1.7 Maintain Currency Definition

This topic explains systematic instructions to maintain currency definition.

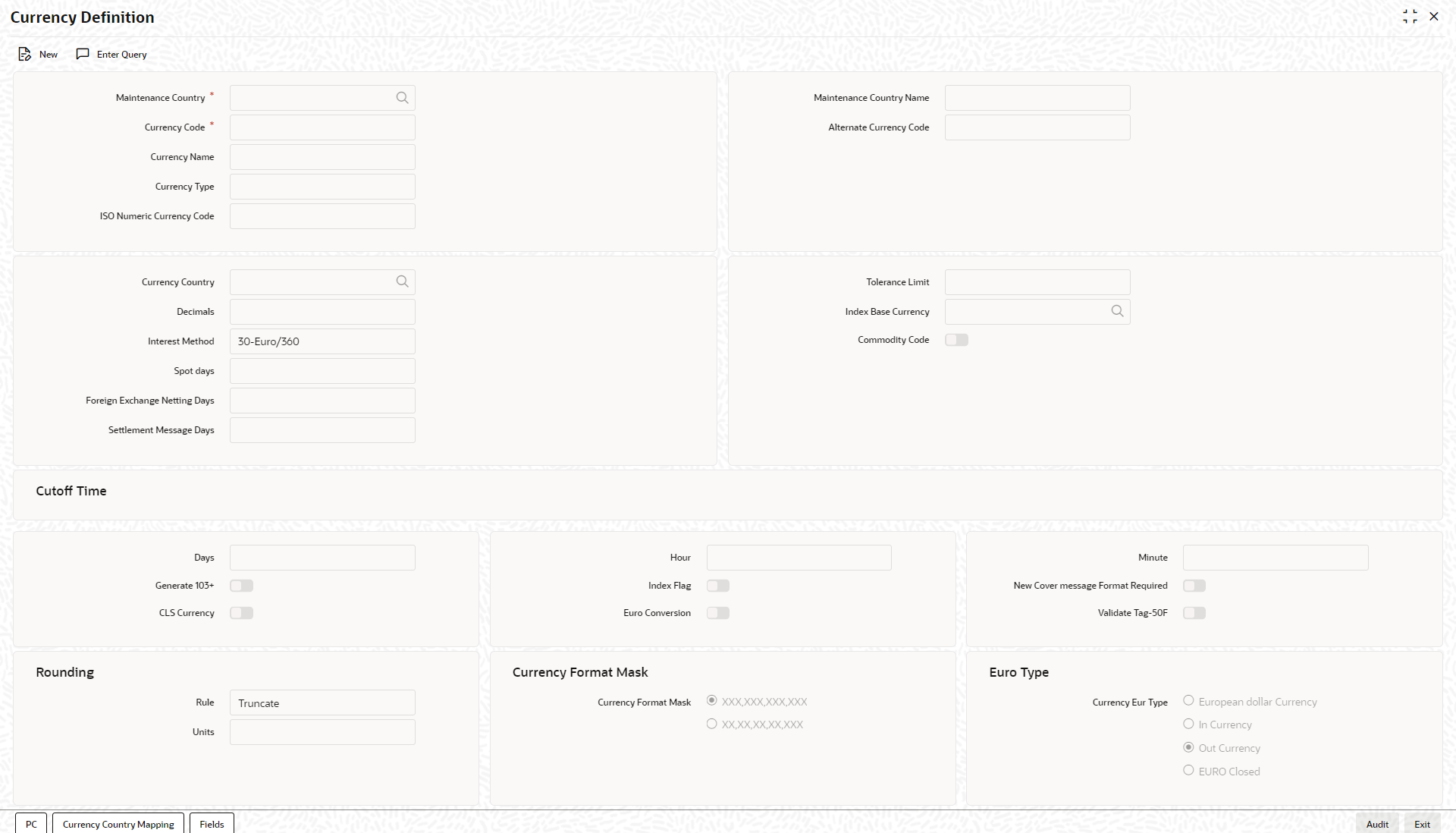

In the Currency Definition screen, define the attributes of the currencies in which the bank can deal. For each currency, attributes like the SWIFT code for the currency, the country to which the currency belongs, the interest method, the spot days, the settlement days, etc. can be defined.

