1.31 Maintain External Collaterals

This topic explains systematic instructions to maintain external collateral details.

Note:

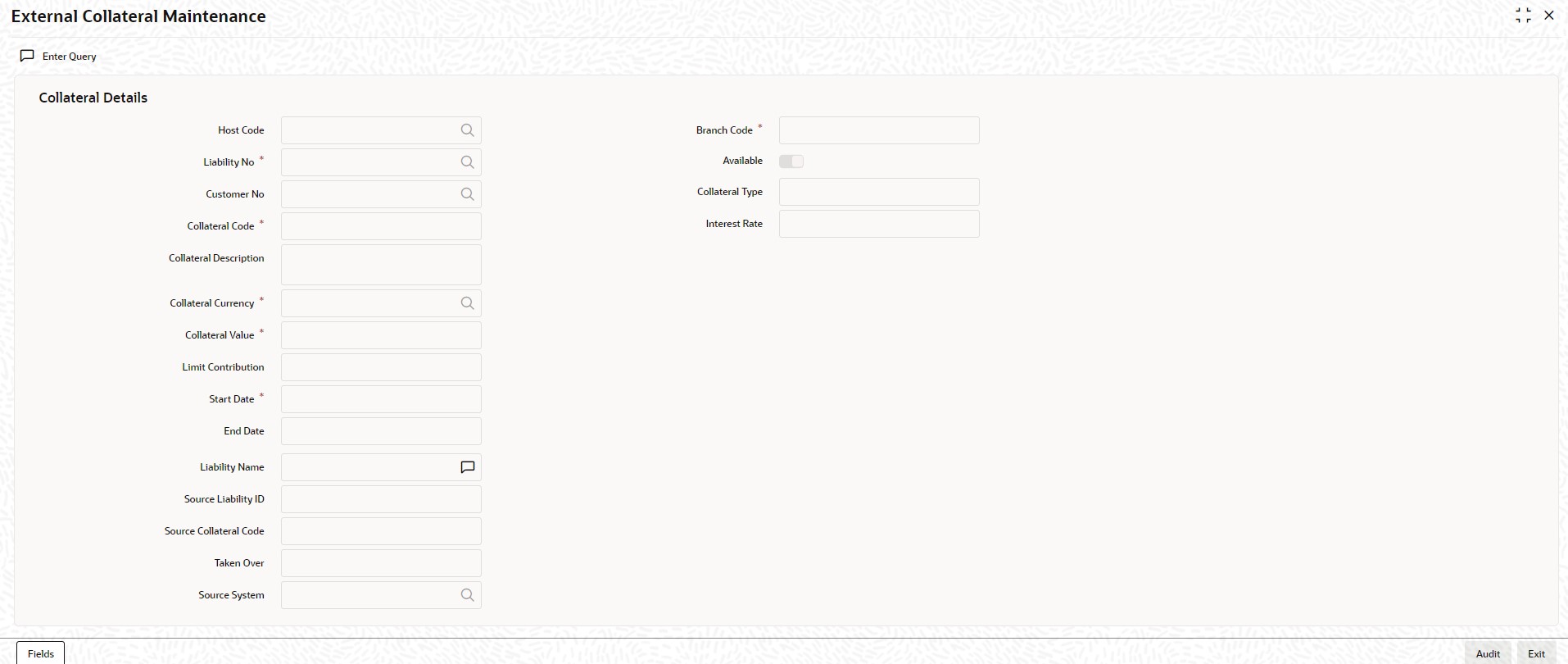

The fields which are marked in asterisk are mandatory.- On Homescreen, type STDCRCOL in the text box, and click Next.The External Collateral Maintenance screen displays.

Figure 1-31 External Collateral Maintenance

- On the External Collateral Maintenance screen, specify the fields.

Note:

The fields, which are marked with an asterisk, are mandatory.For more information on fields, refer to the field description table.

Input in case of a nominal quoted security:Table 1-40 External Collateral Maintenance - Field Description

Field Description Host Code Click Search and specify the host code from the list of values. Branch Code Specify the branch code in which the collateral is created. Available This check box will be checked by default, indicating that the collateral is available for linking to the collateral pool. To manually freeze this collateral, uncheck this box. Liability Number Specify the liability number for which the collateral is linked. Customer Number Click Search and specify the customer number from the list of values. Collateral Code Specify the collateral code here. A maximum of 20 alphanumeric characters are allowed in this field. There should be only one Collateral Code for a given liability. Collateral Description Enter a brief description of the collateral. Collateral Type Select the type of collateral from the drop-down list: - Property

- Vehicle

- Marketable Securities

- Plant and Machinery

- Precious Metal

- Guarantee

- Miscellaneous

- Policy

Interest Rate Specify the interest rate of the collateral. Collateral Currency Specify the currency in which the collateral has to be maintained. Once authorized, the Collateral Currency cannot be changed. Collateral Value The Collateral Value depends on whether the security is Market Value or Non-Market Value based. If it is Market Value based, then the collateral value is calculated as shown in the following examples.If it is Non-Market Value based, then the user has to enter the collateral value manually.

Limit Contribution Specify the final amount of contribution that will be applicable for a limit. For example, Collateral is valued at $1000, and the user wishes to offer the customer credit only worth $ 980. This amount is 98% of the collateral contribution.

(1000 - 980)/1000 = 2% is the Hair cut percentage, This means the user wants to have a lendable margin of 98%.

For instance, if the user enters the lendable margin percentage, then based on the entered value, the hair cut will be calculated as described above and the limit contribution will be calculated.

Start Date and End Date Specify the tenor of the collateral using the Start Date and End Date fields. The collateral is considered effective only during this period. The Start Date indicates the date from which the collateral becomes effective. The End Date that is specified here indicates the date on which the collateral ceases to exist. On the end date, the credit limit of the credit line backed by the collateral, will be reduced by the amount that the collateral contributes to the credit line.

Liability Name Specify the liability name. Source Liability ID Specify the source liability ID. Source Collateral Code Specify the source collateral code. Taken Over Taken Over collateral is checked if the collateral linked to CI/CL account is taken over. Source System Click Search and specify the source system from the list of values. Input in case of a unit quoted security:Table 1-41 Example 1

Nominal Amount Price Code Market Price Collateral Value [(Market price/100) *Nominal Amount] 10,00,000 BOM1 65 (65/100) * 10,00,000=650000 5,00,000 BOM2 70 (70/100) * 5,00,000= 350000 7,00,000 BOM3 80 (80/100) * 7,00,000= 560000 Table 1-42 Example 2

Number of Units Price Code Market Price Collateral Value (Number of Units x Market price) 65 BOM1 120 7800 70 BOM2 130 9100 40 CAL1 95 3800 - Click Exit to end the transaction.

Parent topic: Core Maintenance