- User Guide

- Structure Maintenance

- Account Structure

- Create Structure

- Structure Details

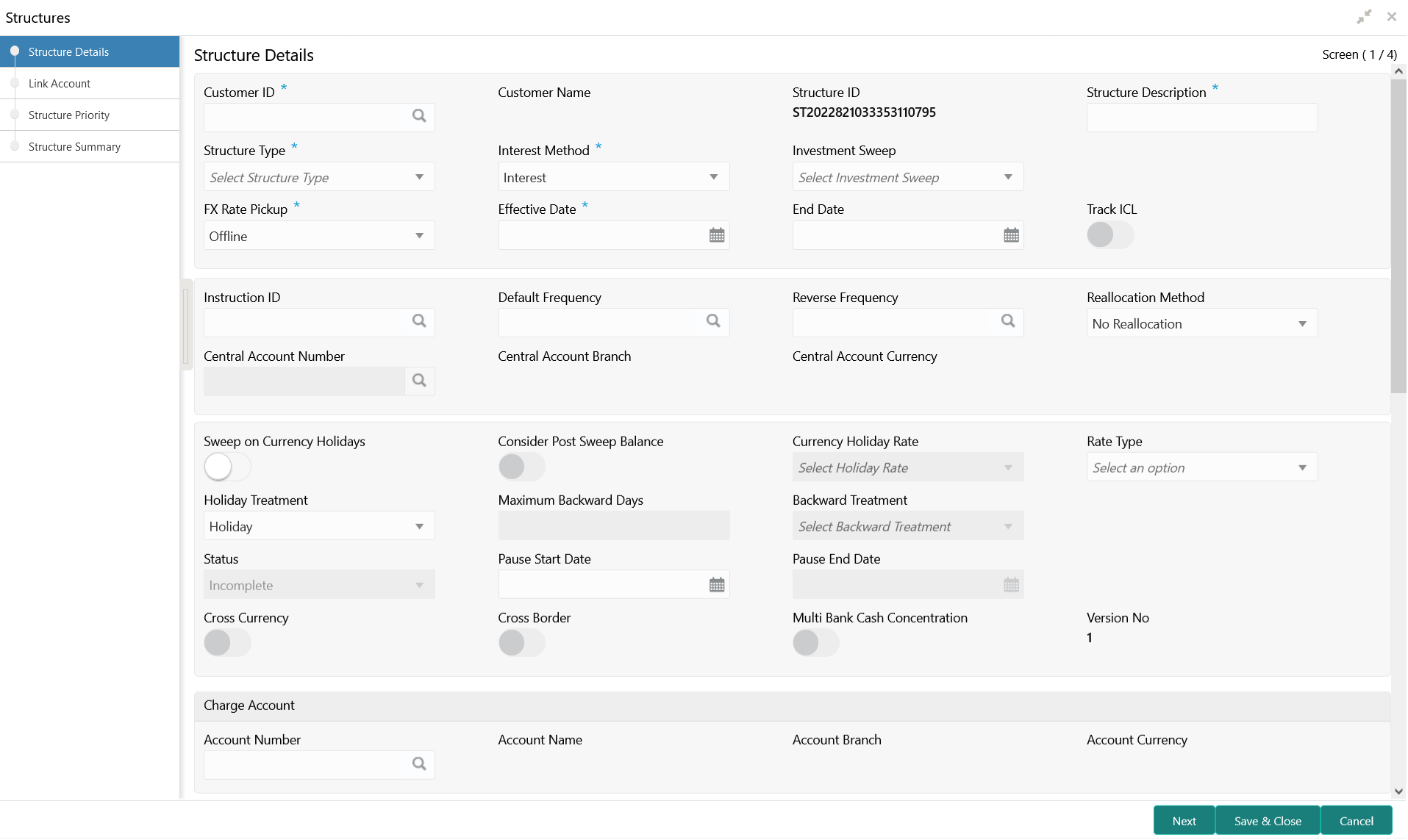

6.1.1.1 Structure Details

This topic describes the systematic instructions to update the structure details for creating a new structure.

- On Home screen, click Oracle Banking Liquidity Management System. Under Oracle Banking Liquidity Management System, click Structure.

- Under Structure, click Account Structure.

- Click + button on the Account

Structure to add a new structure.The Structure Details screen displays.

- Specify the fields on Structure Details screen.

Note:

The fields, which are marked with an asterisk, are mandatory.For more information on fields, refer to the field description table.

Table 6-2 Structure Details – Field Description

Field Description Customer ID Click Search to view and select the customer ID from the list. The list displays all the customer IDs maintained in the system. Customer Name Displays the customer names based on the Customer ID selected. Structure ID Displays the unique structure ID. Structure Description Specify the description for the new structure. Structure Type Select the type of structure from the drop-down list. The available options are:- Sweep

- Pool

- Hybrid

Interest Method Select the interest method for the structure from the drop-down list. The available options are:- Interest

- Advantage

- Optimization

Note:

This field is editable only for Pool Structures. For Sweep Structures, it is automatically populated to Interest Method.Investment Sweeps Select the investment sweeps for the structure from the drop-down list. The available options are:- Term Deposit

- Money Market

Note:

This field is editable only if the Structure Type is selected as Sweep.FX Rate Pickup Select the FX rate pickup for the structure from the drop-down list. The available options are:- Online: The system needs to integrate with an external system to fetch the rates in an online mode.

- Offline: This option is selected by default wherein the rate available in the system is used for cross currency calculations.

