2 External Payments Interface

This topic describes the External Payments Interface (EPI), which provides the capability of interfacing with merchant websites.

The application supports the facility to interface with third party systems. Through the support of external payment interfaces, the bank’s customers can make purchases from merchant sites by using their bank accounts. A transaction through EPI is performed as follows:

- A customer logs on to the merchant site. This could be an online shopping site, online travel booking or any other site where the customer is required to initiate a payment towards a merchant.

- The customer reaches the page on the merchant’s site wherein he is required to select a mode of payment. The customer selects the mode of payment as bank account and selects the bank.

- The customer is redirected to the bank’s internet banking URL wherein he is required to enter his login credentials.

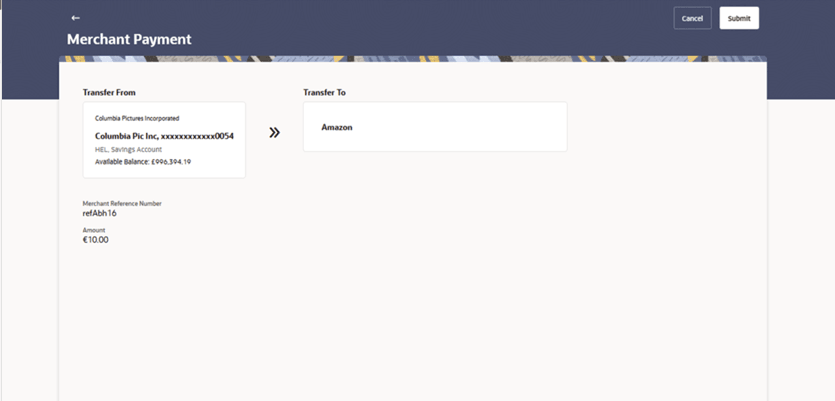

- On successful verification of the customer’s login credentials, the screen on which the customer can verify the defaulted account number and confirm the transaction appears.

- If no account number is defaulted, the customer can select the account from which the funds are to be debited and can then proceed to confirm the transaction.

- The customer is redirected to the merchant site on which the status of the transaction is displayed.

Pre-requisites:

- Transaction access is provided to business user

- CASA accounts are maintained in the host system under a party ID mapped to the user

- Merchants are maintained within OBDX

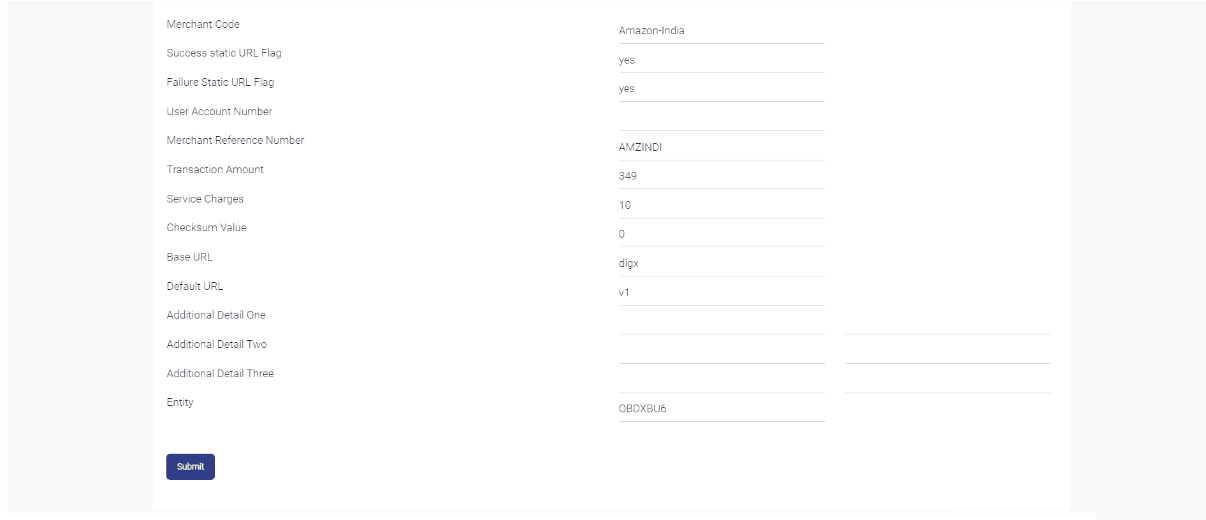

To perform a transaction through EPI: