- Common Core - Core Entities and Services User Guide

- Core Maintenance

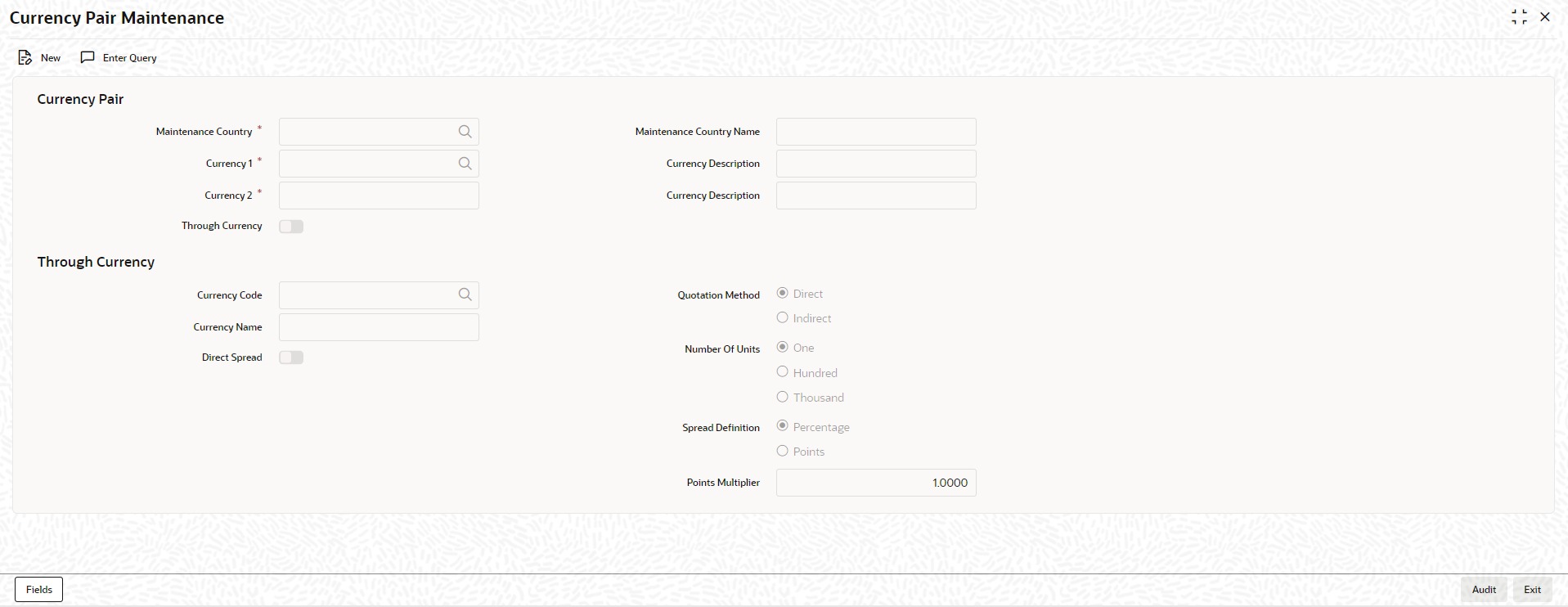

- Maintain Currency Pair

1.10 Maintain Currency Pair

This topic explains systematic instructions to maintain currency pairs.

In the foreign exchange markets, the exchange rates for some currency pairs such as the USD-GBP or USD-JPY are easily obtainable, since these are frequently traded. The exchange rates of other currencies such as the ZAR-INR (South African Rand - Indian Rupee), which is not traded very often, is determined through a third currency. This third currency is usually the US dollar, since the US dollar is quoted in all trading centers.

In the Currency Pair Maintenance screen, define the static attributes of currency pairs for which a regular market quote is readily available. For other pairs, which do not have a regular market quote, specify the third currency through which the system should compute the exchange rate.

The currency pair screen is maintained at the bank level by Head Office branch using the Currency Pair Maintenance screen.

Note:

The fields which are marked in asterisk are mandatory.- On Homescreen, type CYDCCYPR in the text box, and click Next.The Currency Pair Maintenance screen displays.System Features - From among the currencies maintained in the currency screen, the system builds all possible combinations of currencies in pairs. For example, if you have maintained the following currency codes: USD, YEN. The system will give you a choice of defining parameters for the following:

- USD-INR

- USD-YEN

- INR-USD

- INR-YEN

- YEN-USD

- YEN-INR

- The user wants to define a direct exchange rate for the pair, of frequently traded currencies like INR-USD or USD-GBP, or USD-JPY for which market quotes are available.

