4 Redemption under Oracle FLEXCUBE Core Banking

This topic provides the systematic instructions for users to quickly liquidate their term deposits when necessary.

In times of financial emergencies, the primary source of funds for most people is their savings and investments. The facility to liquidate funds becomes imperative in such cases. The redeem term deposit feature enables customers to quickly liquidate their term deposits in any such situations.

Using this option, the customer can redeem either the entire amount or a partial amount of a term deposit.

Customers can choose to payout the funds from a deposit through any of the following methods for premature withdrawal or full redemption:

- Transfer to own account

- Transfer to internal account

- Transfer to a domestic account

- Transfer to international account

Note:

Transfers to only Own and Internal Accounts are supported when the host is Oracle FLEXCUBE Core Banking.In case of premature withdrawal or on deposit maturity of Term Deposit, the following transfers are permitted:

- Conventional term deposit transfer is permissible to Current and Savings account with same local currency

- RFC term deposit transfer is permissible only to RFC accounts with same currency

- NRE term deposit transfer is permissible only to NRE account or its international account

- NRO term deposit transfer is permissible only to NRO account with same currency

- FCNR term deposit transfer is permissible only to NRE account with same currency

To redeem the term deposit:

- Perform anyone of the following navigation to access the Redeem Term

Deposit screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Deposits tab, and then click on the Deposit Account Number .

- From the Deposit Details page, click on the More Actions, and then click on the Redeem Term Deposit.

- From the Search bar, type Deposits – Redeem Term Depositand press Enter.

- On the Dashboard, click Overview widget, click Deposits card, then click on the Deposit Account Number .

- From the Deposit Details page, click on the More Actions, and then click on the Redeem Term Deposit.