The currencies can be maintained only at the Head Office. The list of currencies will be made available to the branches based on the currencies that have been defined for the country linked to that branch.

Note:

The fields which are marked in asterisk are mandatory.- On Homescreen, type CYDCDEFE in the text box, and click Next.The Currency Definition screen displays.

- On the Currency Definition screen, specify the fields.For more information on fields, refer to the field description table.

Table 1-8 Currency Definition - Field Description

Field Description Maintenance Country Click Search and specify the country code for which the currency is maintained from the list of values. The list displays all the authorized and open country codes along with their description maintained in the system. For example, if the country code for a bank or a branch maintained which is operating in Singapore for the currency USD, then specify the country code as SG. The system defaults the field Maintenance Country as the US.

Maintenance Country Name The system displays the name of the country for which the currency is maintained. Currency Code Specify the code of the currency. The currencies are identified in Oracle FLEXCUBE Universal Banking by the SWIFT codes assigned to them. The currency will be identified by this code in all transactions that involve it. Currency Name Enter the detailed name of the currency in not more than thirty-five alphanumeric characters. Currency Type As per the bank’s requirement, the user can choose to classify currencies into different currency types. The bank can use its discretion to decide the basis of classifying currencies into different currency types. A currency type can consist of a maximum of three characters.

Depending on the customer account mask maintained, the value in the Currency Type field would be used during the generation of customer account numbers through the Customer Accounts Maintenance screen.

If it is decided to include currency type as part of the customer account number (in the account number mask), then at the time of creating a new customer account number, select the currency of the account number being generated. In the options list provided for currency, the currency code is displayed along with the associated currency type say, USD– 1, GBP – 2, etc. When the account number gets populated, it is the currency type that forms a part of the customer account number.

ISO Numeric Currency Code Specify the currency code specified by the International Standardization Organization. Alternate Currency Code Specify the alternate currency code. Country Currency Click Search and specify the country from the list of values. After identifying the currency, specify the country to which the currency belongs. Decimals Specify the number of decimal units up to which the currency can be denominated. The number of decimals allowed for any amount in the currency can be - - 0 - Currency with no decimals

- 2 - Currency with two decimals

- 3 - Currency with three decimals

- 4 - Currency with four decimals

Interest Method Select the interest rate to be used for transactions that involve this currency from the drop-down list. - 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

Spot Days The number of spot working days applicable for the currency is specified here. For example, the tenor of an MM contract is as follows - - Value Date - 01/01/99

- Maturity Date - 31/01/99

- Contract Currency - USD

- Contract Amount - 5000

For this contract, the payment advices will be sent on 28/01/96.

Foreign Exchange Netting Days Oracle FLEXCUBE Universal Banking provides a facility wherein all transactions relating to a customer, meant to be settled on a particular day and made before a specific cut-off day are collated, and netted and a single payment message is sent instead of individual messages for each payment. This cut-off day can be parameterized and is called Netting Days. The number of FX netting days applicable for the specified currency is maintained here. Note:

The system validates that the FX Netting days are lesser than or equal to the spot days.Settlement Message Days Specify the Settlement Message Days for a currency. Settlement messages for the components of a contract (in the LC, BC, LD, MM, and FX modules) will be generated according to the settlement days specified for the currency of the settlement account.

For example, when maintaining the details of USD in the Currency Definition screen, specify the Settlement Message Days as 2. This implies that two working days before the settlement of a component through a USD account, a settlement message will be automatically generated if specified (when runs the Settlement Messages function at the end of the day).

