8 Edit Maturity Instructions

At any point in time, a customer may want to change the maturity instruction set for a term deposit. The Edit Maturity Instruction feature enables a customer to change the maturity instruction that was set at the time the deposit was being opened.

Using this option, the customer can change the maturity instruction of a term deposit.

Navigation Path:

From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Deposits tab, and then click on the Deposits Account Number. From the Deposits Details page, click on the More Actions, and then click on the Edit Maturity InstructionsOR

From the Search bar, type Term Deposits – Edit Maturity Instructions and press Enter

OR

On the Dashboard, click Overview widget, click Term Deposits card, then click Deposits Account Number. From the Deposits Details page, click on the More Actions, and then click on the Edit Maturity Instructions

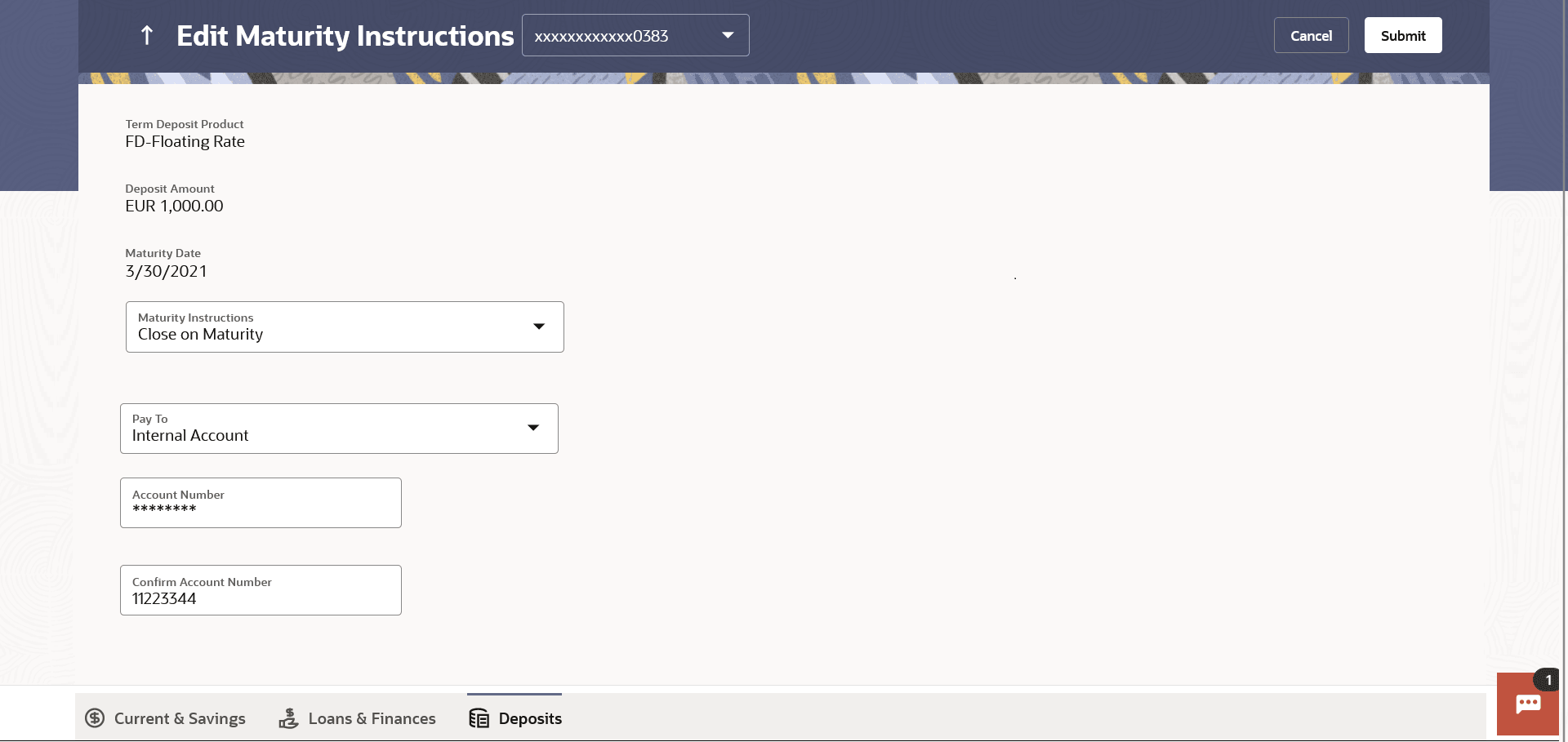

Figure 8-1 Edit Maturity Instructions

Table 8-1 Field Description

| Field Name | Description |

|---|---|

| Deposit Account | Select the term deposit whose maturity instructions is to be changed. |

| Term Deposit Product | The name of the product under which the term deposit is opened. |

| Deposit Amount | The deposit amount. |

| Maturity Date | The date on which the term deposit will mature. |

| Maturity Instructions | The maturity instructions set at the time of opening the deposit

account will be displayed by default. The customer will be able to change these

instructions are required.

The options can be:

|

| Roll over Amount |

Special amount to be rolled over. This field is displayed if the option Renew Special Amount and Pay Out the Remaining Amount has been selected as Maturity Instruction. |

| Transfer Principal and Interest to |

This field is displayed only if the customer selects the option Close on Maturity from the Maturity Instructions list. The customer can identify if the entire maturity amount is to be transferred to a single CASA account or if the principal and interest amounts are to be split and transferred to two separate CASA accounts. The options are:

|

| Pay To |

This field is displayed if the customer has selected any maturity instruction that involves any part of the deposit amount to be paid out at the time of maturity. In case the maturity instruction Close on Maturity has been selected, this field will be displayed only if the user has selected the option Single Account from the Transfer Principal and Interest to field. The customer is required to select the mode through which the amount to be paid out is transferred. The options are:

This field is not displayed if the option Renew Principal and Interest has been selected as Maturity Instruction. |

