- Brokerage User Guide

- Process Brokerage on a Contract

- Brokerage Rule Definition

- Define Attributes of the Brokerage Rule

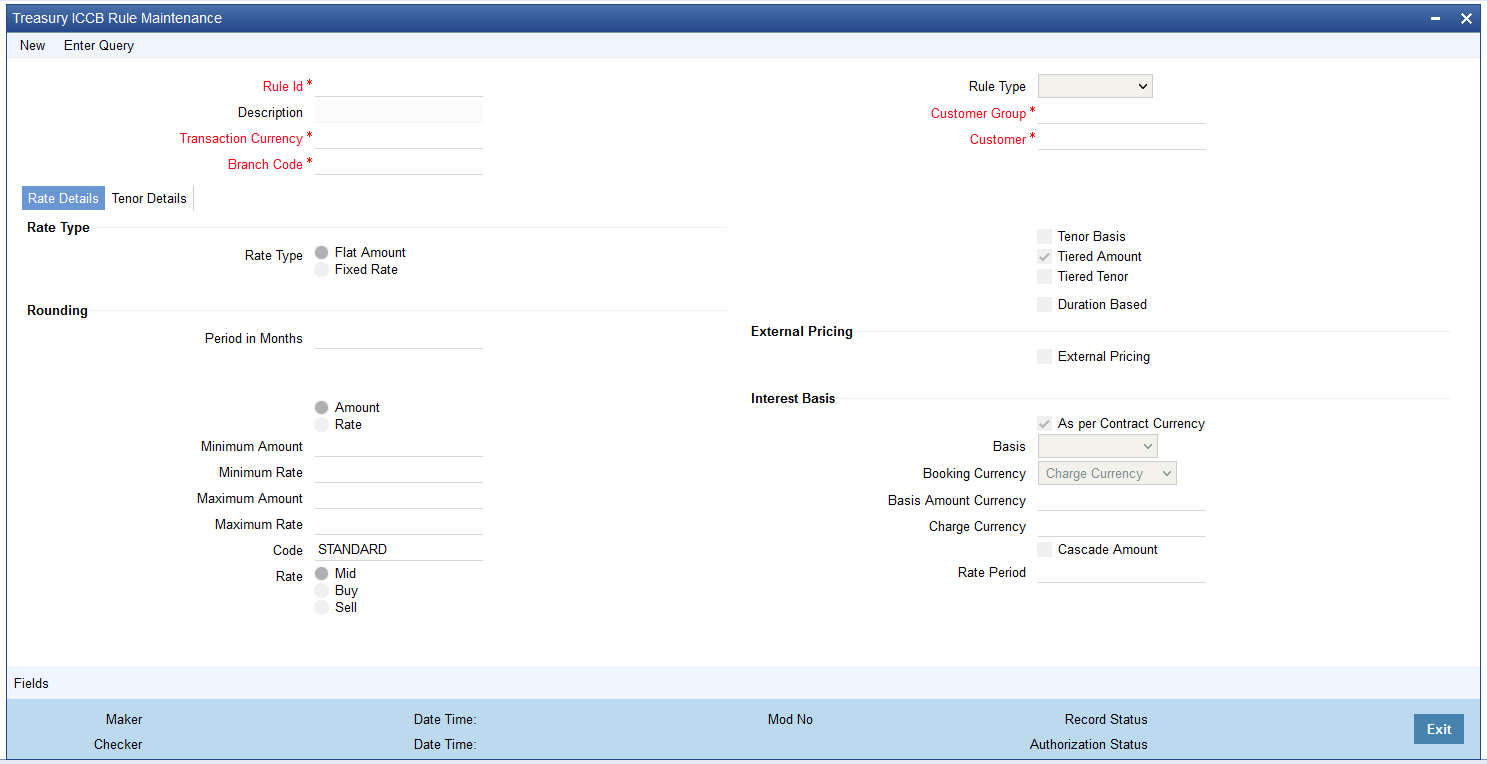

1.2.2 Define Attributes of the Brokerage Rule

This topic describes the systematic information to define Brokerage rules.

The user can apply a brokerage rule on any contract, irrespective of the currency of the contract, the customer and the branch involved.

- A specific branch, customer category, customer and currency

- A specific branch, customer category, customer and all currencies

- A specific branch, customer category, currency and all customers

- A specific branch, currency and all customer categories and customers

- A specific branch, customer categories and all currencies and customers

- A specific branch and all customer categories, customers and currencies

- A specific customer category, customer, currency, and all branches

- A specific customer category, customer and all currencies and branches

- A specific customer category, currency and all customers and branches

- A specific currency and all customer categories, customers and branches

- A specific customer category and all customers, currencies and branches

- All branches, customer categories, customers and currencies

Note:

As mentioned earlier, the rules applicable for combinations involving all branches (the All option in the Branch Code field) can be maintained only from the head office branch.Specify the User ID and Password, and login to Homepage.

- On the Homepage, enter CFDTRRLM in the text field and

then click the next arrow.The Treasury ICCB Rule Maintenance screen displays.

Note:

All fields with (*) symbol are mandatory. - On the Treasury ICCB Rule Maintenance screen, specify

the fields.For field details and description, refer to the below table.

Table 1-3 Treasury ICCB Rule Maintenance- Field Description

Field Description Rule Id Select the Id of the rule for which you are defining attributes. Every brokerage rule is identified by a unique ten-character code, called a Rule ID. You can link a valid Brokerage Rule ID to the appropriate broker and product. When a deal is processed, the brokerage attributes defined for the Rule ID that is associated with a broker and product can be applied on the deal.

To recall, the Rule ID for a brokerage rule is specified in the ICCB Rule Branch Availability maintenance. Accordingly, in the Rule ID field in this screen, you must select the ID of the brokerage rule that you wish to build by maintaining the attributes.

The option list in the Rule ID field is populated based on the following conditions:- Only those Rule Ids that are available for users at the current branch according to the ICCB Rule Branch Availability maintenance are displayed

- The maintenance of ICCB rules must be allowed for users at the current branch, according to the restrictions maintained in the Common Branch Restrictions maintenance for the restriction type ICCB RULE

Description Specify a description for the brokerage rule.

This description is associated with the brokerage rule for information retrieval purposes.

Transaction Currency Select the All option in the currency code, If you wish to define the attributes for all currencies. If you are maintaining the attributes for the selected ICCB rule in specific currency other than the All, select the Transaction Currency on which the rule mapping maintenance is to be made applicable.

Customer Group Select the customer group on which the rule mapping maintenance is to be made applicable.

You can create a generalized brokerage rule mapping record by selecting the All option in the Customer Group field. This specification is defaulted to the Customer and Customer Account fields. You are forbid to change the specification.

Rule Type Specify whether the rule type for calculating brokerage is Aggregation Type or Individual Type.- Aggregation type indicates that brokerage is calculated on the total value of the deals

- Individual type indicates that brokerage is calculated on a deal-by-deal basis

Customer Specify the customer Id of the customer for whom you are maintaining the rule mapping. Branch Code Select the branch for which the attributes are being defined, if you are maintaining the attributes for the selected ICCB rule from the head office branch, you can

If you wish to define the attributes for all branches, you can select the ALL option in the Branch Code field to indicate this.

If you are maintaining the attributes for the selected ICCB rule from a branch other than the head office, you can only select those branches that are found in the allowed list of branches for:- the ICCB rule definition Restriction Type (ICCBRULE), in the Common Branch Restrictions maintenance for the current branch

- the selected rule being built, according to the ICCB Rule Availability maintenance In other words, the option list in the Branch Code field would display only those branches that are allowed both for the rule and the current branch.

Rate Type Select the rate type from the following:- Flat amount- You can specify a fixed amount as brokerage. This is the brokerage amount for all contracts involving the brokerage rule you are defining.