Effective Date Select the date from when the structure becomes effective. Note:

This date cannot be less than the system date but can be a future date.End Date Select the date till when the structure is effective. Note:

This date should always be greater than the effective date.Track ICL Select the toggle to enable the ICL tracking. Instruction ID Click Search icon to view and select the instruction ID from the list. The list displays all the instruction types maintained in the system. If the Instruction ID is applied at the structure level, then all the pairs of the structure is processed with the same Instruction ID.Note:

This field is editable only if the Structure Type is selected as Sweep.Default Frequency Click Search icon to view and select the default frequency to be executed from the list. The list displays all the frequencies maintained in the system. The frequency defined at the structure level is applied to all the account pairs in the structure, but the user can override and define a specific frequency for a specific pair of account. This changed preference overrides the global preference.

Note:

This field is editable only if the Structure Type is selected as Sweep and Hybrid.Reverse Frequency Click Search icon to view and select the reverse frequency to be executed from the list. The list displays all the frequencies maintained in the system. The frequency defined at the structure level gets defaulted to all the account pairs in the structure, but the user can override and define a specific frequency for a specific pair of account. This changed preference overrides the global preference.Note:

This field is editable only if the Structure Type is selected as Sweep.Reallocation Method Select the reallocation method from the drop-down list. This option refers to the method in which the interest is shared with the participating account entities. The available options are:- Sweep Structure

- No Reallocation - No interest is paid back to the child accounts.

- Pool Structure

- Central Distribution - The interest arrived is credited to one central account, which can be any one of the participating accounts or a separate account.

- Even Distribution - The interest is evenly distributed among the participating accounts.

- Even Direct Distribution - The interest reward is evenly spread across all accounts with positive balances.

- Percentage Based Distribution - The pre-defined percentage of the interest is distributed among the participating accounts.

Note:

This option is applicable only at the pair level. - Fair Share Distribution - If the interest is positive, it is distributed among the positive contributors in the ratio of their contribution. If the interest is negative, it is distributed among the negative contributors in the ratio of their contribution.

- Reverse Fair Share Distribution - If the interest is positive, it is distributed among the negative contributors in the ratio of their contribution. If the interest is negative, it is distributed among the positive contributors in the ratio of their contribution.

- Absolute Pro-Data Distribution - Absolute balances of all accounts are considered and the interest would be shared proportionally to all accounts.

Central Account Number Click Search icon to view and select the central account number to be applied from the list. The list displays all the accounts maintained in the system. This field is editable only if the Reallocation Method is selected as Central Distribution. The interest reallocation for the structure is done to the selected account.

Central Account Branch Displays the central account branch. Central Account Currency Displays the central account currency. Sweep on Currency Holidays Select the toggle to allow sweep on currency holidays. Consider Post Sweep Balance Select the toggle to consider the post sweep balances on the accounts. When sweeping from level II, this toggle should be checked if the Original Account Balance + Sweep Amount is to be considered for further sweep processing.

If this toggle is not checked, the sweep are performed on the account participating in the structure based on the original fetched balances. Do not consider the incremental balances post sweep.

Currency Holiday Rate Select the rate pick up for the sweeps on currency holidays from the drop-down list. The available option is:- Previous Days Rate

Note:

This field is enabled only if the Sweep on Currency Holidays toggle is selected.Rate Type Select the rate type to be used if the underlying structure has cross currency pairs. The available option is:- Standard Rate

Holiday Treatment Select the type of holiday treatment from the drop-down list. The available option are:- Next Working Date - Perform the action on the next working day.

- Previous Working Date - Perform the action on the previous working day.

- Holiday – Do not perform the sweep and mark it as holiday.

Maximum Backward Days Specify the maximum number of days the system can go back to execute the structure when the execution day falls on a holiday. Note:

This field is enabled only if the Holiday Treatment is selected as Previous Working Date.Backward Treatment Select the backward treatment to be applied from the drop-down list. The available options are:- Move Forward - The action is performed on the next working day.

- Holiday - Do not perform the sweep.

Note:

This field is enabled only if the Holiday Treatment is selected as Previous Working Date.When the Maximum Backward Days set is also falling on a holiday, then the system determines the day on which the action is executed based on the Backward Treatment

Status Displays the current status of the structure and is populated by the system. The available options are:- Active: The structure is complete and is in Active status.

- Paused: The structure is on temporary hold.

- Incomplete: The structure is still being created.

- Expired: The structure is expired.

- In-Active: The structure is not active and is in operational at a future date.

Pause Start Date Select the date from when the structure gets paused. Note:

This field can be a future date but should not be less than the system date.Pause End Date Select the date till when the structure gets paused. . Cross Currency This field gets automatically selected on save if the underlying structure is created with accounts which are in different currencies. Cross Border This field gets automatically selected on save if the underlying structure is created with accounts which are from two or more different countries. Multi Bank Cash Concentration This field gets automatically selected on save if the underlying structure created has external bank accounts. Version Number Displays the version number of the structure. Account Number Click Search to view and select the required account number to collect the charges. The charge account number will be the accounts belonging to the parent customer and linked child customers. Account Name Displays the account name based on the account number selected. Account Branch Displays the account branch based on the account number selected. Account Currency Displays the account currency based on the account number selected. Parameters like Frequency, Reverse Frequency and Instruction Type which are defined at the structure level is applicable at each account pair level in the structure. However, the user can change these parameters at the account pairing level. If the user changes them at the account pair level, the system ignores the structure level set up and go by the pair level settings.

- Click Next to save and navigate to the next screen (Link Account).

- Click Save and Close. to save and close the details.

- Click Cancel to discard the changes and close the window.

Parent topic: Create Structure