| Pay Principal To |

This field is displayed only if the customer has selected the option Close on Maturity from the Maturity Instructions list and proceeds to select the option Separate Accounts from the Transfer Principal and Interest to field. The customer is required to select the mode through which the principal amount to be paid out is transferred. The options are:

|

| Pay Interest To |

This field is displayed only if the customer has selected the option Close on Maturity from the Maturity Instructions list and proceeds to select the option Separate Accounts from the Transfer Principal and Interest to field. The customer is required to select the mode through which the interest amount out of the total maturity amount to be paid out is transferred. The options are:

|

|

Own Account This section is displayed if the option Own Account has been selected in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Transfer Account | The account number along with the account nickname to which the funds are to be transferred. |

| The following fields are displayed once the customer has selected an account in the Transfer Account field. | |

| Beneficiary Name | The name of the holder of the account selected in Transfer Account. |

| Bank Name | Name of the beneficiary bank. |

| Bank Address | Address of the beneficiary bank. |

| City | City of the beneficiary bank. |

|

Internal Bank Account This section is displayed if the customer has selected the option Internal Account in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Account Number | The customer can identify a current or savings account of the bank to which the funds are to be transferred once the deposit matures. |

| Confirm Account Number | The user is required to re-enter the account number in this field so as to confirm the same. |

|

Domestic Bank Account This section is displayed if the customer has selected the option Domestic Bank Account in the Pay To field or in the Pay Principal To or Pay Interest To fields. |

|

| Account Number | The customer can identify a current or savings account to which the funds are to be transferred once the deposit matures. |

| Account Name | Name of the account holder who will be the beneficiary to whom funds will be transferred once the deposit matures. |

| Bank Code | The customer is required to identify the bank code in which the beneficiary account is held. |

| Look Up Bank Code | Search option to look for bank code of the destination account. |

| The following fields and values will be displayed once the customer has specified a bank code. | |

| Bank Name | Name of the beneficiary bank. |

| Bank Address | Address of the beneficiary bank. |

| City | City of the beneficiary bank. |

To edit the maturity instructions: