3 Term Deposit Details

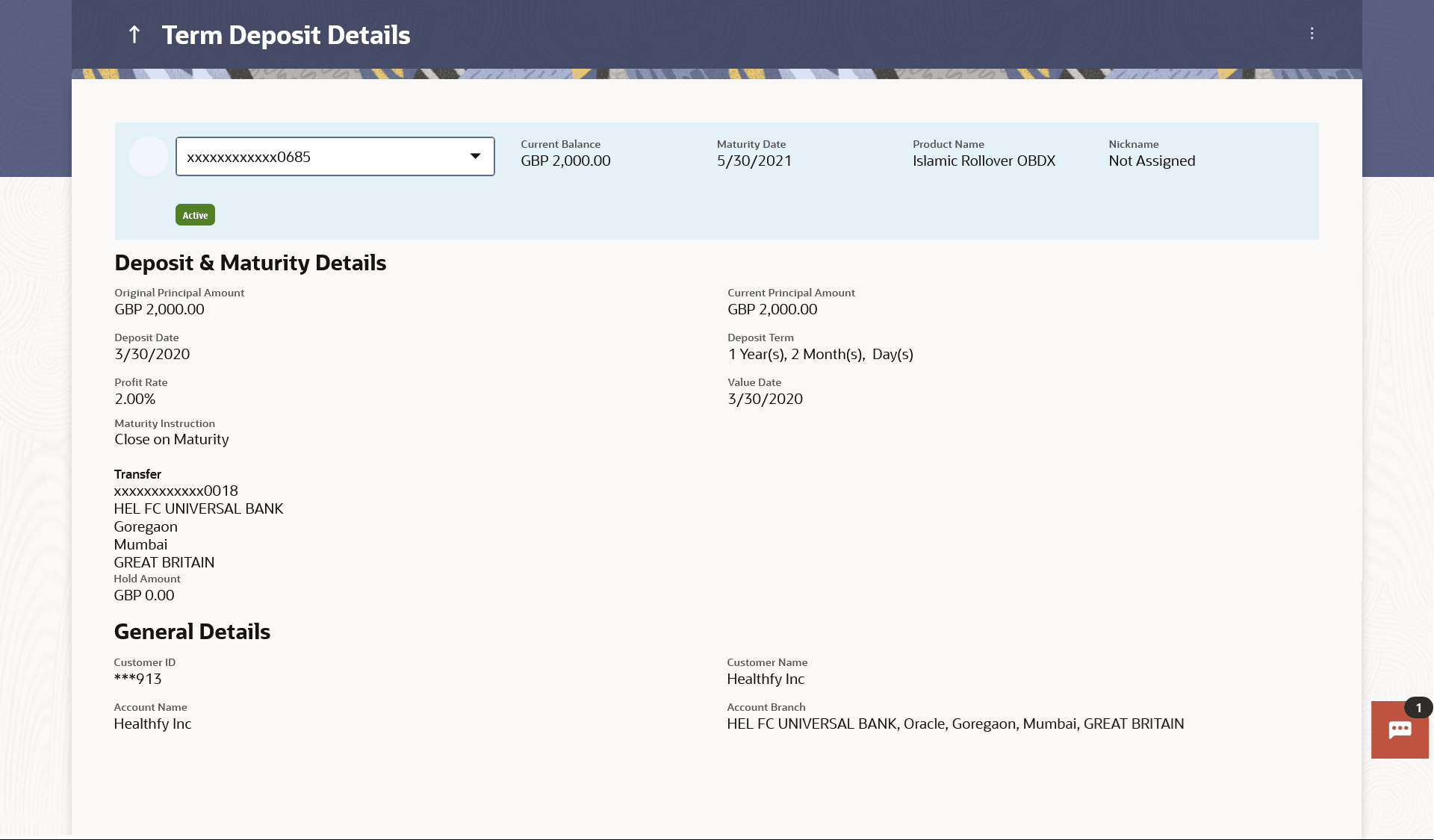

This topic describes the information pertaining to a specific term deposit held by the customer.

Details such as holding pattern and names of account holders, the current status of the deposit, the profit rate applicable and the deposit amounts and dates, are displayed.

