3.1.1 Make Payment - Saved Payee

This topic describes the systematic instruction to Make Payment - Saved Payee screen. User can make payment to Saved Payee with this feature.

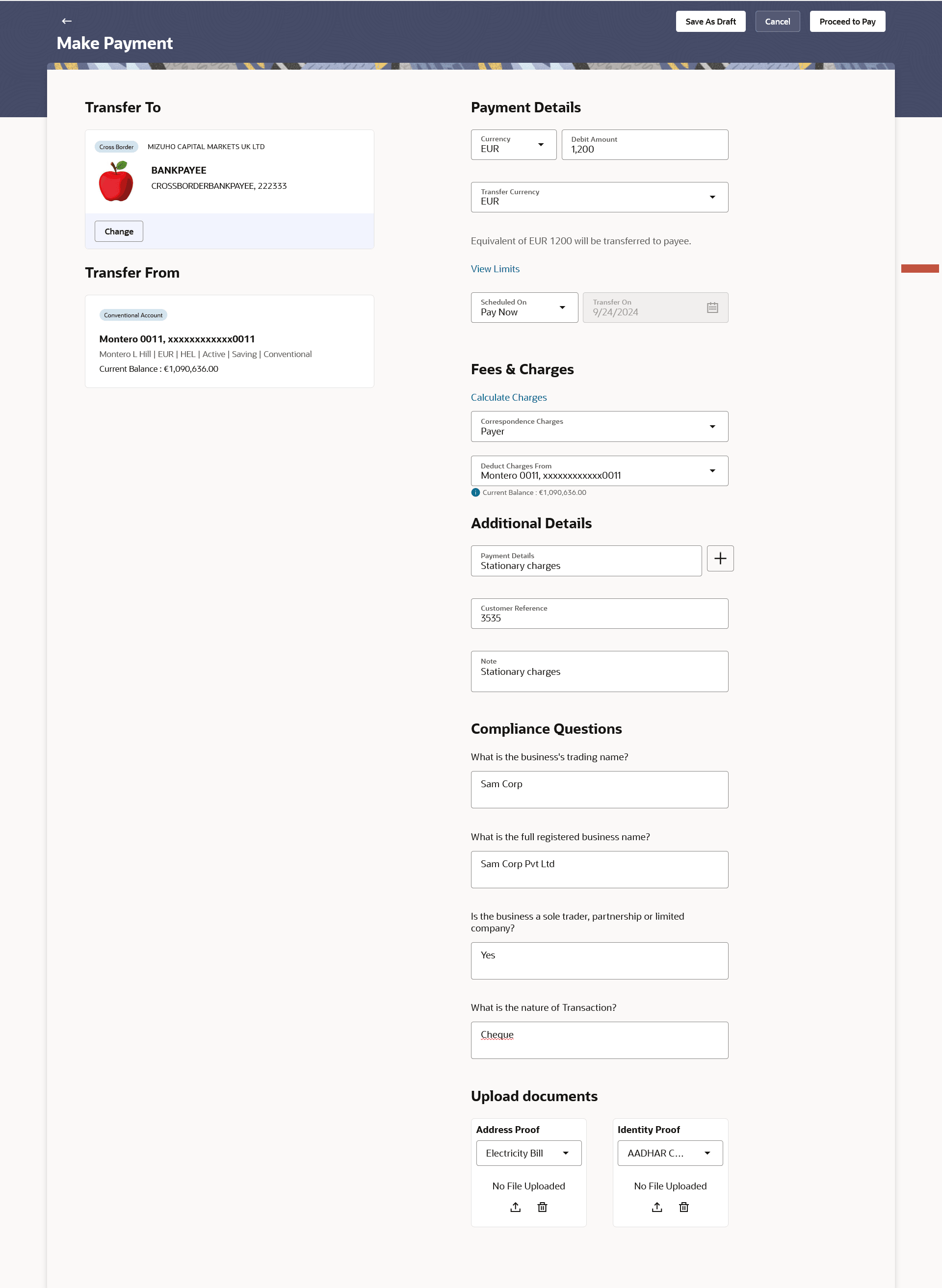

This feature allows Oracle Banking Digital Experience user to make payment to Saved Payee. All payees (Within Bank, Domestic and Cross Border payees) created by the user are listed for selection. Details of the payee are auto populated on the transaction screen once a selection has been made. Based on the payee selection, the account for debiting funds towards the existing payee will get defaulted on the Transfer From field and user can change the source account if required.

