1 Operational Ledger - An Overview

This topic describes the overview about the Operational Ledger.

Oracle Banking Operational Ledger Cloud Service (OBOL) is an all-in-one financial management solution designed to simply accounting and financial reconciliation for banks. It consolidates the handling of financial transactions, promoting accuracy, compliance, and transparency.

Oracle Banking Operational Ledger streamlines management for banks, departments, and business units through a unified platform, making consolidation and reporting. It automates transaction posting and reconciliation, to minimize manual errors and save time on everyday tasks. The solution also provides traceability of financial activities by implementing strong user access controls and audit features.

The system works smoothly with various banking systems, such as core banking, payments, loans, and treasury, promoting a cohesive method for financial reporting and accounting. It also manages transactions in multi-currency, featuring exchange rate management and automatic conversion, which simplifies global operations.

Oracle Banking Operational Ledger is designed using Oracle Banking Micro services Architecture to manage large volumes of General Ledger (GL) entries while maintaining accurate balance tracking. Accurately recording financial transactions like deposits, withdrawals, loans, and investments, and this is done using a unified chart of accounts. The Oracle Banking Operational Ledger accommodates multiple currencies, and branches, facilitating seamless consolidation across various units.

The General Ledger in Oracle Banking Operational Ledger is organized in a hierarchical format, consisting of Head GL, Nodes, and Leaf’s, which facilitates efficient tracking and balance management. The system guarantees precise financial information for balances like cash, liabilities, and assets, while also handling transactions between branches. Additionally, it supports foreign currency revaluation and accounts for changes in exchange rates effectively. Moreover, Oracle Banking Operational Ledger manages the closing of financial periods, making sure that all transactions are completed, balances are matched, and financial statements are ready at the end of each financial period. .

Dashboard

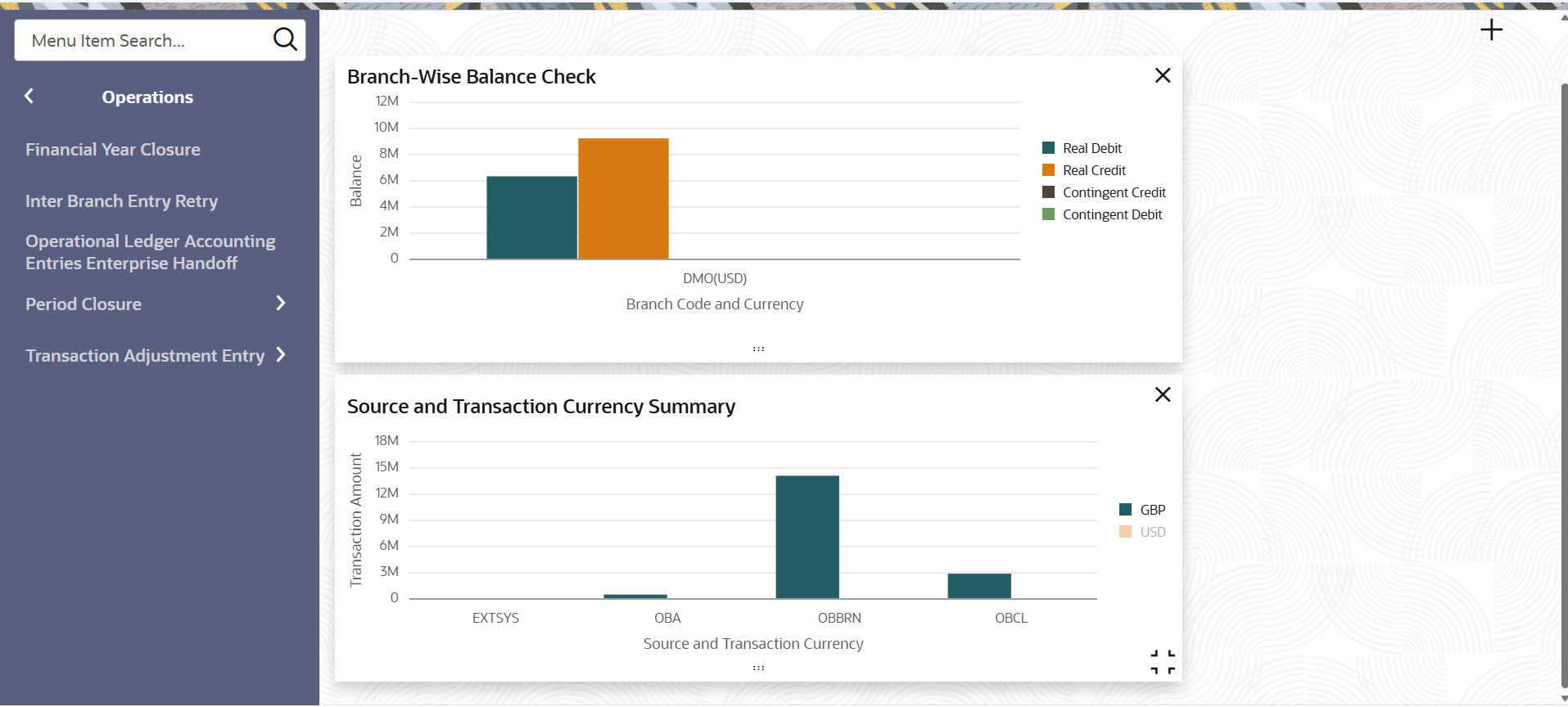

- Source and Transaction Currency Summary: This widget offers a real-time view of transaction amounts, sorted by source or branch and currency. It displays a bar chart that makes it easy to compare transaction volumes across various currencies for each source or branch.

- Branch-Wise Balance Check: This widget provides a clear overview of the financial status of each branch, displaying both real and contingent balances (Debit and Credit). A bar chart shows the information, with balances categorized by branch and currency.