- Supply Chain Finance User Guide

- Maintenance for Supply Chain Finance

- Interest Maintenance

- Interest Pricing

- Create Interest Pricing

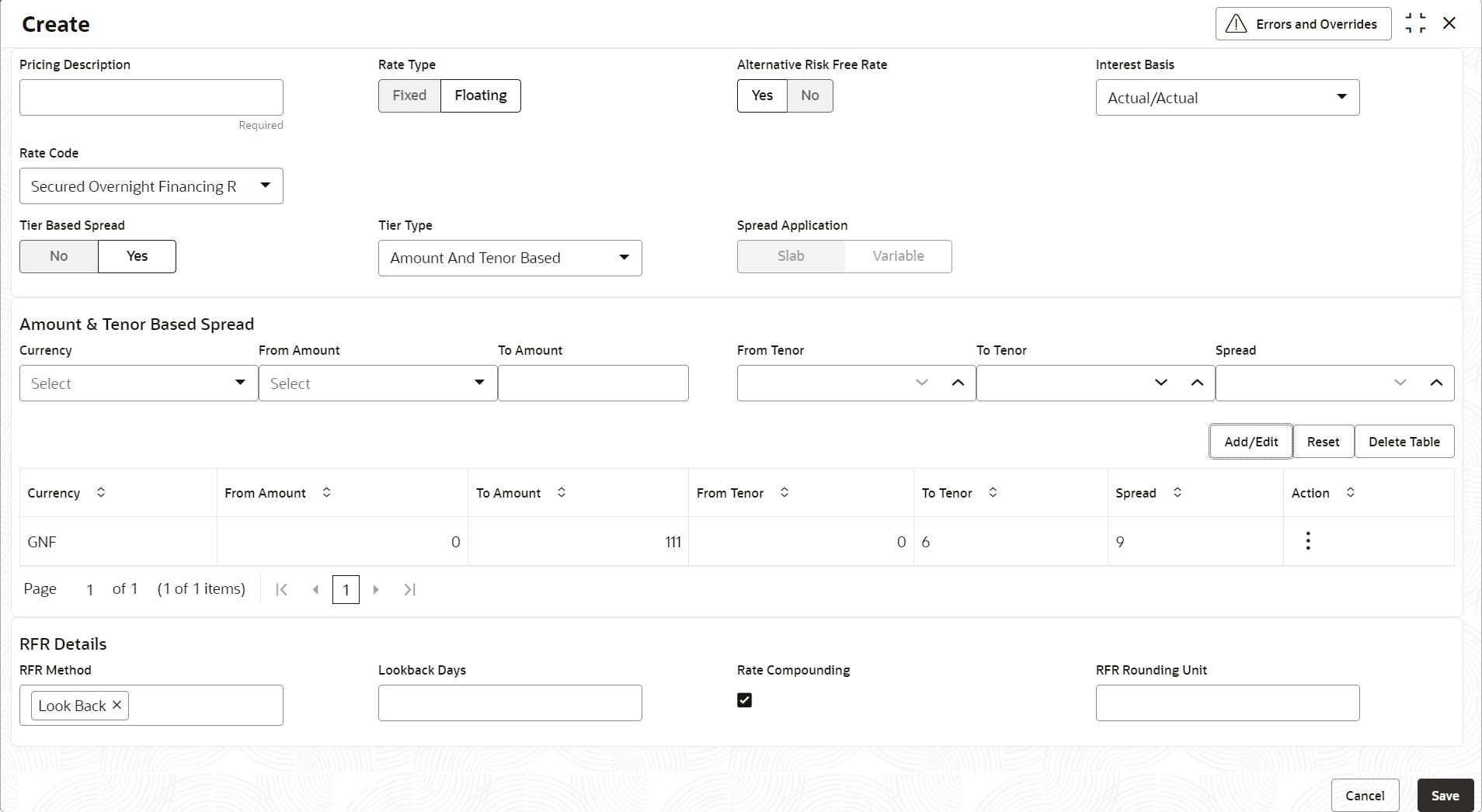

2.8.1.1 Create Interest Pricing

This topic describes the systematic instruction to define rules for interest pricing based on the bank’s requirements.

- On Home screen, click Supply Chain Finance. Under Supply Chain Finance, click Maintenance.

- Under Maintenance, click Interest. Under Interest, click Interest Pricing.

- Under Interest Pricing, click Create Interest

Pricing.The Create Interest Pricing screen displays.

- Specify the fields on Create Interest Pricing

screen.For more information on fields, refer to the field description table.

