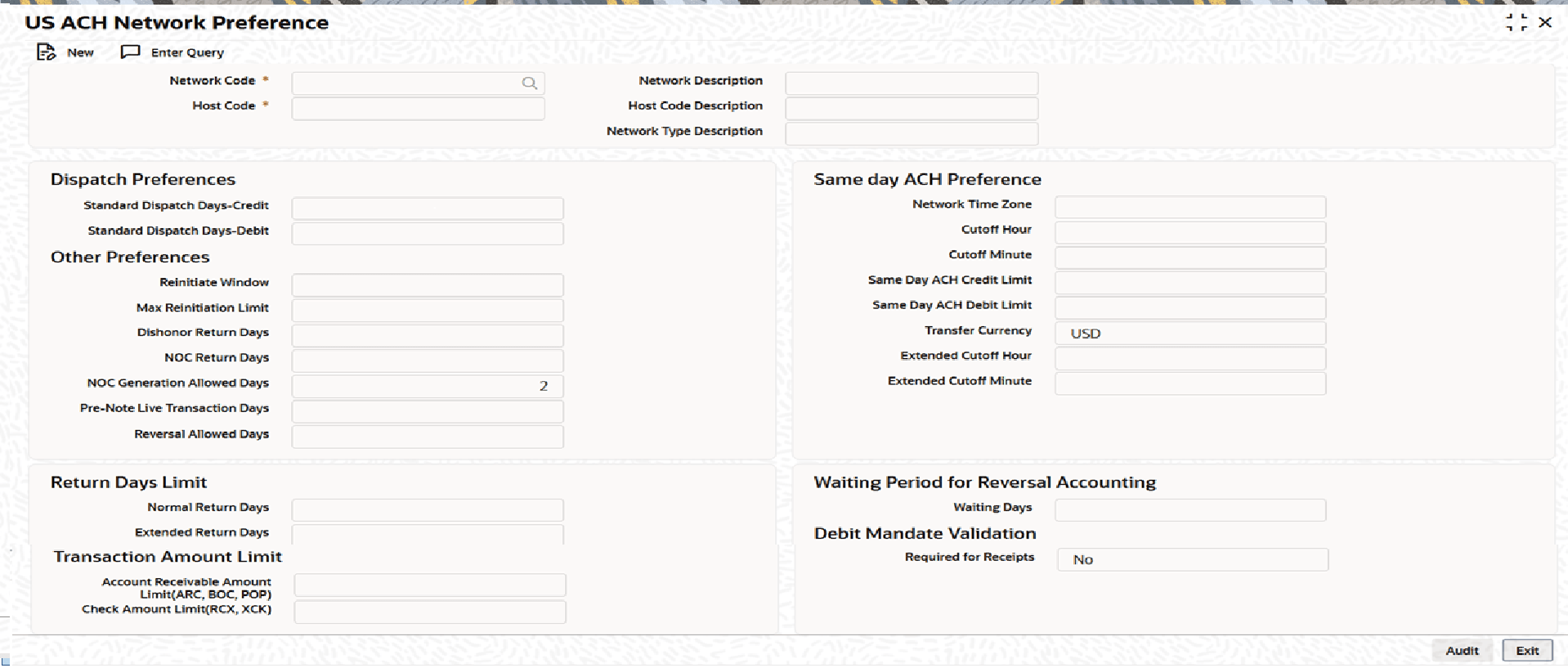

2.1.2 US NACHA Network Preference

Use US NACHA Network Preference screen to capture NACHA Network cutoff time for Same day and extended ACH transactions.

- On Homepage, specify PNDNWPRF in the text box, and click next

arrow.US NACHA Network Preference screen is displayed.

- On US NACHA Network Preference screen, click New to specify the

fields.For more information about the fields, refer to field description table.

Table 2-4 US NACHA Network Preference - Field Description

Field Description Network Code Select the appropriate NACHA Network Code from the list of values. Network Code Description System defaults the description on the Network Code selected. Network Type Description System defaults the Network Type Description on the Network Code selected. Host Code System defaults the Host Code of transaction branch when the user clicks the New button. Host Code Description System defaults the description on the Host Code selected. Dispatch Preferences This section displays the Dispatch Preferences details. Standard Dispatch Days-Credit Specify the field with 2 Business Days. Standard Dispatch Days-Debit Specify the field with 1 Business Days. Same day ACH Preference This section displays the Same day ACH Preference details. Network Time Zone This field displays the Time Zone of the current host. Cutoff Hour Specify the Cuttoff Hour. Cutoff Minute Specify the Cuttoff Minute. Same Day ACH Limit Specify the Same Day ACH Limit. Transfer Currency System displays this field with USD as the default value. Extended Cutoff Hour Specify the Extended Cutoff Hour based on bank operations. Extended Cutoff Minute Specify the Extended Cutoff Minute based on bank operations. Other Preferences This section displays the Other Preferences details. Reinitiate Window Specify the Reinitiate Window. Max Reinitiation Limit Specify the maximum reinitiation limit. Dishonor Return Days Specify the Dishonor Return Days. NOC Return Days Specify the NOC Return Days. NOC Generation Allowed Days System displays the allowed days for NOC generation. Pre-Note Live Transaction Days Specify the Pre-Note Live Transaction Days. Reversal Allowed Days Specify the allowed days for Reversal. Return Days Limit This section displays the Return Days Limit details. Normal Return Days Specify the normal return days. Extended Return Days Specify the extended return days. Waiting Period for Reversal Accounting This section displays the Waiting Period for Reversal Accounting details. Waiting Days Specify the waiting days. Debit Mandate Validation This section displays the Debit Mandate Validation details. Required for Receipts Select Yes or No in the Required for Receipts drop-down list. Transaction Amount Limit This section displays the Transaction Amount Limit details. Account Receivable Amount Limit(ARC, BOC, POP) Specify the maximum amount that can be received for transactions initiated for Accounts Receivable Conversion (ARC), Back Office Conversion (BOC), or Point-of-Purchase (POP) payment method. Check Amount Limit(RCX, XCK) Specify the maximum transaction amount permitted for check-based payments initiated for Represented Check Entry (RCX) or Destroyed Check Entry (XCK). Note:

- When a transaction starts from the Outbound US ACH Debit Transaction Input (PNDODONL) screen using SEC Code ARC, BOC, or POP, clicking the Enrich button ensures that the amount does not exceed the Account Receivable Amount Limit defined in the US ACH Network Preference (PNDNWPRF) screen.

- When a transaction starts from the Outbound US ACH Debit Transaction Input (PNDODONL) screen using SEC Code RCK or XCK, clicking the Enrich button triggers the system to check that the transaction amount does not exceed the Check Amount Limit defined in the US ACH Network Preference (PNDNWPRF) screen.

- If any validation fails, the system displays the error message, Entered amount is greater than the allowed transaction limit.

Parent topic: NACHA Maintenance