Payment related details will be populated based on type of payee selected and based on regionalization. Refer section Regionalization for Domestic Payments to view region specific payment fields.

To initiate payment to single user:

- In the Transfer To section, select the Saved

Payee option. .

- The Transfer To overlay screen will display with

the Saved Payee tab.

Note:

- Users have the option to add a new payee through the New Payee tab.

- Additionally, they can locate specific payees by entering a few characters in the search field. This search functionality is available in categories such as Payee Type, Nickname, Account Name, and Account Number.

- Click on the

icon to add the new payee.

icon to add the new payee.

The system redirects to Add Bank Account Payee screen.

Figure 3-2 Make Payment- Transfer To overlay screen

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-2 Make Payment- Transfer To overlay screen - Field Description

Field Name Description Search for payee Allow user to search payee with the Payee Type, Nickname, Account Name, Account Number. Details for Payee All the saved payees listed on the Saved Payees overlay screen. Below details are displayed for each payee -

Payee Type Displays the payment type associated with the payee. It could be:

- Within Bank

- Domestic

- Cross Border

Payee Photo/Initials Displays the payee's photo, if uploaded, against each payee name. If the payee’s photo is not uploaded, the initials of the payee will be displayed in place of the photo. Bank Name Displays bank name of the payee in case of Domestic and Cross Border Payee Nickname Displays the payee by their nick names defined at the time of payee creation. Account Name, Account Number Displays the Account name or nick number of the source account from which the funds are to be debited.

- The Transfer To overlay screen will display with

the Saved Payee tab.

- On selection of payee, the screen populates the Transfer From

and Payment Details.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-3 Make Payment- Saved Payee - Field Description

Field Name Description Transfer To Information specified in below fields are related to transfer to. Payee Type Displays the payee type. The options are:

- Within Bank

- Domestic

- Cross Border

Bank Name The name of the payee’s bank. Photo/name Initials The profile photo of the payee. Payee Nickname The nickname of the payee. Account Name, Account Number Displays the Account name and account number of the payee. Debit Account Details Transfer From Displays the debit account details such as Type, Nickname, Account name, Account number, Currency, Branch name, etc as configured in the day 0 configuration of account.

Based on the payee selected the account will be defaulted, and on click all available accounts will be available to select. Refer Transfer From Drawer section.

Badge Type Displays the type of the source account from which the funds are to be debited towards the payee. The values could be - Islamic

Conventional

Account Details Displays details like - nick name, account number, branch, currency, current balance etc. based on configuration for account in day0. Payment Details Currency Select the currency in which the payment is to be made. For My Account and Within Bank payments it will display debit account and credit account currency.

For Domestic and Cross Border payments it will display debit account and network currencies.

Debit/Transfer Amount Specify the amount for which the payment is to be made. This could be Debit amount or Transfer amount based on currency selected. When Debit currency is selected, it will be Debit amount.

When Credit currency or network currency is selected, it will be Transfer amount.

Transfer Currency Select transfer currency. This will come in case the debit account currency is selected and network allows different currency transfers. Low Value Payment Select if the payment is low value payment. This field is enabled for cross border payment as per regionalisation configuration and the amount is below the maximum amount defined for low value payment.

View Limits Link to view the transaction limits. For more information on Limits, refer View Limits section.

Exchange Rate Display indicative exchange rate in case of cross currency transfer. Network Type Select the network type for the payment. Refer section Regionalization for Domestic Payments for region specific networks. Applicable for domestic payments.

Scheduled On The facility to specify the date on which the payment is to be made. The options are:

- Pay Now: Select this option if you wish to make the payment on the same day.

- Pay Later: Select this option if you wish to make the payment at a future date. If you select this option, you will be required to specify the date on which the payment is to be made.

- Recurring: Select this option if you wish to make the recurring payments.

- For domestic and cross border - options in Scheduled On comes based on the regionalisation configuration.

Transfer On Specify the date on which the payment is to be made. This field appears if the option Pay Later is selected from the Scheduled On list.