- The user wants to define a through currency for the pair, for those currencies which are not so well traded, market quotes may not be available. Therefore the user can route the conversion rate for the pair via a Through Currency. For example, in the case of GBPNLG, for which a direct exchange rate may not be available, the user can define a through currency say, USD. The exchange rate between GBP-USD and NLG-USD will be picked up by the system to compute the exchange rate between GBP-NLG.

- On the Currency Pair Maintenance screen, specify the fields.

For more information on fields, refer to the field description table.

Table 1-15 Currency Pair Maintenance - Field Description

Field Description Maintenance Country Click Search and specify the country code for which the currency pair is maintained from the list of values. The list displays all the authorized and open country codes along with their description maintained in the system. For example, if the country code is maintained for a bank or a branch, which is operating in Singapore for the currency USD, then specify the country code as SG. The system defaults the field Country to US.

Currency 1 Click Search and specify the currency 1 for pairing. Currency Description The system displays the description of Currency 1. Currency 2 Specify the Currency 2 for pairing. Currency Description The system displays the description of Currency 2. Maintenance Country Name The system displays the name of the country for which the currency pair is maintained. Currency Pair A currency pair (specified as Currency 1 and Currency 2, in the Currency Pair Maintenance screen) represents the two currencies which need to maintain exchange rates. The pair should be selected according to the quotation method followed by the market, which could be Direct or Indirect (for details refer to the field quotation method). Exchange rates can be defined as Currency 1 against Currency 2 or Currency 2 against Currency 1.

Through Currency If the exchange rate for a particular currency pair is not to be maintained, specify the Through Currency via which the exchange rate between the currencies should be calculated.

To maintain a through currency for a currency pair, check against the box Through Currency.Currency Code, Currency Name, and Direct Spread Click Search and specify the currency code which want to specify as the through currency. The exchange rate for the currencies involved in the pair will be calculated using the through currency. The system displays the currency name. Check the box Direct Spread to enable direct spread for a currency.

Note:

While maintaining a pair involving an In currency (In - Out and In - In), only specify the Euro as the Through Currency. The user cannot maintain a Through Currency for a pair constituted by an In currency and the Euro.Whenever a through currency for a currency pair is defined, the user will not be allowed to specify the following for the pair:- Number of Units

- Spread Definition

Quotation Method This is the method to be followed for quoting the exchange rate. There are two methods as follows: - Direct

- Indirect

In the Direct method, the exchange rate for the currency pair is quoted as follows:- Buy Rate = Mid Rate - Buy Spread

- Sell Rate = Mid Rate + Sell Spread

- Currency 1 = Rate x Currency 2

In the Indirect method, the exchange rate for the currency pair is quoted as follows:- Buy Rate = Mid Rate + Buy Spread

- Sell Rate = Mid Rate - Sell Spread

- Currency 2 = Rate x Currency 1

For example, the market follows the direct quote convention for the currency pair USD-DEM (For example, 1USD=1.6051DEM). To maintain this pair, Specify Currency 1 as USD and Currency 2 as DEM, and specify Direct in this field. For the USD-GBP pair, which is quoted indirectly (1 GBP = 1, 5021 USD), the USD will be defined as Currency 1 and the GBP as Currency 2, with the quotation method Indirect.

Number of Units Select the number of units from the following options: - One

- Hundred

- Thousand

Spread Definition Select the method in which the spread for a currency pair needs to be defined. There are two ways of calculating the effective spread as follows: - Percentage - Spread/100 x Mid Rate

- Points - Spread x Points Multiplier

The method of spread definition specified here applies to two instances:- While maintaining exchange rates for this currency pair

- While maintaining Customer Spread for this currency pair

Points Multiplier Points are the smallest unit of measurement in the exchange rate of a currency pair. If the Points option is selected in the Spread Definition field, specify the multiplication factor for the points to compute an effective spread. For example, For the currency pair USD-DEM, the rates are as follows:- Mid Rate - 1.6045

- Buy Rate - 1.6040

- Sell Rate - 1.6051

In the Currency Exchange Rates Input screen, where rates and spreads for a currency pair are defined, also can specify the buy and sell spreads as 5 and 6 instead of as 0.0005 and 0.0006 (that is, as spread points), and specify here the points multiplier as 0.0001.

The effective spread, buy and sell rates are then computed as follows:- Effective Buy Spread = Buy Spread x Points Multiplier (5 x 0.0001 = 0.0005)

- Buy Rate= Mid Rate - Buy Spread (1.6045 - 0.0005 = 1.6040)

- Click Exit to end the transaction.

Parent topic: Core Maintenance