10.3 Advantage Method

This topic describes the information about the advantage method for the pool structure.

- Credit/Debit formula for computing the interest

- Debit formula for computing the tax

The system will perform the interest calculation as well as compute the tax on the same. As per the liquidation cycle maintained in the system, Oracle Banking Liquidity Management will do the Interest and Tax postings to DDA.

The Interest Payable GL (Credit Interest), Interest Receivable GL (Debit Interest) and the Tax Payable GL (WHT) along with the accounting will be maintained in the IC sub system.

Reallocation of Advantage

To reallocate advantage interest along with tax, the notional header should be mapped to a specific IC Product.

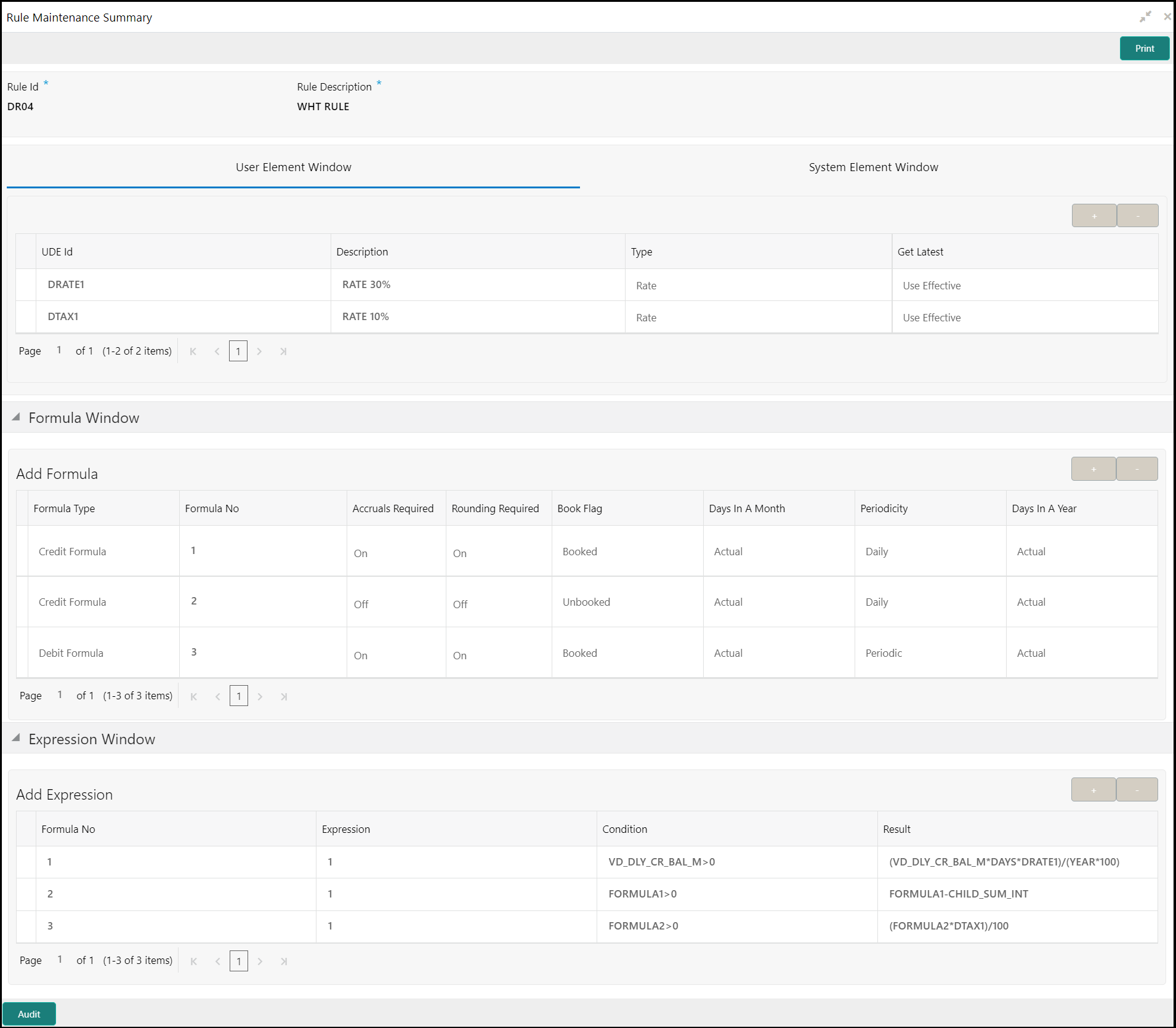

The IC product rule would be as follows:

Table 10-1 Header IC Setup (Group – HDG1 Product HED1)

| Condition | Expression | Description | Formula |

|---|---|---|---|

| VD_DLY_CR_BAL_M >0 | IC_VD_CR_BAL*CR_RATE | Credit Interest Pool Level Non Booked | FRM1 |

| VD_DLY_DR_BAL_M >0 | IC_VD_DR_BAL*DR_RATE | Debit Interest Pool Level Non Booked | FRM2 |

| FRM_1>0 | FRM1-CHILD_SUM_INT | Net Credit Interest – Advantage | FRM3 |

| FRM_2>0 | FRM2-CHILD_SUM_INT | Net Debit Interest – Advantage | FRM4 |

| FRM_3>0 | FRM_3*TAX | Tax for Credit | FRM5 |

| FRM_4>0 | FRM_4*TAX | Tax for Debit | FRM6 |

- WHT Interest Map

This topic describes the information to map the child account formulae to the Notional Parent account.

Parent topic: Withholding Tax