Select Frequency The frequency in which the repeat transfers are to be executed. The options are:

- Daily

- Weekly

- Fortnightly

- Monthly

- Bi-monthly

- Quarterly

- Semi-Annually

- Annually

- Advanced

Note: If the Advanced option is selected, one can configure a frequency for the transaction to occur, specifying intervals such as once every X day, weeks, or months.

This field appears if the option Recurring is selected from the Scheduled On list.

Start Transferring The date on which the first recurring transfer is to be executed. Stop Transferring Select the option by which to specify when the recurring transfers are to stop being executed. The following two options are available:

- On Date: Select this option if you wish to specify a date on which the last transfer is to be executed.

- After Instances: Select this option if you wish to specify the number of recurring transfers that are to be executed as part of the instruction.

This field appears if the option Recurring is selected from the Scheduled On list.

Date Specify the date on which the last transfer is to be executed. This fields appears if the option On Date is selected in the Stop Transferring field.

Instances Number of instances. This field appears if the option After Instances is selected in the Stop Transferring field.

Also Transfer Today Select this option to also initiate a one-time transfer towards the payee for the same amount. This option is enabled when recurring is selected in Scheduled On. Fees & Charges Information specified in below fields are related to fee and charges. Calculate Charges Click on the link to calculate the fees and charges applicable for the transaction. Correspondence Charges This field will be displayed for Cross Border payments. Select who will bear the charges in case of Cross Border payments - Payer, Payee, Shared Deduct Charges From The Bank may levy charges for certain payment networks. The user can choose which debit account to use when paying the charges. The accounting entries for the charge’s components will be reflected in the statement of the account selected here.

This field is enabled for all Payment Types – Within Bank, Domestic and Cross Border. In case of Cross Border Payments, it is enabled when Payer or Shared option is selected in the Correspondence Charges.

Current Balance The net balance of the source account. Additional Details Information specified in below fields are related to additional details. Payment Purpose The purpose of payment. It will be a list of allowed purpose codes. Payment Details You can add up to 4 fields each of length not more than 35. These will carry the unstructured remittance information to the Payment Processor. Customer Reference Number The reference number assigned to the customer. Note Specify a note or remarks for the transaction, if required. Compliance Questions For Cross Border payments the screen asks few compliance questions. OBDX supports configuring a list of questions from backend for On-premises. Once configured and enabled in regionalisation, the questions will show up on the screen. Upload Documents For Cross Border payments the screen lets the user attach documents. OBDX supports configuring a list of mandatory/non-mandatory documents from backend for On-premises. Once configured and enabled, the list will show up on the screen. Note:

When the payment is submitted, the documents will be stored to a configured Document Store (DMS or DB or any other repository depending on the implementation). The document reference numbers will be passed to the back-end payment processor along with the payment request. - Fill the details in the respective fields.

- Perform anyone of the following actions:

- Click Proceed to Pay to initiate the payment

request.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click Save as Draft to store the unfinished transaction for later completion.

- Click Proceed to Pay to initiate the payment

request.

- Perform anyone of the following actions:

- Verify the details and click Confirm.

The success message appears of request of payment transfer along with the reference number, host reference number.

- Click Cancel to cancel the transaction.

- Click Back to navigate back to previous screen.

- Verify the details and click Confirm.

- Perform anyone of the following actions:

- Click Transaction Details to view the details of the transaction.

- Click Go to Dashboard to go to the Dashboard screen.

- Click e-Receipt to generate the electronic receipt of the transaction. For additional details, refer the e-receipt section in the Retail Customer Services User Manual.

- Click Payments to go to the Payment Overview page.

- Click Make Another Payment to make new payment.

- Click Save as Favourite to save payment as favourite transaction.

- Click Check Status to see the status of the payment transaction. System will redirect to the Payment Details screen.

- Click Add as Payee to save the payee to whom the payment is made.

- Click

icon to share to share payment details. It opens default mail client with

relative message in the body.

icon to share to share payment details. It opens default mail client with

relative message in the body.

Note:

- The Add as Payee option is displayed during the ad hoc payment procedure. By clicking on Add as Payee, user will be taken to the Add Bank Account Payee screen to include a new payee.

- The functionality to share payment details is not available for My Account payment transfers.

Parent topic: Make Payment -Transfer to single user