- Core Entities and Services User Guide

- Core Maintenance

- Maintain FATCA Product

1.19 Maintain FATCA Product

This topic describes the systematic instructions to maintain FATCA product.

FATCA is the acronym for Foreign Account Tax Compliance Act enacted by the US Government as part of the Hiring Incentives to Restore Employment (HIRE) Act, in 2010.This topic deals with Foreign Account Tax Compliance regulation. It includes the description about functions that would help Oracle Treasury to support FATCA.

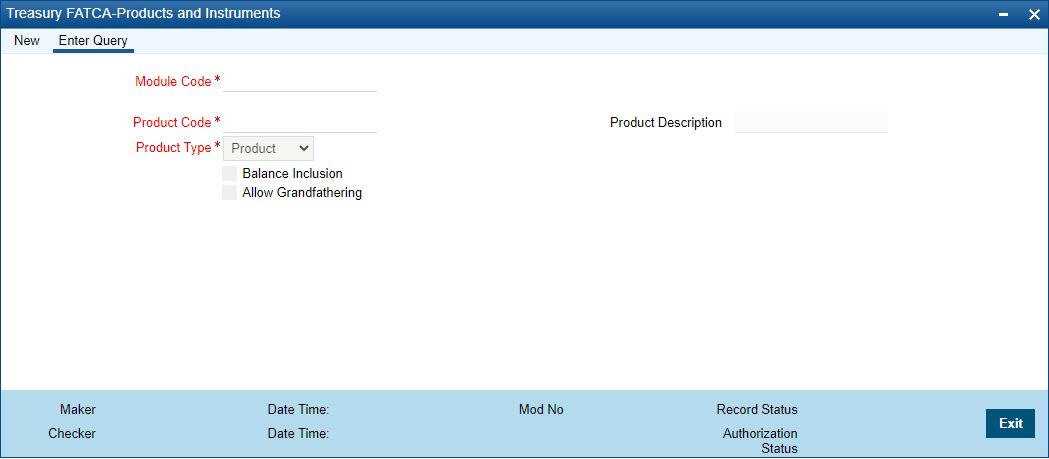

- On the Home page, specify STDTRFPM in the text box, and click next arrow.The Treasury FATCA-Products and Instruments screen is displayed.

Figure 1-22 Treasury FATCA-Products and Instruments

Description of "Figure 1-22 Treasury FATCA-Products and Instruments" - On the Treasury FATCA Products and Instruments screen, specify the fields.

For more information on fields, refer the below table.

Table 1-22 Treasury FATCA-Products and Instruments

Field Description Module Code Select the valid module code from the list of values.

Product Code Select the valid product code from the available list of values.

Product Description The system displays the description for the selected product code.

Type Select the type of the product from the drop-down list. Following are the options available in the drop-down list:

- Product

- Account Class

- Instrument

Balance Inclusion Select the Balance Inclusion check box if the balance of the contract account should be included for FATCA.

Allow Grandfathering Select the Allow Grandfathering check box if the grandfathering of contracts booked using the product/account class/instrument is allowed. Grandfathered obligations needs to be checked based on the Allow Grandfathering field.

The obligation is grandfathered if Account Opening Date is less than Grandfathered cutoff date and there are no changes in tenor, amount or rate of interest after grandfathered cutoff date.

While authorizing, if customer is a reportable FATCA status or is recalcitrant, the system identifies all accounts, contracts, and deals for the customer booked using products, account classes or instruments.

For each of the customer the total FATCA balance should be updated in the threshold currency maintained for that type of customer. The FATCA balance of the customer will be the sum total of all balances of the customer obligations. If the maintenance is being modified, then at the time of authorization of the maintenance, the system will perform the following:

If the maintenance is being modified, then at the time of authorization of the maintenance, the system will perform the following:

- If a product, account class or instrument is being removed from the list then all accounts, contracts, or deals booked using the product, account class or instrument should be removed from the tracking table

- The customer balance should be updated accordingly

If a new product, account class or instrument is being added to the list at the time of authorization of the maintenance, the system should scan for all contracts, accounts, or deals booked using the newly added product, account class or instrument with Balance Inclusion field checked. If the counterparty of such a contract, account, or deal has a reportable FATCA status, a row should be inserted into the FATCA tracking table.

Parent topic: Core Maintenance