- Enterprise Collateral Management User Manual

- Collaterals

- Collateral Maintenance Launch

- Other Bank Deposit

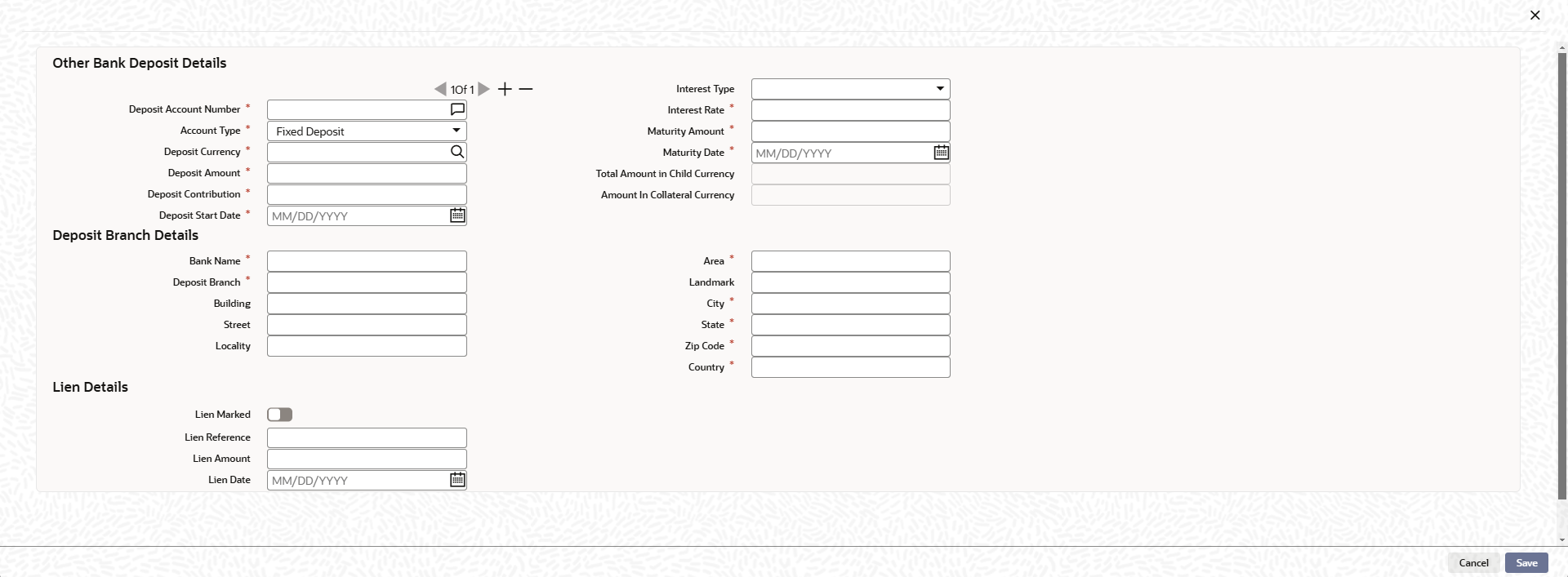

2.12.17 Other Bank Deposit

This topic provides information on Other Bank deposit.

- On the Home screen, specify

GCDCOLOD in the text box and click the

icon.

icon. - On Other Bank Deposits screen , click the

Other Bank Deposits Details tab.

Using this screen, customer collateral of type other bank deposits can be maintained. Multiple other bank deposit records can be linked same customer collateral. Collateral value is updated duly considering total amount of these deposits.

When multiple other bank deposits records are added to customer collateral, last of end dates is updated as collateral end date. At the end date of the last record, collateral value is updated as zero. However, when a particular deposit linked to a collateral reaches end date first, then the collateral value is reduced to this extent.

The Other Bank Deposit Details screen is displayed. For more information on fields, refer to the field description table.Table 2-97 Other Bank Deposits Details - Field Description

Field Description Deposit Account Number Specify the unique deposit account number and account type across multiple deposit accounts attached to the same collateral. Note: Deposit account number should be unique when deposit type is same.

Account Type Select the account type from the drop-down list. The available options are: - Fixed Deposit

- Recurring Deposit

- Reinvestment Deposit

Deposit Currency If deposit currency is different from collateral currency, configured rate is considered and converted deposit amount is updated as collateral value. Deposit Amount and Contribution The deposit contribution is the value of the deposit contributing to the collateral. If deposit contribution is not mentioned deposit amount itself is updated as deposit contribution which is considered for collateral value.

Deposit Start Date The deposit start date cannot be future dated. Interest Type and Rate Select the interest type from the drop-down list. The available options are: - Weekly

- Monthly

- Quarterly

- Half-Yearly

- Yearly

Interest Rate Specify the interest rate. Maturity Date The maturity date cannot be back dated. Maturity Amount The maturity amount cannot be less than deposit amount. Amount in Collateral Currency Wherever other bank deposit currency is different from collateral currency, other bank deposit value in the collateral is converted to collateral currency as per rate configured and collateral value is updated. Deposit Branch Details You can maintain deposit bank and its branch details. Lien Details Existing lien details against the deposit can be noted. Lien Amount Lien amount cannot be greater than deposit amount. If existing lien is available, then collateral value is reduced to the extent of lien amount. Note:- While arriving at collateral value existing lien amount is reckoned and accordingly deposit value is considered for collateral value.

- Collateral value is calculated as deposit balance minus lien amount.

Lien Date Lien date cannot be prior to 'Deposit Start Date'. Lien date cannot be future dated. Following sub-screens are not relevant to Corporate Deposits type of collateral. Appropriate message is displayed when the same are invoked for entering data at the time of collateral maintenance.- Insurance

- Field Investigation details

- Valuation details

- Click Save to save the record.

Parent topic: Collateral Maintenance Launch