The customer can also perform the following activities on the specific deposit account from this page:

- Redeem term deposit

- Edit Maturity Instructions

- View Statement

- Request Statement

Perform anyone of the following navigation to access the Term Deposit Details screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Term Deposits . Under Term Deposits , click Overview, select Conventional from the list, then click on the Deposit Number link of the TD Accounts Summery, then Term Deposit Details .

- From the Search bar, type Term Deposits – Term Deposit Details and press Enter.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Term Deposits . Under Term Deposits , click then Term Deposit Details

- The Term Deposits widget of the Dashboard, click on the Deposit Number link of the TD Accounts Summery, then Term Deposit Details .

- The Term Deposits widget of the Dashboard, click on the Deposit Number link of the TD Accounts Summery, then Term Deposit Details .

- Access through the kebab menu of transactions available under the Term Deposit module.

The Term Deposit Details screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-1 Field Description

| Field Name | Description |

|---|---|

| Deposit Account | Term deposit account number of user in the masked format. The account number could be of the users own Party or any linked party accounts, that he has access to. |

| Status |

The current status of the term deposit account. The possible values are:

|

| Current Balance | Current principal amount that is the revised principal amount after top-up / partial redemption. |

| Maturity Date | The date on which the term deposit will mature. |

| Product Name | Name of the product under which TD was opened. |

| Nickname |

The nickname given to the term deposit account by the account holder. This nickname can be changed or deleted. In case no nickname has been defined for the term deposit account, the option to add nickname will be displayed here. For more information, refer Account Nickname. |

| Deposit & Maturity Details | |

| Original Principal Amount | Original principal amount at the time of opening of term deposit account. |

| Current Principal Amount | The current principal amount is the revised principal amount after top-up / partial redemption, if done. |

| Deposit Date | Date on which the amount is deposited for initiation of deposit. |

| Deposit Term |

Term of deposit in years, months and days for the respective product (as maintained by the Core Banking Application). The deposit term appears, if value is one or more than one for each of years/ months/ days for example: 5 Years, 4 Months, 10 Days. |

| Profit Rate | The rate of profit applicable on the term deposit. |

| Value Date | Value date of the deposit as maintained by the Core Banking Application. |

| Maturity Amount | The value of the term deposit at the time of maturity. |

| Maturity Instructions |

Maturity instructions set by the user for the selected Term Deposit account. The options are:

|

| Transfer |

The details of the account/s to which the maturity amount is to be transferred are displayed. The details include the account number/s in masked format, the transfer type (i.e. own, internal or domestic) and the details of the bank and branch of the account/s. This field is not displayed, if maturity instruction selected is Renew Principal and Profit. |

| Special Amount |

Special amount to be rolled over. This field appears if you select Renew Specific Amount and Payout the Remaining Amount option from the Maturity Instruction list. |

| Pay to |

Account transfer options. The options are:

This field does not appear, if you select Renew Principal and Profit option from the Maturity Instructions list. |

| Own Account |

This section appears for Own Account transfer. |

| Transfer Account | Account number in masked format along with the account

nickname to which the funds are to be

transferred.

On selection of Transfer Account, account related details get displayed like Account Holder's Name and Branch Details. |

| Internal Bank Account |

This section appears for Internal Bank Account transfer. |

| Account Number | Account Number in masked format to which the funds will be transferred. |

| Domestic Bank |

This section appears for Domestic Bank Account transfer. |

| Beneficiary Name | Beneficiary name of the term deposit. |

| Account Number | Account number in masked format to which the funds will be transferred. |

| Bank Code | Destination account’s bank code. |

| International Bank Account |

This section appears for International Bank Account transfer. |

| Beneficiary Name | Beneficiary name of the term deposit. |

| Account Number | Account number in masked format to which the funds will be transferred. |

| SWIFT Code | SWIFT code of the bank where the destination account is held. |

| Hold Amount | Hold amount for the term deposit as maintained at the Core Banking Application. |

| Deposit Certificate Number |

Unique number as assigned by the host to the term deposit. Note: This field is displayed only when the host is Oracle FLEXCUBE Core Banking. |

| General Details | |

| Customer ID | The primary account holder’s customer ID in masked format. |

| Account Name | The name of the account holder |

| Customer Name | The name of the customer |

| Account Branch | Details of the branch at which the deposit account is held. |

The following actions can also be performed from this page:

- Add account nickname/ modify/ delete nickname. For more information on Account Nickname refer Account Nickname.

- Click on the kebab menu to access account related transactions.