Note:

The fields marked as Required are mandatory.Table 2-31 Create Interest Pricing - Field Description

Field Name Description Pricing Description Specify a description for the interest pricing. Rate Type Select whether the rate type is Fixed or Floating. Fixed Rate Type Select whether the fixed rate should be Standard or User Input.

This field is displayed only if the Rate Type is selected as Fixed.

Rate Specify the interest pricing rate.

This field is displayed only if the Fixed Rate Type is selected as User Input.

Alternative Risk Free Rate Select Yes if the rate code needs to be risk free. Else select No.

This field is displayed only if the Rate Type is selected as Floating.

Interest Basis Select the basis for calculation of interest.

The available options are:- Actual/Actual

- Actual/360

- Actual/365

Rate Code Select the base rate code. Required base rates can be configured and are listed in this field.

Some of the rate code options are:- Secured Overnight Finance Rates

- Swiss Average Rate Overnight

- Sterling Overnight Index Average

- EURO Short Term Rate

This field is disabled if the Fixed Rate Type is selected as User Input.

Rate Calculation Type Select the type of rate calculation.

The available options are:- Down

- Interpolate

- Round

- Up

This field is displayed only if the Rate Type is selected as Floating.

Rate Code Usage Select whether the rate should be updated automatically whenever there is a base rate change or updated periodically.

This field is displayed only if the Rate Type is selected as Floating.

Reset Tenor Specify the tenor to reset the floating rate (in days).

This field is displayed only if the Rate Type is selected as Floating.

Rate Revision Frequency Select the frequency of updating the rate.

The available options are:- Daily

- Weekly

- Monthly

- Half Yearly

This field is displayed only if the Rate Code Usage is selected as Periodic.

Tier Based Spread Select Yes if the spread is tier-based. Else select No. Spread Specify the spread value.

This field is displayed only if the Tier Based Spread is selected as No.

Tier Type Select the tier type for applying the spread.

The available options are:- Amount Based

- Amount and Tenor Based

- Tenor Based

This field is displayed only if the Tier Based Spread is selected as Yes.

Spread Application Select Slab to apply the spread slab-wise and Variable to apply it variable-wise.

This field is enabled only if the Tier Type is selected as Tenor Based.

Amount/Tenor Based Spread This section displays the following fields to specify spread details for the interest pricing. Currency Select the currency of spread.

This field is displayed only if the Tier Type is selected as Amount Based or Amount and Tenor Based.

From Amount Displays the lower limit for the amount based spread.

This field is displayed only if the Tier Type is selected as Amount Based or Amount and Tenor Based.

To Amount Specify the upper limit for the amount based spread.

This field is displayed only if the Tier Type is selected as Amount Based or Amount and Tenor Based.

From Tenor Displays the lower limit for the tenor based spread.

This field is displayed only if the Tier Type is selected as Amount and Tenor Based or Tenor Based.

To Tenor Specify the upper limit for the tenor based spread.

This field is displayed only if the Tier Type is selected as Amount and Tenor Based or Tenor Based.

Spread Specify the spread value for amount or tenor.

This field is displayed only if the Tier Based Spread is selected as Yes.

RFR Details This section appears only if Alternative Risk Free Rate is selected as Yes. RFR Method Select the applicable risk free rate method.

- Index Value

- Interest Rollover

- Last Recent

- Last Reset

- Lockout

- Look Back

- Plain

You can select Look Back and Lock Out together. Remaining methods can be selected standalone only.

Lockout Days Specify the applicable lockout days. Look Back Days Specify the applicable look back days. Rate Compounding Select the checkbox if the rate has to be compounded. RFR Rounding Unit Specify the risk free rate rounding unit as agreed with the borrower.

This field is displayed only if Rate Compounding checkbox is selected.

- If Alternative Risk Free Rate field is set to

Yes, then RFR Details section

gets displayed.

- Click the RFR Method field to select the applicable risk free rate method.

- If Lockout or Look Back methods are selected, specify the values accordingly in the respective fields.

- Click the Rate Compounding checkbox to specify the risk free rate rounding value, if applicable.

- If the Tier Based Spread field is set to Yes, then select the required Tier Type list.

- Based on the Tier Type selected, specify the tier and spread details.

- Click Add/Edit to add the spread details to the grid.

- Repeat the steps to add more tiers, if required.

- Click Reset to clear the entered values.

- Select the record in the grid and then click Options icon in the Action column.

- Click Edit to edit the selected row.

- Click Delete to delete the selected row.

- Click Save to save the record and send it for authorization.

Parent topic: Interest Pricing