This topic describes the systematic instructions to configure the interest rule maintenance details.

Specify User ID and Password, and login to Home screen.

- On Home screen, click Interest and Charges. Under Interest and Charges, click Interest Rule Maintenance.

- Under Interest Rule Maintenance, click Create Interest Rule Maintenance.

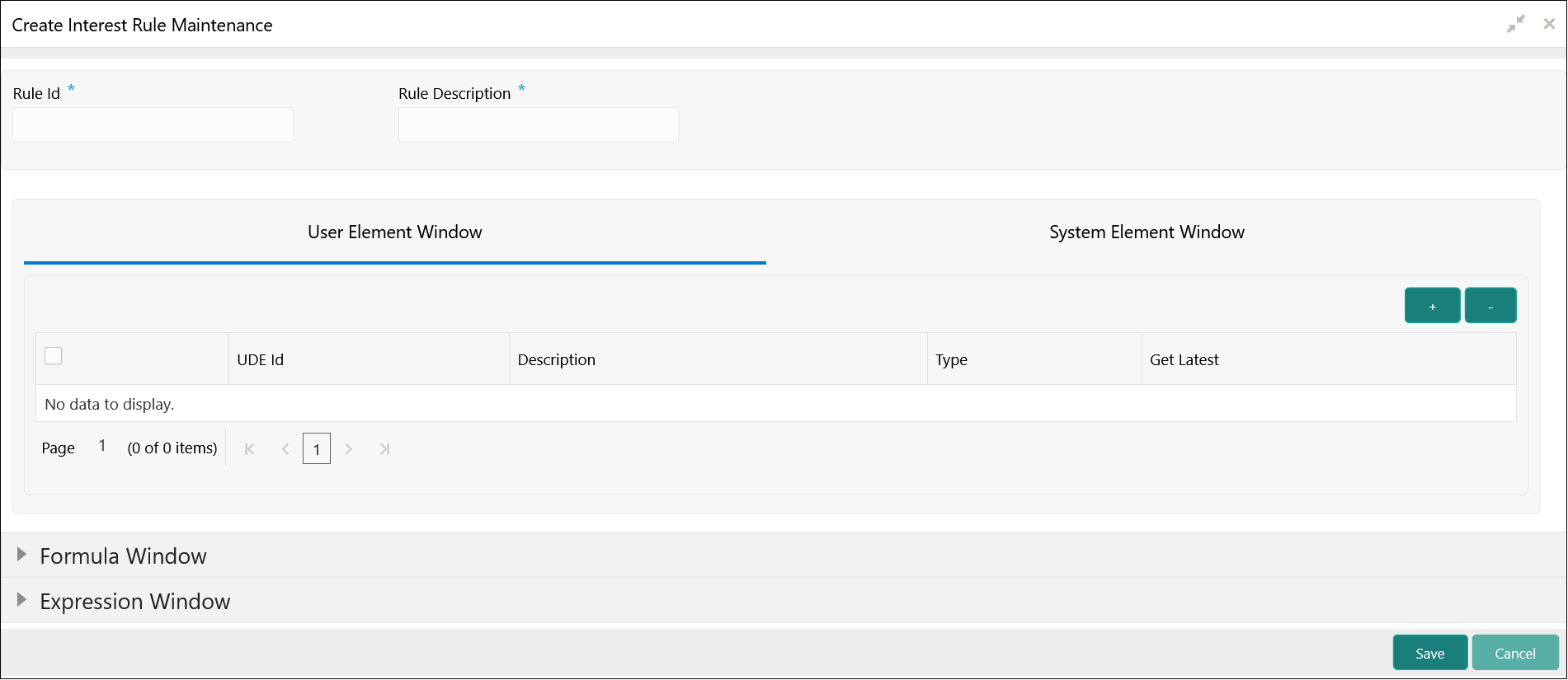

The

Create Interest Rule Maintenance screen displays.

- Specify the fields on Create Interest Rule Maintenance screen.

Note:

The fields, which are marked with an asterisk, are mandatory.

For more information on fields, refer to the field description table.

User Element Window and System Element Window:

In the same way, the user picks up the SDEs applicable for the defined rule. The user should identify the UDEs which the user would be using in the rule. The types of UDEs are as follows:

The interest that you charge on a debit balance is an example of a debit rate. The interest that you pay on a credit balance is an example of a credit rate. A User Data Element will be an amount under the following circumstances:

- In the case of a tier structure, the upper and lower limit of a tier or a tier amount.