The settlement details of a contract are as follows -

- Settlement Date - 06 May 1999

- Settlement Account Currency - USD

- Component - Principal

- Settlement Message - Yes

- Component Currency - GBP

When generating the Settlement Messages function, at the end of the day, on 04 May 1999, a settlement message for the principal component of the contract will be generated.

The user can run the Settlement Messages function as part of EOD operations from the Application Browser to automatically generate settlement messages for contracts marked out for automatic liquidation.

The settlement day specification for a currency will determine the contracts that are picked up for settlement message generation.

Tolerance Limit When maintaining an In Currency, or the Euro in the Currency Definition screen, define a Tolerance Limit for it. The limit is expressed as a percentage. The Implication - During the transition period, settlement of components in In currencies can be made either in the same currency or in the Euro (EUR) depending on the settlement account(s) maintained. (Similarly, components in Euro can either be settled in EUR or an In currency.) In the settlement messages that are generated (MT 100, MT202), the settlement amount would be reported in the Settlement Account Currency. However, the user can opt to additionally furnish the value of the component in Euro Related Information (ERI) currency. The user have to manually specify the settlement amount value, in the ERI currency, in the Settlement Message Details screen.

When generating the message towards settlement (MT100, MT202), the system ensures that the value the user specifies as the ERI Amount conforms to the Tolerance Limit defined for the ERI Currency (in the Currency Definition screen). That is, the system computes the ERI equivalent of the settling amount using the pegged rates and compares the same against the ERI amount input by the user. If the difference is within the tolerance limits defined for the ERI currency, the user-specified amount is used.

If the user-specified ERI amount breaches the Tolerance Limit defined for the ERI currency, the system calculates and reports the ERI Amount based on the exchange rate defined for the settlement currency vis-à-vis the ERI currency.

For example, in the SWIFT messages (MT 100 and MT 202) that are generated towards settlement, the value of the component can be reported both in the Nostro account currency (in Field 32A) and in an ERI currency that the user specifies (in field 72). In Oracle FLEXCUBE Universal Banking, this information is captured in the European Related Information (ERI) fields in the Settlement Message Details screen.

Assume the following scenario -- The settlement account is an EUR account.

- The user has to settle an amount of DEM 10000.

- The user has defined the ERI currency for DEM as DEM.

- The Tolerance Limit for DEM as 0.05%.

- The exchange rate - 1 Euro = 1.30 DEM

The settlement amount in Euro would therefore be 7692.36 (rounded to the nearest higher cent). This amount will be reported in field 32A of the settlement messages. Now, if want to furnish the settlement amount in the ERI currency (in this case, DEM) the user has to manually enter the DEM value in the ERI Amount field. The user may enter DEM 10000. (EUR 7692.36 converts into DEM 10000.068.)

The value that is entered is well within the Tolerance Limit of 0.05% defined for DEM. Therefore, this value will be reported in field 72 of the settlement messages.

Since the Tolerance Limit for DEM is 0.05%, specify an ERI Amount between DEM 9995 and DEM 10005 (DEM 10000 * 0.05/100 = DEM 5). If an ERI value is entered exceeding DEM 10005 or less than DEM 9950, the system recalculates the ERI Amount at the time of generating the settlement messages. The recalculation will be based on the pegged rates between the Settlement Currency and the ERI currency.

Note:

The system validates the ERI amount only when generating settlement messages. It does not validate the ERI amount at the time of input (in the Settlement Message Details screen).Index Base Currency Click Search and specify the currency that should be used to handle index-based securities traded by the banks, wherein the deals are done in index currency and their settlement is done through the local currency. Commodity Code Check this box to indicate that the maintained currency code is a commodity code that is restricted not to populate in payment messages during message generation in the Currency Code field. Hour and Minute The currency cut-off time refers to the time by which all transactions involving a currency should be generated. For a currency, specify the cut-off Hour and Minute. This time should be expressed in the local time of the bank. The maintenance of a cut-off time for a currency has particular reference to outgoing funds transfers involving it. The cut-off time (in hours and minutes) that is maintained to be applicable for payment transactions involving a currency applies to the head office branch of the bank. Days Specify the cut-off days for payment transactions involving the currency. For example, the value date of a funds transfer transaction (incoming payment) involving USD, is 3rd June 2001. The number of cut-off days specified for the currency is 2. This means that the payment must be received on or before 1st June 2001. If the payment is received on 1st June, it must be received before the cut-off time specified for USD. If the USD cut-off time is 1200 hrs, then if the payment is received on 1st June 2001, it must be received before 1200 hrs.

