9.1.1 Identification of the Entity

This topic provides the systematic instructions for users to capture basic details of the entity such as the name and address details of the entity.

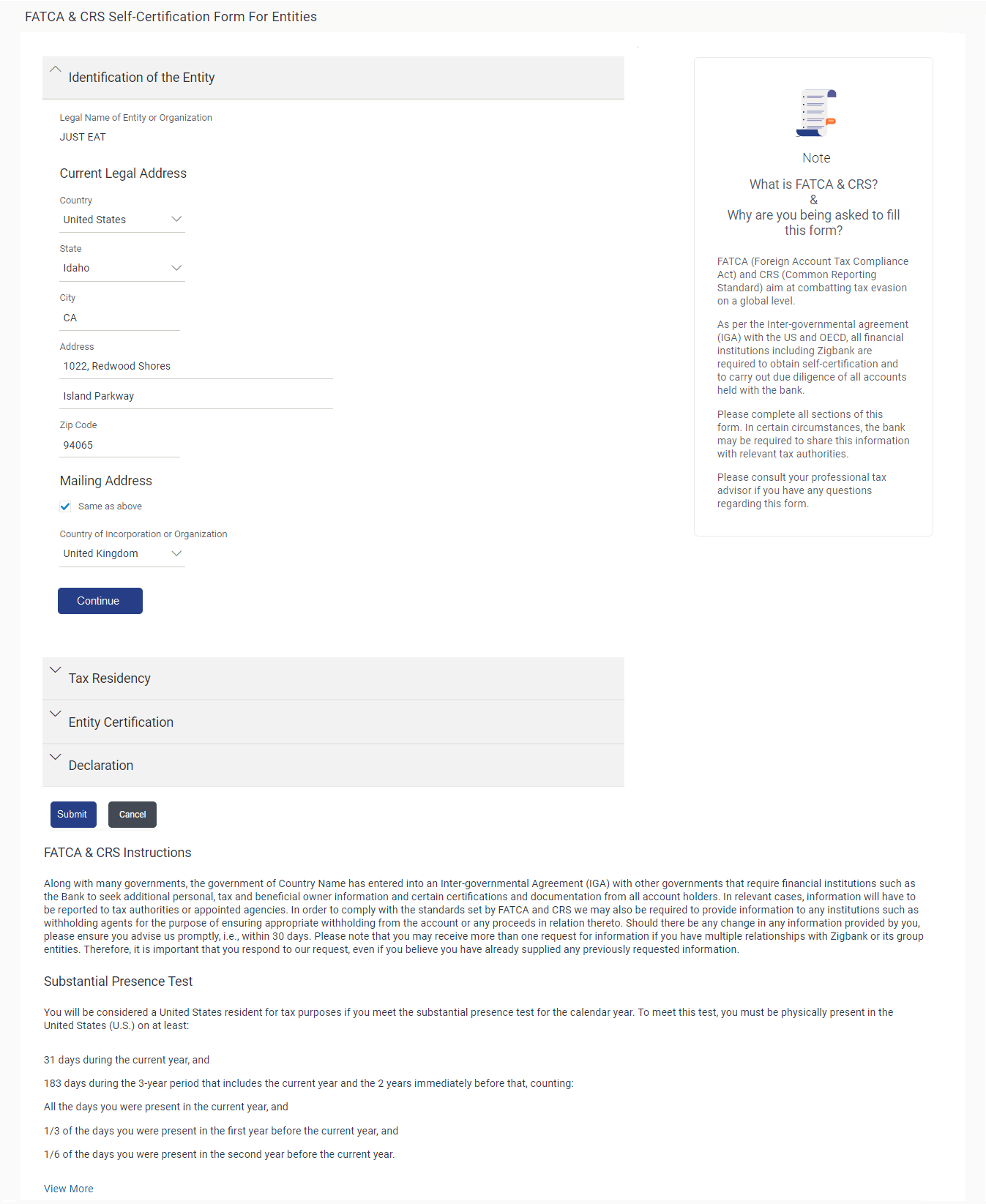

Figure 9-2 Identification of Entity Note:

For more information on fields, refer to the field description table.

Table 9-1 Identification of Entity - Field Description

| Field Name | Description |

|---|---|

| Legal Name of the Entity or Organization | The name of the entity or company as maintained with the bank is displayed. |

| Current Legal Address | |

| Country | Select the country in which the entity is operating. |

| City | Enter the name of the city in which the entity has its main headquarters. |

| Address 1-2 | Enter the address details of the main headquarters of the entity. |

| Zip Code | Enter the zip code of the entity’s address. |

| Mailing Address | |

| Same as above | Select this checkbox if the entity’s mailing address is the same as the current legal address. |

| Country |

Select the country of the entity’s mailing address. This field appears if the Same as above check box is not selected. |

| City |

Enter the name of the city of the mailing address of the entity. This field appears if the Same as above check box is not selected. |

| Address 1-2 |

Enter the mailing address details. This field appears if the Same as above check box is not selected. |

| Zip Code |

Enter the zip code of the mailing address of the entity. This field appears if the Same as above check box is not selected. |

| Country of Incorporation or Organization | Select the country of origin of the entity or organization. |

Parent topic: FATCA and CRS Self - Certification Form for Entities