2.1.4 Account Details

This topic provides the systematic instructions to capture the account related information for the application.

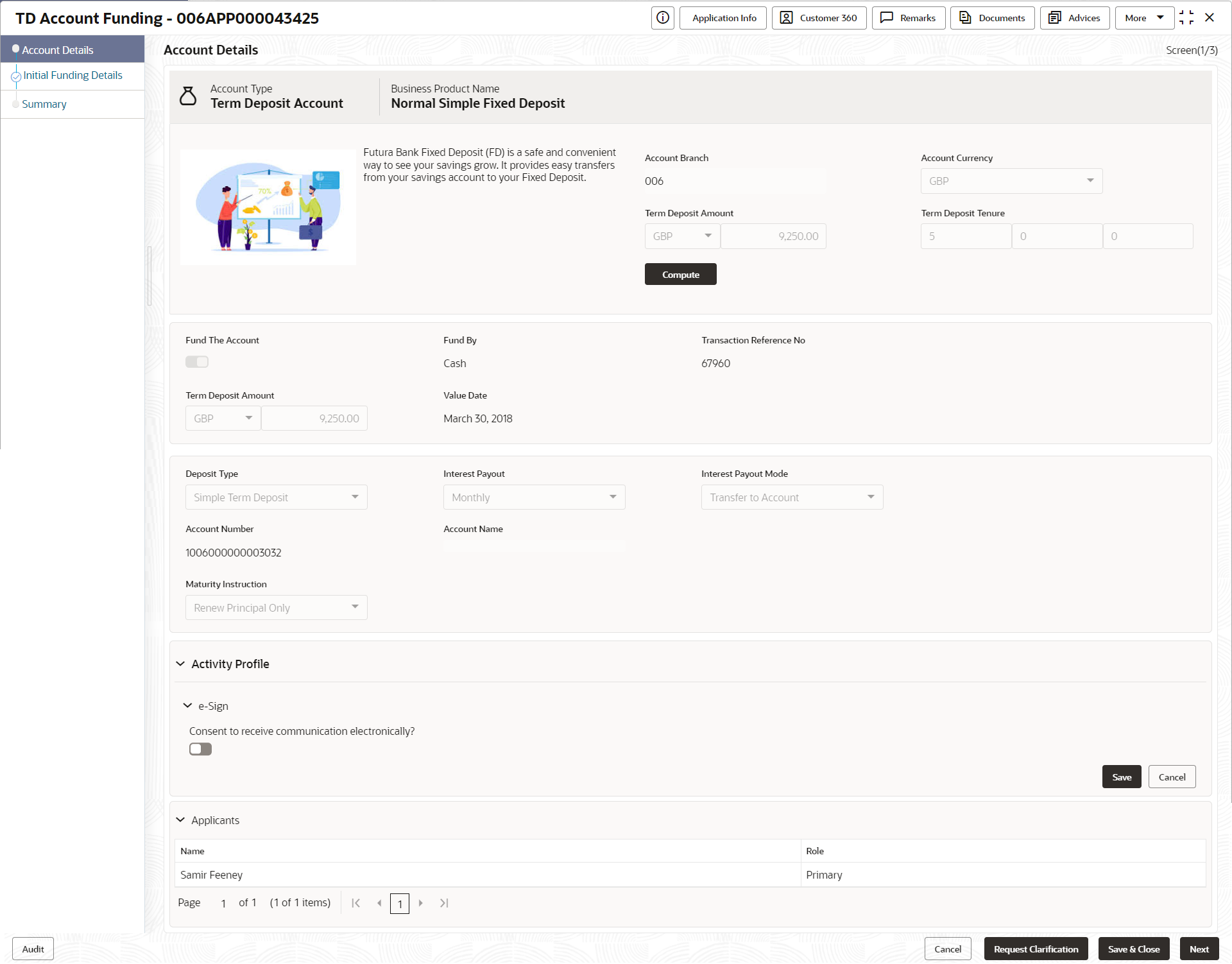

The Account Details data segment displays the account details.

- Click Next in previous data segment screen to proceed

with the next data segment, after successfully capturing the data.The Account Details screen displays.

- Specify the fields on Account Details screen.For more information on fields, refer to the field description table.

Note:

The fields, which mentioned as Required, are mandatory.Table 2-11 Account Details

Abbreviation Description Account Type Displays the account type based on the product selected in the product catalogue. Business Product Name Displays the business product name based on the product selected in the product catalogue. <Product Image> Displays the business product image. <Product Description> Displays a short description of the business product. Account Branch By default, displays the logged-in user’s home branch. System allows to select the branch from the branch list of values. Account Currency Select the currency from the drop-down list, if required. Available options in the drop-down list are based on the currency allowed for the selected business product. By default, base currency of user logged-in branch is displayed. Term Deposit Amount Select the currency and the specify loan amount. Select the currency from the drop-down list. Term Deposit Tenure Select the loan tenure in year, months and days. Compute Click Compute and the following fields are displayed:

- Interest Rate

- Interest Amount

- Maturity Amount

Interest Rate Display the interest rate which is applicable on term deposit amount. Interest Amount Displays the interest amount which is calculated based on the interest rate and term deposit amount. Maturity Amount Displays the maturity amount which is disbursed by the end of term. This amount is total of Term Deposit Amount and Interest Amount. Fund the Account Fund the Account will always be ‘On’ for Term Deposit.

