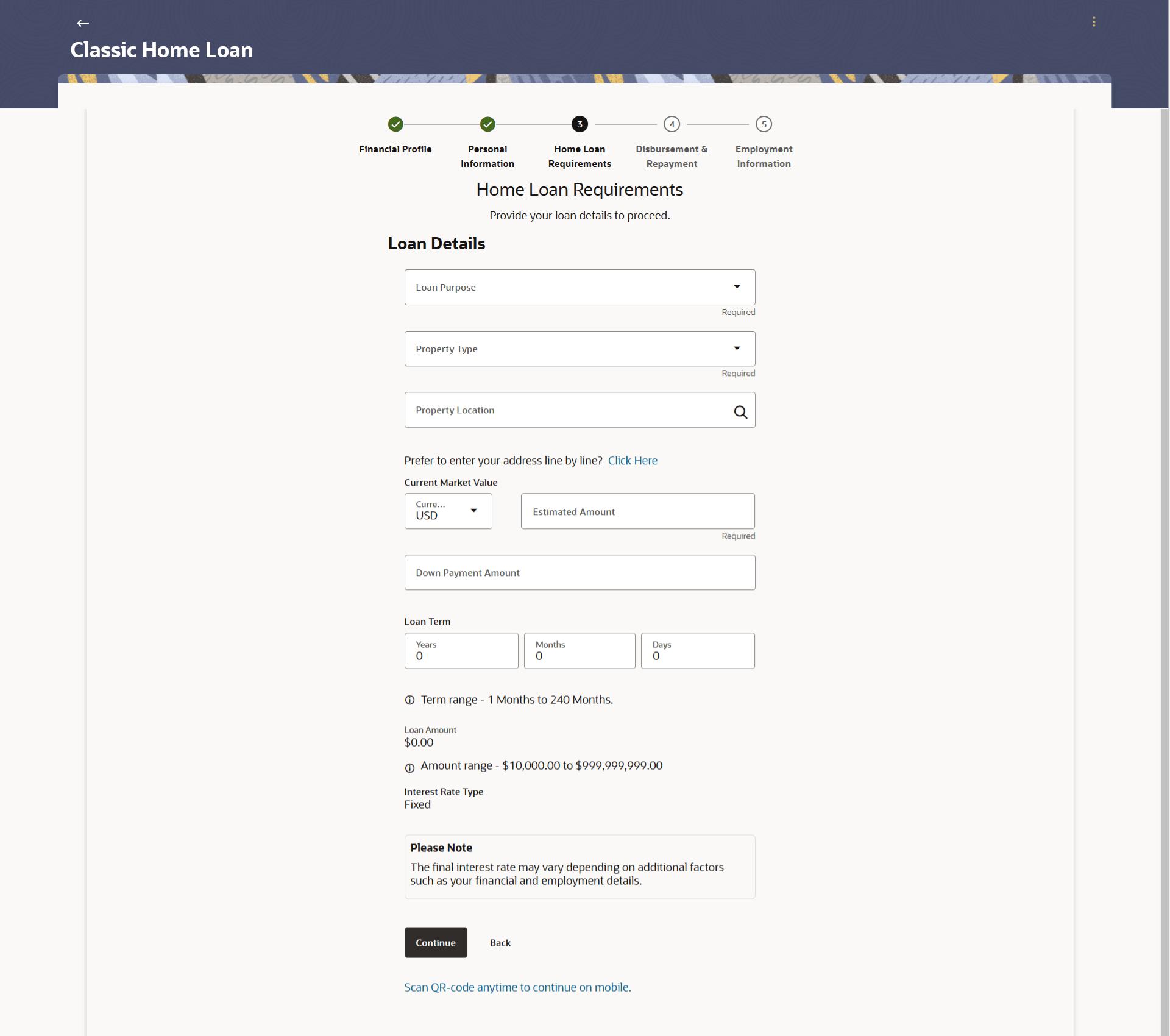

1.7 Loan Requirements

This topic describes the section of the application form where applicants provide information about the home being purchased and the loan itself.

In this step, you are required to specify information pertaining to the property for which you wish to avail the loan and also specify loan details such as the down payment amount, the amount you wish to borrow and the tenure of the loan.

Figure 1-10 Loan Requirements

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-10 Loan Requirements - Field Description

| Field Name | Description |

|---|---|

| Loan Details | |

| Loan Purpose |

The purpose for which the loan is being availed. If this field is a dropdown, the options are:

Note: Depending on the maintenance in OBO, this field can be a dropdown or an input field. |

| Property Type |

The type of property being purchased. The options are:

|

| Property Location | The state and city in which the property is located. |

| Property Address Overlay |

This overlay is displayed when you click on the Click Here link available under the Property Address field. On this overlay, you can enter the property address line by line or even select it on the map that is provided. |

| House/Unit Number | Enter the house number of the property. |

| Building Name | Enter the building name of the property. |

| Street | Specify the street address of the property. |

| Locality | Specify the locality in which the property is located. |

| Zip Code | Enter the zip code of the property. |

| City | The city in which the property is located. |

| State | The state in which the property is located. |

| Country | The country in which the property is located. |

| Current Market Value | The current market value of the property. |

| Down Payment Amount | The amount that you are willing to pay from own funds for the purchase of the property. |

| Loan Term | The tenure of the loan in terms of years, months, and days.

Note:

|

| Loan Amount | The loan amount that you would like to borrow. |

| Interest Rate Type | The type of interest rate to be applied on the loan i.e. fixed or

floating.

Note: In the event that a single type of interest rate is defined for the loan product, this field will be designated as read-only, and the corresponding applicable interest rate type will be presented alongside it. |

Parent topic: Home Loan Application