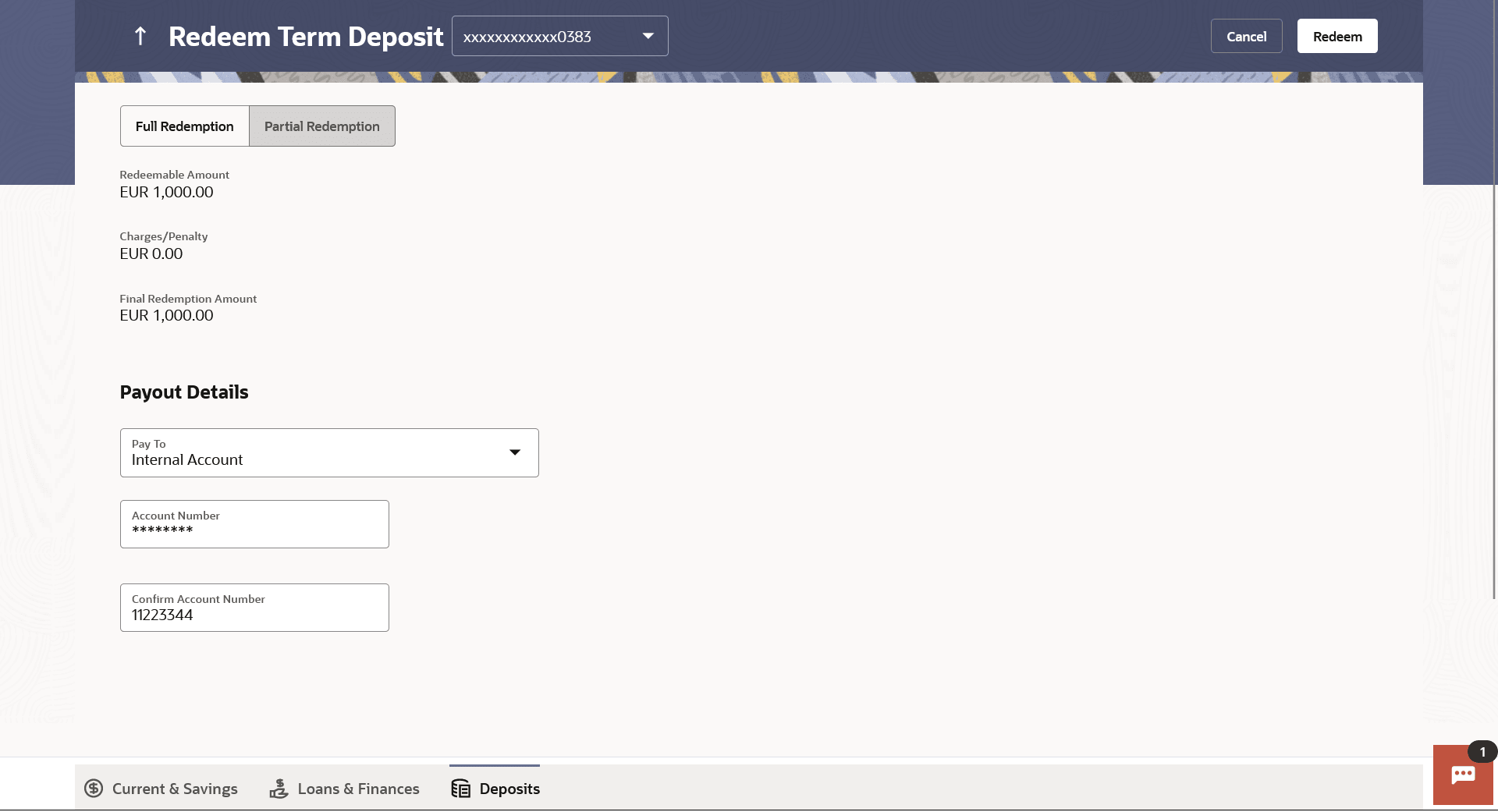

The Redeem Term Deposit screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 4-1 Redeem Term Deposit - Field Description

Field Name Description Deposit Account Select the term deposit that is to be redeemed. Redemption Type The customer can select whether redemption is to be partial or full. The available options are:

- Partial Redemption

- Full Redemption

Redeemable Amount The total amount of the deposit that can be redeemed is displayed. Redemption Amount The customer is required to specify the amount to be redeemed. The amount specified will be in the same currency as that in which the deposit is held. This field is displayed only if the customer selects the option Partial Redemption in the Redemption Type field.

Charges/ Penalty Any charges or penalty, if applicable, will be displayed. Final Redemption Amount The amount being redeemed is displayed. This amount will include any deductions in terms of charges or penalties added to the amount being redeemed. (i.e. after deducting any penalty charges if applicable). Payout Details The fields related to payment details are described below Pay To The customer is required to specify the mode through which the redeemed amount is to be transferred. The available options are:

- Own Accounts

- Internal Bank Account

- Domestic Bank Account

- International Bank Account

Note: Pay out to only Own and Internal Accounts are supported when the host is Oracle FLEXCUBE Core Banking.

Own Account The following field is displayed if the customer has selected the option Own Account in the Pay To field. Transfer Account The customer can select a current or savings account to which the funds will be transferred. All the customer’s current and savings accounts held with the bank will be listed down and available for selection. The following fields are displayed once the customer has selected an account in the Transfer Account field. Beneficiary Name The name of the holder of the account selected in Transfer Account. Bank Name The name of the bank in which the selected account is held Bank Address The address of the bank in which the selected account is held. City The city of the bank in which the account is held. Internal Account The following field is displayed if the customer has selected the option Internal Account in the Pay To field.

Account Number The customer can identify a current or savings account held within the same bank, to which the funds are to be transferred. Confirm Account Number The customer must re-enter the account number in this field so as to confirm the account number entered in the above field is correct. Domestic Bank Account The following fields are displayed if the customer has selected the option Domestic Bank Account in the Pay To field.