- In the case of a charge, when it is indicated as a flat amount.

- Any amount that can be used in the definition of formula.

A UDE as a number is typically used for a Rule where interest is defined based on the number of transactions. A UDE under this category can also be used to store a numerical value that may be used in a formula. For example, in the formula you would like to multiply an intermediate result with a certain number before arriving at the final result. The ‘certain number’ in the formula can be a UDE.

The user can enter the actual values of the UDEs (like the interest rate, the upper limit for the tier, etc.) in the IC User Data Element Maintenance screen. This is because you can specify 3-6 different values for each data element. A rule can, therefore, be applied on different accounts since it just represents a method of interest calculation. The following example illustrates this.

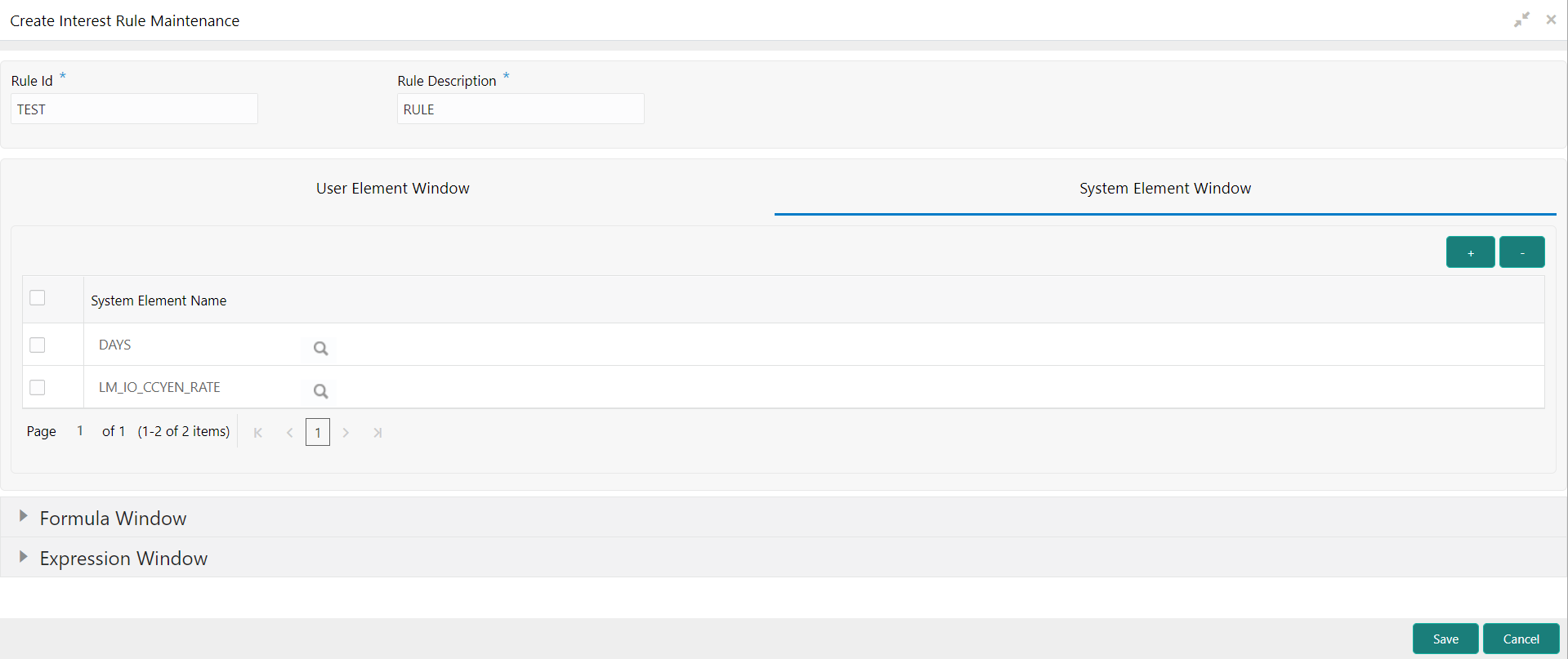

- Click System Element Window to update the system element details.

The

System Element Window displays.

For more information on fields, refer to the field description table.

