3 Account Structure Maintenance

This topic describes about the Account Structure Maintenance in Liquidity Management.

Account structure is an efficient tool to optimize the working capital of a business processes. A suitable physical account structure provides greater degree of control and flexibility, to the corporate treasuries. It also allows the better visibility and control of corporate accounts. With the account structures corporate customers gets the holistic view of all group of accounts to take funding or investment decisions.

The structure reflects the hierarchical relationship of the accounts as well as the corporate strategies in organizing accounts relationships.

- Sweeping:

Sweeping works on principles of automatic fund transfer between parent and child accounts to aggregate balances physically and achieves the mobilization and consolidation of the available balances into a central account called header account. Oracle Banking Digital Experience enables the corporate customer to define various forms of Sweeps/Cash Concentration methods while building the sweep type of account structure. Sweeps are executed automatically based on a pre-arranged sweep instruction set by the customer at account structure level and at account pair level and per the set frequency.

- Notional Pooling:

Notional pooling refers to the off set of interest income and expense (credit and debit interest), resulting from the varying cash positions in different accounts held with the bank. It is mechanism for calculating interest on the combined credit and debit balances of accounts that a corporate chooses to cluster together, without actually transferring any funds. The balances in accounts are pooled on a notional basis.

Account structure maintenance of Oracle Banking Digital Experience enables the corporate customer to build their own account structures between the accounts enabled for liquidity management. Further the application also supports viewing and modifying existing account structures using digital banking platform.

- Pre-requisites:

- Transaction and Party ID access is provided to corporate user.

- Approval rule set up for corporate user to perform the actions.

- Accounts are enabled at in the respective host application for liquidity management.

- Account and transaction access has been provided to the user.

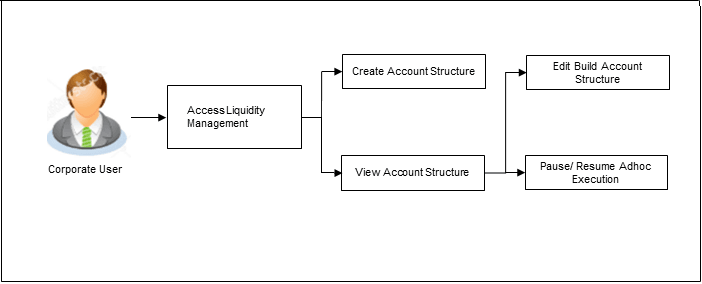

- Work Flow:The Work Flow screen displays.

- Features supported in application:Account structure allows the corporate user:

- Build an Account Structure

- View Account Structure

- Edit Account Structure

- Ad hoc Execution

- Pause Account Structure

- Copy Account Structure

- Navigation Path:

- From Menu, click Liquidity Management, and then click Overview. From Overview, click Quick Links, and then click Structure List.

- From Menu, click Liquidity Management, and then click Structure List.

This topic contains the following sub-topics:

- Account Structures

This topic describes the systematic information to Account Structures, which shows the summary of all the accounts. - Create Account Structure

This topic describes the systematic instruction to Account Structure creation. - View Account Structure

This topic describes the information about View Account Structure. - Edit Account Structure

This topic describes the information about Edit Account Structure screen. - Drain Pool Structure

This topic describes the systematic instruction to Drain Pool Structure. - Execute Account Structure

This topic describes the information about Execute Account Structure, these options allow the corporate user to execute account structure and applicable only for sweep structures. - Pause Account Structure

This topic describes the information about Pause Account Structure. These options allow the corporate user to pause or resume the execution of the account structure temporarily. - Copy Account Structure

This topic describes the systematic information to Copy Account Structure. These options allow the corporate user to view the details and copy the structure to initiate new structure creation request.