10.1.3 Tax Residency Information

This topic describes the systematic instruction to Tax Residency Information section. This section enables users to specify information about your tax residency.

Users are required to identify the countries in which you are considered a tax resident and also specify information pertaining to your relationship with the United States of America.

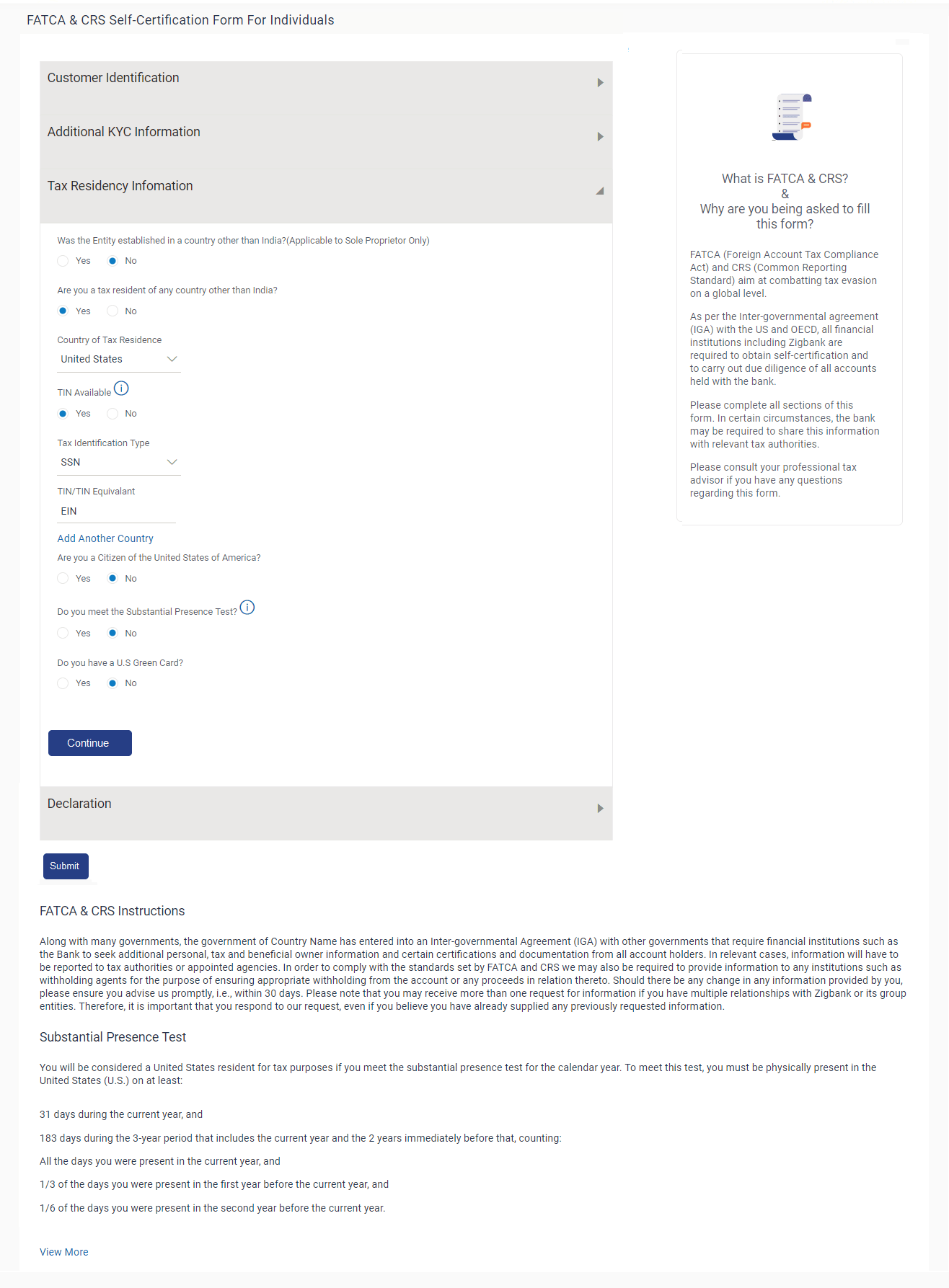

Figure 10-4 Tax Residency Information

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 10-3 Tax Residency Information - Field Description

| Field Name | Description |

|---|---|

| Was the Entity established in a country other than <Name of Country>? (Applicable to Sole Proprietors only) | This field is applicable to sole proprietors only. Specify whether the entity was established in the country or in another country.

The options are:

|

| Are you a tax resident of any country other than <Name of Country>? | Specify whether you are a tax resident of country other than the country in which your accounts are held.

The options are:

|

| Yes - in either of above two fields | The following fields are enabled if you have selected the option Yes in either of the two fields above. |

| Country of Tax Residence | Select the country in which you are considered a tax resident. |

| TIN Available | Specify whether your Taxpayer Identification Number (TIN) of the country in which you are a tax resident, is available or not.

The options are:

|

| Tax Identification Type | Select your TIN type from the list. The values in this list are populated based on the Identification documents that are accepted as TINs in the country that you have selected as Country of Tax Residence.

This field appears if you have selected the option Yes against the TIN Available field. |

| Other Tax Identification Type | Specify the identification document that you are providing as TIN if you have selected the option Other from the list of values available under Tax Identification Type.

This field appears if you have selected the option Other in the Tax Identification Type field. |

| TIN/ TIN Equivalent | Specify the taxpayer identification number.

This field appears only if you have selected the option Yes against the field TIN Available. |

| Reason for Non Availability | Specify the reason of non-availability of taxpayer identification number.

This field appears if you have selected the option No in the TIN Available field. |

| Add Another Country | The link to add details of another country in which the user is a tax resident. You may choose to add further records, up to a defined number, if you are a tax resident of more than one country. |

| Remove Country | This link is displayed against the record of a country that has been added as country of tax residence. Select this link to delete the specific record against which the link is displayed. |

| United States of America | The following fields are specific to the United States of America, in which you are required to identify you relationship with the United States specifically. |

| Are you a citizen of the United States of America? | Specify whether you are a citizen of the United States of America.

The options are:

|

| Do you meet the Substantial Presence Test? | Specify whether you meet the substantial presence test criteria. By means of the substantial presence test, it can be identified whether you are to be considered a citizen of the United States or not.

The options are:

|

| Do you have a U.S. Green Card? | Specify whether you hold a United States green card.

A U.S. Green Card is allotted to persons who are considered lawful permanent residents of the United States and who have been granted permission to reside in as well as to seek employment in the United States. The options are:

|

Parent topic: FATCA and CRS Self - Certification Form for Individuals