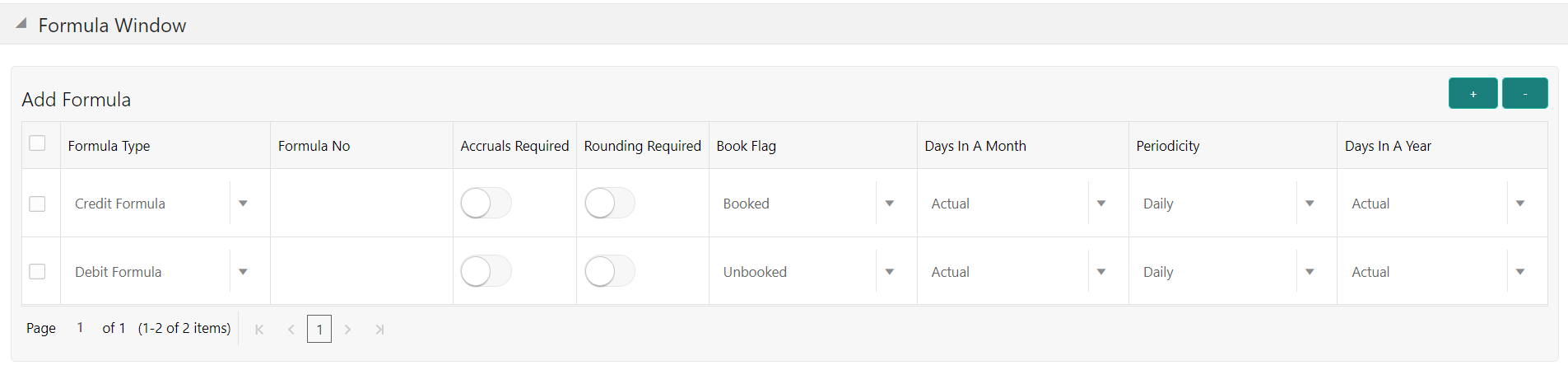

Formula Window:

Using the SDEs and the UDEs specified for a Rule, the user can calculate interest. The user have to specify the method for calculating interest in the form of formulae. Using the SDEs and the UDEs, the user can create any number of formulae for a rule.

- Click Formula Window button to invoke the formula section.

The

Formula Window displays.

For more information on fields, refer to the field description table.

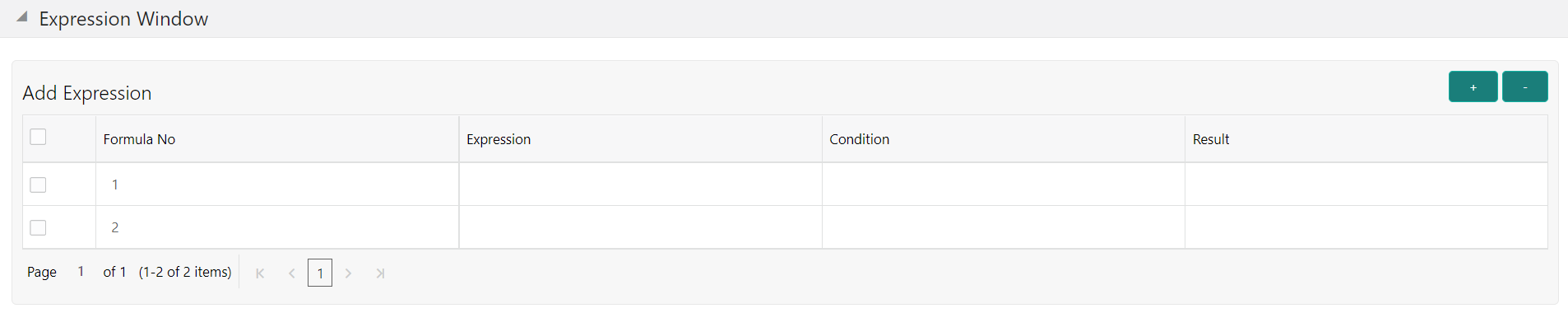

Expression Window

- Click Expression Window button to invoke Add Expression table grid.

The

Expression Window displays.

For more information on fields, refer to the field description table.

Debit / Credit

The result of a formula will be an amount that has to be either debited from the customer account or credited to it. For example, the debit interest that the user charge on an overdraft would be debited from the customer account; while the credit interest that the user pay would be credited to the customer account. In this screen, you indicate this. Often, when calculating interest for an account, the user would want to debit interest under certain conditions and, under certain other conditions, credit interest. In such a case, the user can build formulae to suit both conditions. The formula that is used to calculate interest for the account would depend on the condition that is fulfilled.

- Click Save to save the details.