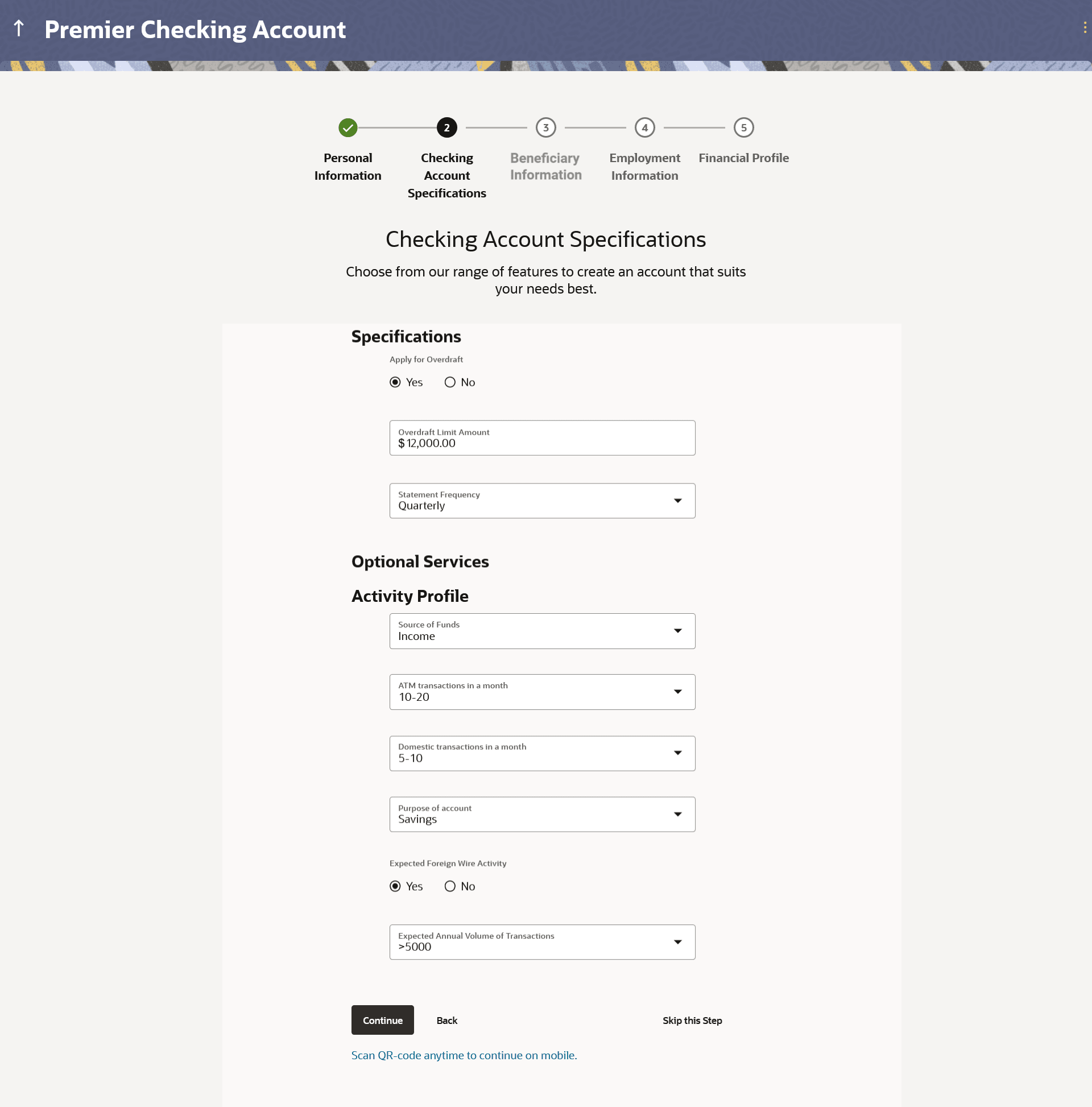

1.10 Checking Account Preferences

This topic describes the section where you can specify your service preferences.

This step enables you to enhance the features of the account you are applying for. You can provide your preferences related to services you would like on your account which could include Debit Card, Passbook, Cheque Book, access to Direct Banking and Phone Banking, etc. You can also select the currency in which you wish your account to be held and define account statement preferences such as the delivery mode and frequency.

In the case of joint application forms, you can specify the optional services as preferred by each applicant separately. Additionally, if applying for a joint account, you will also be required to specify information regarding how the account is to be operated.

Figure 1-16 Checking Account Preferences

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-16 Checking Account Preferences - Field Description

| Field Name | Description |

|---|---|

| Activity Profile & Specifications | |

| Apply for Overdraft |

Specify whether you want to apply for overdraft facility or not. The options are:

|

| Overdraft Limit Amount |

The amount of overdraft limit to be requested. This field is enabled only if the option Yes has been selected in the Apply for Overdraft field. |

| Statement Frequency |

The frequency at which you would like to receive account statements. The options are:

|

| Optional Services |

In case of joint application forms, there will be two sub sections to capture each applicant’s preference with regards to the optional services offered against the account. In this case the sub sections will be titled as Primary Applicant – Optional Services and Joint Applicant – Optional Services respectively. |

| Service |

Each service that has been configured for the product you are applying for will be listed here. Select the check box against the service that the applicant wishes to enable on the account. |

| Account Operation Mode |

This sub section will be displayed only in the case of joint applicant application forms. |

| Mode of Operation |

The available modes of operation by way of which the account will be operated. The options are –

|

| The following fields will be displayed per record if the option As per Mandate has been selected as Mode of Operation. | |

| Amount From | Specify the minimum amount of the amount range for which the mandate is to be set up. |

| Amount To | Specify the maximum amount of the amount range for which the mandate is to be set up. |

| Required Signatories |

Specify the required number of signatories for the specific amount range. The options are –

|

| Add another Mandate | Select this option if you wish to add another mandate record. |

| Activity Profile |

The fields (including type of field and values, in case of dropdowns) displayed under this sub section can change based on mid-office maintenances for the product. The fields described below serve as examples of fields that can appear under this sub section. |

| Preferred Currency | The currency in which you wish to hold your savings account. The currency will be defaulted to USD. If other currencies are supported, you will be able to edit this selection. |

| Source of Funds |

Specify the primary source of funds that will be used to debit this account. The options can be:

|

| ATM Transactions in a month |

Specify the approximate number of transactions (domestic as well as international) expected to be performed in this account, in a month. The options can be:

|

| Domestic Transactions in a month |

Specify the approximate number of domestic transactions expected to be performed in this account, in a month. The options can be:

|

| Purpose of account |

Specify the purpose for which this account is being opened. The options can be:

|

| Expected Foreign Wire Activity |

Specify whether you expect funds from foreign countries to be transferred to this account. The options are:

|

| Expected Annual Volume of Transactions |

Specify the expected annual volume of transactions. The options can be:

|

| Courtesy Overdraft |

Specify whether Courtesy Overdraft facility is required or not. The options are:

|

| Choose which one you wish to opt in for Courtesy OD |

Specify the channel through which you wish to opt-in for courtesy overdraft. The options can be:

This field is enabled only if the Yes option is selected in the Courtesy Overdraft field. |

Parent topic: Checking Account Application