Select to indicate if initial funding has been taken for the account opening. Currently, initial funding is allowed through Cash Account Transfer and Other Bank Cheque.

Select the required option from the drop-down list.

This field is conditional mandatory.

Fund By Select the options from the drop-down list. Available options are:

- Cash

- Account Transfer

- Other Bank Cheque

Transaction Reference No Specify the transaction reference number. Term Deposit Amount Displays the term deposit amount updated earlier. Value Date Select the Current Business date. Account Number Select the account number from the Account Search popup.

This field is applicable only if the Fund By is selected as “Account Transfer”

In Account Search popup, the user can view only the accounts of the existing customers who are part of the application.

Account Name Displays the account name for the selected account number. Cheque Number Specify the Cheque number.

This field is non-mandatory for Account Transfer funding mode.

This field is mandatory for Other Bank Cheque funding mode.

Cheque Date Select the Cheque date.

This field is non-mandatory for Account Transfer funding mode.

This field is mandatory for Other Bank Cheque funding mode.

Bank Name Specify the Bank name.

This field is applicable only if the Fund By is selected as “Other Bank Cheque”.

Branch Name Specify the Branch name.

This field is applicable only if the Fund By is selected as “Other Bank Cheque”.

Cheque Routing Number Specify the Cheque Routing Number.

This field is applicable only if the Fund By is selected as “Other Bank Cheque”.

GL Account Number Specify the GL Account Number where the funding amount is to be credited. You can also search for GL Account Number. GL Account Description Displays the description of selected GL Account.

This field is applicable and mandatory only if the Fund mode is selected as Manual or Automatic.

Deposit Type Displays deposit type as Simple or Reinvestment Term Deposit, based on the Business Product configurations. Interest Payout Specify if the Interest Payout is to be done Monthly or Quarterly. This field appears only for Simple Term Deposit. Interest Payout Mode Specify if the Interest Payout mode is by Transfer to Account or Demand Draft or External Account. Account Number Click Search icon and select the Account Number.

This field appears only if the Interest Payout Mode is selected as Transfer to Account.

User can only accounts of the existing customer in the Account Search popup.

Account Name Displays the account name for the selected account number. BIC Code Click Search icon and select the BIC Code from the list.

This field appears only if the Interest Payout Mode is selected as External Account.

Bank Displays the bank code and name based for the selected BIC Code. Branch Displays the branch code and name based for the selected BIC Code. Account Holder Name Specify the Account Holder name.

This field appears only if the Interest Payout Mode is selected as External Account.

External Account Number Specify the external account number.

This field appears only if the Interest Payout Mode is selected as External Account.

Maturity Instruction Select the maturity type from the drop-down list. Available options are:

Available options for Simple Term Deposit are:

- Renew Principal

- Do not Renew

Available options for Reinvestment Term Deposit are:

- Renew Principal and Interest

- Renew Principal only

- Do not renew

Maturity Payout Mode If the Maturity Instruction selected is either Do Not Renew or Renew only Principal for Reinvestment Term Deposit, you need to specify the Maturity Payout Mode. Select if the Maturity Payout mode is by Transfer to Account or Demand Draft or External Account. External Account Transfer Maturity This section displays the external account transfer maturity details. BIC Code Click Search icon and select the BIC Code from the list. Bank Displays the bank code and name based for the selected BIC Code. Branch Displays the branch code and name based for the selected BIC Code. Account Holder Name Specify the Account Holder name. External Account Number Specify the external account number to which the maturity amount has to be transferred. E-Sign Specify whether the customer needs electronic communication.

If the answer is Yes then it is mandatory to capture the e-mail ID for communication in the application.

This questionnaire appears based on the seed configuration set for the product type.

Note:

The GL Account and GL Account Description will be applicable depending on the following scenarios:Table 2-12 Fund By

Fund By Fund By Mode (In the Plato Properties Table) Applicability Cash Automatic Applicable Cash Manual Applicable Account Transfer Host Non - Applicable Account Transfer Manual Applicable Cheque Host Non - Applicable Cheque Manual Applicable - Click Next to navigate to the next data segment, after successfully capturing the data. The system will validate all mandatory data segments and data fields. If mandatory details are not provided, the system displays an error message for the user to take action. User will not be able to proceed to the next data segment, without capturing the mandatory data.

Parent topic: Application Entry