If the branches are in time zones other than the head office branch time zone, maintain the offset time applicable for each branch in the Branch Parameters screen.

Note:

Even when cut-off days and the cut-off time for a currency have both been specified, the cut-off checks are performed for a funds transfer transaction only if specified as applicable for the product involved in the transaction.Generate 103+ Check Generate 103+ box only if want to generate outgoing MT103 messages in the MT103 + format. If enabling this option for a specific currency, ensure to also enable this option -

- For bank branch in the Branch Parameters Maintenance

- For the customer of the contract in the BIC Code Maintenance

- For the product used by the contract in the product Preferences

Consequently, while processing transactions in the specified currency for such a customer, branch, and product, for which the Generate 103+ option is enabled, the system generates outgoing payment messages in the MT103 + format.

Note:

Since the system is also capable of processing incoming MT 103 messages in the MT 103+ format. Therefore, during the upload process for the branch, the system considers a MT 103 payment message to be of MT 103+ format for those customers, currency and product combinations, for which the Generate 103+ option has been enabled.CLS Currency To allow customers of the bank to settle their FX deals via the CLS (Continuous Linked Settlements) Bank, identify the currency to be a CLS Currency. FX deals in the CLS currency only will be eligible to be routed through the CLS bank. From the available list of CLS currencies, maintain a list of Allowed or Disallowed currencies for a specific customer. Every customer who is a CLS Participant will be allowed to trade in all the available CLS currencies unless specifically mentioned. Index Flag Check this box to derive the index rate of the currency in the Lending module. Euro Conversion Check this box to enable Euro conversion. New Cover message Format Required Check this box to enable the new cover message format. Validate Tag-50F Check this box to indicate that validations need to be performed for the 50F details captured for the ordering customer during contract input. For more details on 50F validations, refer to the topic titled Maintain Addresses for a Customer in Messaging System User Guide. For more details on new cover message formats, refer to the Settlements User Guide.Note:

Customer cover messages are always generated in the new format (MT202COV or MT205- COV).Rule This refers to the method to be followed for rounding off fractional units of a currency. Select the rounding preferences from the drop-down list - - Truncate - The amount is truncated to the number of decimals specified for the currency.

- Up - The amount is rounded up based on the number of decimals and the nearest rounding unit.

- Down - The amount is rounded down based on the number of decimals and the nearest rounding unit.

- Round Near - The amount is rounded near based on the number of decimals and the nearest rounding unit.

Unit If the Up or Down option is selected in the Rule field, specify the nearest unit to which the rounding should take place. The number of units specified here should not be greater than the number of decimals allowed for the currency. For example, The decimal point specified for currency A is 2. The rounding unit is .05 The amount for the transaction is USD 100.326, which will be rounded off depending on the decimals specified and the rounding rule and rounding unit.

For Rounding Rule Up, the amount available for the transaction would be USD 100.35. For rounding rule Down, the transaction amount would have been rounded down to 100.30.

If the rounding rule was specified as Truncate then, the amount would have rounded off to 100.32 (simply, knock off all decimal points beyond the stated decimals places to be rounded off). Thus whenever a Truncate option is selected, there is no need to state the Unit.