Account Number The customer can identify a current or savings account to which the funds are to be transferred. Account Name Enter the name of the account holder who will be the beneficiary to whom funds will be transferred. Bank Code The customer is required to identify the bank code in which the beneficiary account is held. Look Up Bank Code The search option to look for bank code of the destination account. The following fields and values will be displayed once the customer has specified a bank code. Bank Name The name of the bank in which the beneficiary account is held. Bank Address The address of the bank in which the beneficiary account is held. City The city of the bank in which the beneficiary account is held. International Bank Account This section is displayed if the customer has selected the option International Bank Account in the Pay To field. Account Number Specify the account number of the payee. SWIFT Code The SWIFT code will need to be identified if SWIFT Code has been selected in the Pay Via field. Lookup SWIFT Code Link to search the SWIFT code. Search SWIFT Code The following fields appear on a pop up window if the Lookup SWIFT Code link is selected.

SWIFT Code The facility to lookup bank details based on SWIFT code. Bank Name The facility to search for the SWIFT code based on the bank name. Country The facility to search for the SWIFT code based on the country. City The facility to search for the SWIFT code based on city. SWIFT Lookup - Search Result The following fields are displayed once the required SWIFT code is selected from the search results.

SWIFT Code SWIFT code value. Bank Name Name of the bank. City City to which the bank belongs. Branch Bank branch name. Country Country of the bank. Address Displays complete address of the bank. Beneficiary Name Name of the beneficiary. Correspondence Charges Specify who is bearing the charges for transfer. The available options are:

- Beneficiary

- Remitter

- Sharing

- From the Deposit Account list, select the term deposit to be redeemed.

- From the Redemption Type list, select the appropriate

option.Perform one of the following actions:

- If you select the Partial Redemption option, then in the

Redemption Amount field, enter the amount to be redeemed.

- Follow steps from 4.

- If you select Full Redemptionoption, follow steps from 4.

- If you select the Partial Redemption option, then in the

Redemption Amount field, enter the amount to be redeemed.

- From the Pay To list; Perform one of the following actions:

- If you have selected the option Own Account;

- From the Transfer Account list, select the current or savings account in which the redeemed amount is to be credited.

- If you have selected the option Internal Account;

- In the Account Number field, enter the account number which is to be credited with the amount redeemed.

- In the Confirm Account Number field, re-enter the account number as entered in the Account Number field.

- If you have selected the option Domestic Bank Account;

- In the Account Number field, enter the account number of the beneficiary.

- In the Account Name field, enter the account name of the beneficiary.

- From the Network Type list, select the appropriate option.

- In the Bank Code field, enter the bank code,

and click

Submit

OR

Use the Look Up Bank Code link, to select the appropriate bank code.

- If you have selected the option International Bank

Account;

- In the Account Number field, enter an appropriate account for maturity proceeds.

- In the SWIFT code field, enter the SWIFT

code details for maturity

proceeds.

OR

Use the Lookup SWIFT Code link, to select the appropriate SWIFT code.

Click Reset to clear the populated data and enter / select a new SWIFT code, if required.

- Click Verify to fetch the bank details based on the SWIFT code entered.

- In the Beneficiary Name field, enter the name of the beneficiary.

- From the Correspondence Chargeslist, select the appropriate option.

- If you have selected the option Own Account;

- Perform any one of the following actions:

- Click Submit.The Deposit Details, and Maturity Details appears.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click Submit.

- Perform any one of the following actions:

- Verify the details and click Confirm.The confirm screen is displayed with a success message along with the reference number.

- Click Back to navigate back to the previous screen.

- Click Cancel to cancel the transaction.

- Verify the details and click Confirm.

- Perform any one of the following actions:

- Click the Transaction Details to view the details of the transaction.

- Click the Deposit Details link to view the deposit account details.

- Click the View Accounts link to visit Term Deposit Summary page.

- Click the Open New Deposit link to open a new deposit account.

- Click the Go To Dashboard link to navigate back to dashboard page.