

The fields which are marked as Required are manadatory.For more information refer to the field description table below:

Table 3-17 Charges Commissions and Taxes - Field Description

Field Name Description Charges This section displays the Charges details. Account No Select the account which will be charged for the specific charge. Description of Charges Displays the description of the charges. Amount Displays the amount that is maintained under the charge. Total Charges Displays the total charge that will be levied in the transaction. Commissions This section displays the Commission details. Account No Select the account from which the commission will be taken. Description of Commissions Displays the description commission applicable. Amount Displays the amount that is maintained under the commission. Total Commission Displays the total commission amount. Taxes This section displays the Taxes details. Account No Select the account from which the taxes will be taken. Description of Taxes Displays the description taxes applicable. Amount Displays the amount that is maintained under the taxes. Total Taxes Displays the total Taxes amount. - In the Charges section, select the appropriate account, from the Account No list.

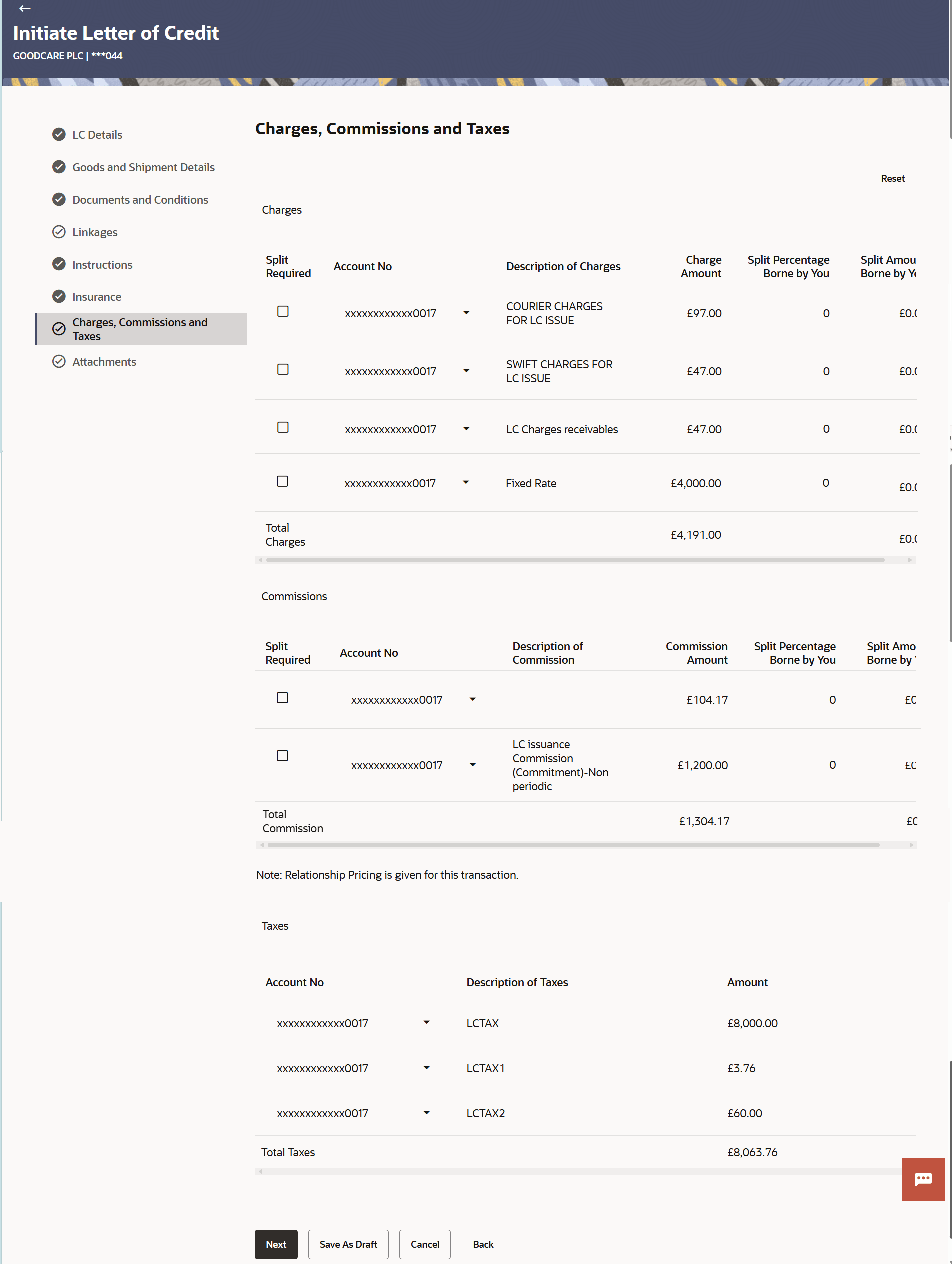

- Click Split Charges link on the top right corner of the screen, if you want to

split the charges.The Initiate Letter of Credit – Charges screen appears with split

charge details.Charges – Split Charges

The user can enter the split percentage borne by them. System defaults the split percentage as 50. The user can view the actual value that is to be paid by him in the ‘Split Amount Borne by You’ field.

For more information refer to the field description table below:

Table 3-18 Charges Commissions and Taxes - Field Description

Field Name Description Charges This section displays the Charges details. Split Required Select the check box for which split of charge is required. Account No Select the account number for levying Cancellation Charges / Import Advice Charges. Description of Charges Displays the reason/ narration of charges levied for various LC processes. Charge Amount Displays the amount of charges. Split Percentage Borne by You The system defaults the split percentage that is to be paid by you, which is 50. The user can change the value.

Split Amount Borne by You Displays the split amount that is to be paid by you. Total Charges Displays the total charge amount. Commissions This section displays the Commission details. Split Required Select the check box for which split of commission is required. Account No Select the account from which the commission will be taken. Description of Commissions Displays the description commission applicable. Commission Amount Displays the amount that is maintained under the commission. Split Percentage Borne by You The system defaults the split percentage that is to be paid by you, which is 50. The user can change the value.

Split Amount Borne by You Displays the split amount that is to be paid by you. Total Commission Displays the total commission amount. Taxes This section displays the Taxes details. Account No Select the account from which the taxes will be taken. Description of Taxes Displays the description taxes applicable. Amount Displays the amount that is maintained under the taxes. Total Taxes Displays the total Taxes amount. - In the Charges section, select the appropriate account, from the Account No. list.

- In the Split Percentage Borne by You field, edit the value, if required.

- Perform any one of the following actions:

- Click Next to save the entered details and proceed to the next

level.

The Attachments tab appears in the Initiate Letter of Credit screen.

- Click Save As Draft, system allows transaction details to be saved as a template or draft. (For more details, refer Save As Template or Save As Draft sections.)

- Click Cancel to cancel the

transaction.

The Dashboard appears.

- Click Back to go back to previous screen.

- Click Next to save the entered details and proceed to the next

level.

Parent topic: Initiate a Letter of Credit