Currency Format Mask Select the format in which amounts in this currency are to be displayed for contracts in this currency from the following options - - XXX,XXX,XXX,XXX

- XX,XX,XX,XX,XXX

Currency Eur Type When maintaining a currency in the Currency Definition screen, specify the Type of the currency in the transition phase of the European Economic and Monetary Union (EMU). This can be done in the Currency Eur Type field. Select the Euro type for the currency from the following options - - European Dollar Currency

- In Currency

- Out Currency

- Euro Closed

The specifications in this field enable us to handle the first phase of the EMU, which commenced on 01 January 1999. National currencies of In countries are referred to as In Currency. When maintaining other currencies, select the Out Currency option under Currency Eur Type.

When the transition period ends, the national currencies of the participating countries would cease to exist as valid legal tenders. The Euro would be the only legal tender in the participating countries. Consequently, the Euro changes made to Oracle FLEXCUBE Universal Banking will no longer be required.

The user can turn off the changes at the end of the transition period by -- Closing all In currencies, and

- Selecting the Euro Closed option (for the Euro)

For example,Table 1-9 Rounding Preference

Amount before Rounding Rounding Method Number of Decimals Rounding Unit Amount after Rounding 1234.678 Truncate 2 - 1234.67 1234.678 Round up to the nearest rounding unit 2 .01 1234.68 1234.678 Round down to the nearest rounding unit 2 .01 1234.67 The treatment for interest calculation varies with each of the interest calculation methods. Each method is dealt with individually below -Table 1-10 12

Interest Method Interest Calculation 30(Euro)/360 10,000x10/100x114/360 In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 Euro Method, all months have 30 days, February included.)

- February - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

- March - 24 days (include from date exclude to date)

30(US)/360 10,000x10/100x114/360 In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

- February - 29 days (In 30 US Method, actual days are accounted for the leap year.)

- March - 24 days (include from date exclude to date)

Actual/360 10,000x10/100x115/360 In this method, the number of days is calculated as follows -- December -31 days (include from date exclude to date)

- January - 31 days

- February - 29 days (leap year)

- March - 24 days (include from date exclude to date)

30(Euro)/365 10,000x10/100x114/365 In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 Euro Method, all months have 30 days, February included.)

- February - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

- March - 24 days (include from date exclude to date)

30(US)/365 10,000x10/100x114/365 In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

- February - 29 days (In 30 US Method, actual days are accounted for the leap year.)

- March - 24 days (include from date exclude to date)

Actual/365 10,000x10/100x115/365 In this method, the number of days is calculated as follows -- December - 31 days (include from date exclude to date)

- January - 31 days

- February - 29 days (leap year)

- March - 24 days (include from date exclude to date)

30(Euro)/Actual 10,000x10/100 x (30/365+84/366) In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 Euro Method, all months have 30 days, February included)

- February - 30 days (In 30 Euro Method, February always has 30 days, leap year or not)

- March - 24 days (include from date exclude to date)

Note:

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year.30(US)/Actual 10,000x10/100 x (30/365+84/366) In this method, the number of days is calculated as follows -- December - 30 days (include from date exclude to date)

- January - 30 days (In 30 US Method, all months have 30 days, only for February are the actual number of days calculated.)

- February - 29 days (In 30 US Method, actual days are accounted for the leap year.)

- March - 24 days (include from date exclude to date)

Note:

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year.Actual/Actual 10,000x10/100 x (31/365 + 84/366) In this method, the number of days is calculated as follows -Total = 31 + (31+29+24=84) =115- December - 31 days (include from date exclude to date)

- January - 31 days

- February - 29 days (leap year)

- March - 24 days (include from date exclude to date)

Therefore, the denominator for the 31 days in December is 365 as it is a non-leap year and the denominator for the 84 days in 2000 is 366 as it is a leap year.Note:

When the interest period crosses from a non-leap year to a leap year (or otherwise), the basis of actual days has to be treated separately in each year. - Click Exit to end the transaction.

- Maintain Debit and Credit Exchange Rate Limit

This topic explains systematic instructions to maintain debit and credit auto exchange rate limits. - Maintain Currency Country Mapping

This topic explains systematic instructions to maintain currency country mapping.

Parent topic: Core Maintenance