- Fixed rate- You can specify a percentage as brokerage. The rate that you specify can be applied on the contract amount to calculate the brokerage amount.

The rate type indicates whether the Brokerage to be applied for the Rule ID is a flat amount or a percentage of the basis amount.

Tenor Basis Select the tenor basis option to indicate that defined Rule ID is to be applied based on the tenor of the contract.

The tenor of the contract is calculated as the difference between the Maturity Date and the Value Date of the contract.

After the tenor is calculated, brokerage is computed based on the tenor slabs. For more information, refer to the Calculating Brokerage using a Tenor- Based Tier/Slab Structure topic.

Tiered Amount Select the tiered amount option if you wish to maintain the basis amount structure as Tiers. Leave it blank if you are maintaining a slab structure. The Basis Amount is the upper limit of the slab or tier to which a particular rate or amount should be applied as brokerage.

You can define the brokerage to be applied on contracts in any one of the following ways:- In a tier structure (cumulative)

- In a slab structure (non-cumulative) You should first indicate whether the Basis Amount that you specify subsequently should be considered as a Slab or a Tier.

Tiered Tenor Select the tiered tenor option to indicate that brokerage is to be calculated on the basis of a tiered tenor structure, by choosing the Tiered Tenor option. Tiered tenor is applicable only for duration based brokerage.

Rounding Specify the rounding fields. Note:

If the rule type is brokerage, then no need to give value in this field.Minimum Amount Specify the minimum amount range within which the amount calculated using the brokerage rate should fall, If you indicated that brokerage should be calculated as a flat amount.

Maximum Amount Specify the maximum amount range within which the amount calculated using the brokerage rate should fall, If you indicated that brokerage should be calculated as a flat amount.

Minimum Rate Specify the minimum rates for brokerage calculations, if you have chosen not to maintain the minimum and maximum amounts. Maximum Rate Specify the maximum rates for brokerage calculations, if you have chosen not to maintain the minimum and maximum amounts.

If the brokerage calculated using this Rule ID exceeds the amount calculated using the maximum rate specified here, the maximum rate amount can be applied as brokerage. Similarly, if the brokerage amount falls below the amount calculated using the minimum rate, the minimum rate amount is considered as brokerage.Note:

If you have specified a flat amount as the Rule Type, then you need not specify the minimum and maximum amount/rate limits.Rate Specify whether the currency rate for deal or slab currency from the following:- Mid

- Buy

- Sell

External Pricing Select this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product.

Interest Basis Specify the below Interest Basis fields. As per Contract Currency Select this box if you wish to calculate the brokerage based on the contract currency. This specifies the calculation basis for the brokerage based on the Contract Currency or Rule Currency.

This specifies whether the brokerage is paid in the charge currency or in the currency of the contract.

If you wish to calculate the brokerage based on the rule currency, then you have to choose the brokerage calculation value from drop-down list next to this field.

Rate Period Specify the rate period. Booking Currency Specify the currency in which the brokerage amount is to be calculated.- Charge Currency- If you specify the brokerage currency as charge currency, brokerage can be calculated in the currency selected in the Charge Currency field. For a contract in foreign currency, the contract amount is converted into the charge currency equivalent before brokerage is applied.

- Contract Currency- If you specify the brokerage currency as the contract currency, brokerage can be calculated in the currency of the contract

Basis Amount Currency Specify the upper limit of the slab or tier to which a particular rate or amount should be applied as brokerage. The brokerage rate or amount (depending on the rate type) is to be specified in the subsequent field.

Fixed Rate If the brokerage is in the form of a percentage of the contract amount, you should specify the applicable rate. This rate can be applied for the Basis Amount To, depending on whether you have defined the application basis as a slab or a tier.

Charge Currency Specify the charge currency.

Tenor Based Rates Specify the tenor based rates. Once an ICCB Rule has been defined, you should associate it with a broker and product through the Brokerage Association screen. Depending on the broker and product involved in a contract, the appropriate rule is made applicable.

Parent topic: Brokerage Rule Definition