- Foreign Exchange User Guide

- Define Attributes Specific to FX Products

- FX Products

- FX Product Definition

3.2.1 FX Product Definition

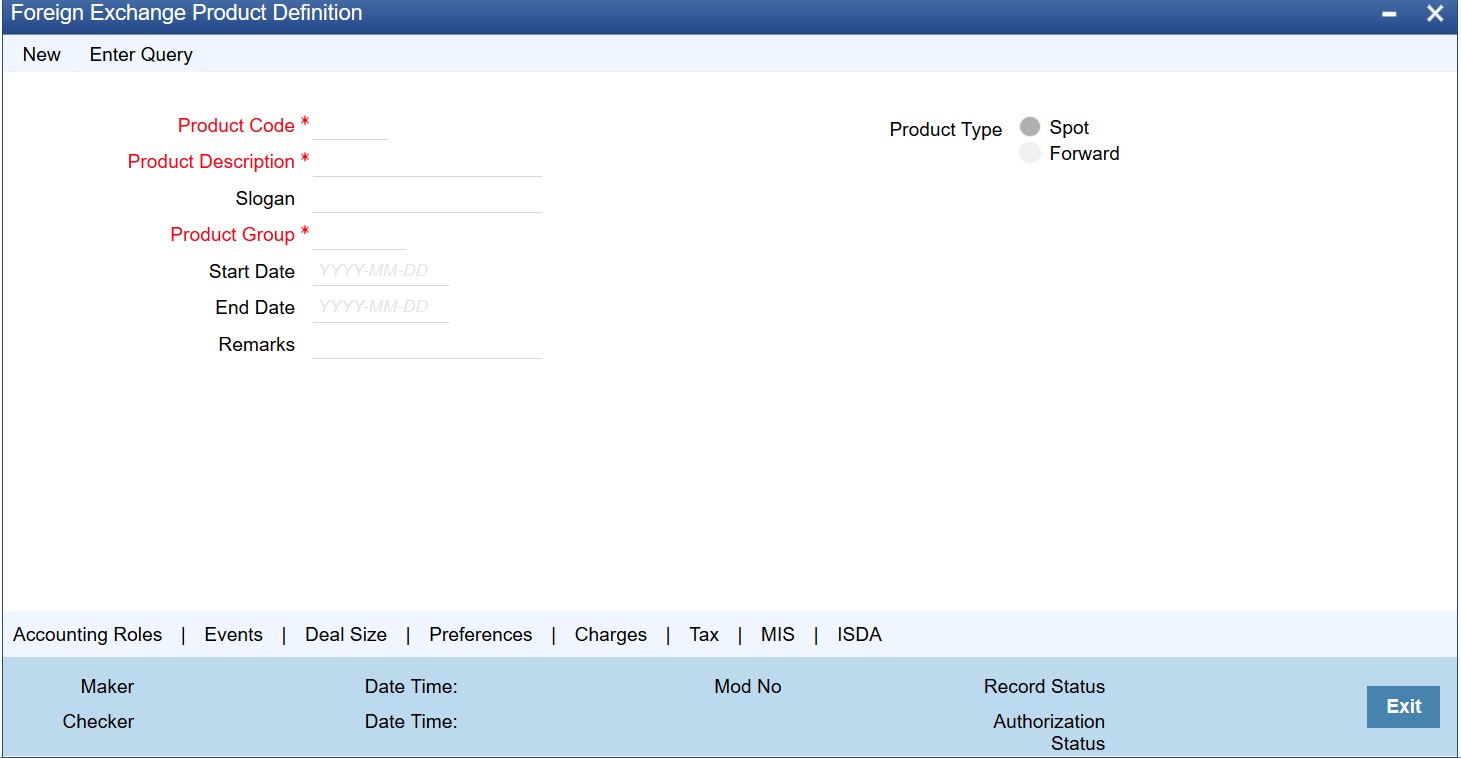

You can create FX products using the Foreign Exchange Product Definition screen.

- On the Home page, type FXDPRMNT in the text box, and click next arrow. The Foreign Exchange Product Definition screen is displayed.

Figure 3-1 Foreign Exchange Product Definition

Description of "Figure 3-1 Foreign Exchange Product Definition" - On the Foreign Exchange Product Definition screen, Enter basic information relating to a foreign exchange product such as the Product Code, Product Description, etc based on the requirement.For any product you create in Oracle Banking Treasury Management, you can define generic attributes, such as:

- Branch

- currency

- Customer restrictions

- Interest details

- Tax details

etc, by clicking on the appropriate icon in the horizontal array of icons in this screen. For a foreign exchange product, in addition to these generic attributes, you can specifically define other attributes. These attributes are discussed in detail in this topic.

You can define the attributes specific to a foreign exchange product in the Foreign Exchange Product Definition Main screen and the Foreign Exchange Product Preferences screen. In these screens, you can specify the product type and set the product preferences, respectively.

For further information on the generic attributes that are defined for a product, please refer the following Oracle Banking Treasury Management / Oracle FLEXCUBE User Manuals under Modularity:

- Interest Class

- Charges and Fees

- Tax

- User Defined Fields

- Settlements

Define product restrictions for branch, currency, customer category and customer in Product Restrictions (CSDTRPDR) screen. For details on product restrictions refer to Product Restriction Maintenance chapter in Core Service User Manual.

Define User Defined Fields in Product UDF Mapping screen (CSDTRPDR). For details on User Defined Fields screen refer Other Maintenances chapter in Core Service User Manual.

For details on product restrictions refer Product Restriction Maintenance chapter in Core Service User Manual.

For information on fields, refer to the below table

Table 3-1 Foreign Exchange Product Definition - Field description

Field Description Code

Specify the code of the FX product.

Description

Enter a small description for the product.

Type

The first attribute that you define for a product is its type. Products can be broadly classified into two types in the Foreign Exchange module of Oracle Banking Treasury Management - Spot and Forward. For example, you want to create a product for GBP/USD spot (buy) deals called Buy GBP. When you define the product, you would indicate that the product type of this product is Spot. Any number of products can be created under each product type

Slogan

Enter a slogan for the product.

Group

Select the group to which the product belongs.

Start Date

Select the date from which the product is effective.

End Date

Select the date till which the product can be used.

Remarks

Enter any additional remarks about the product.

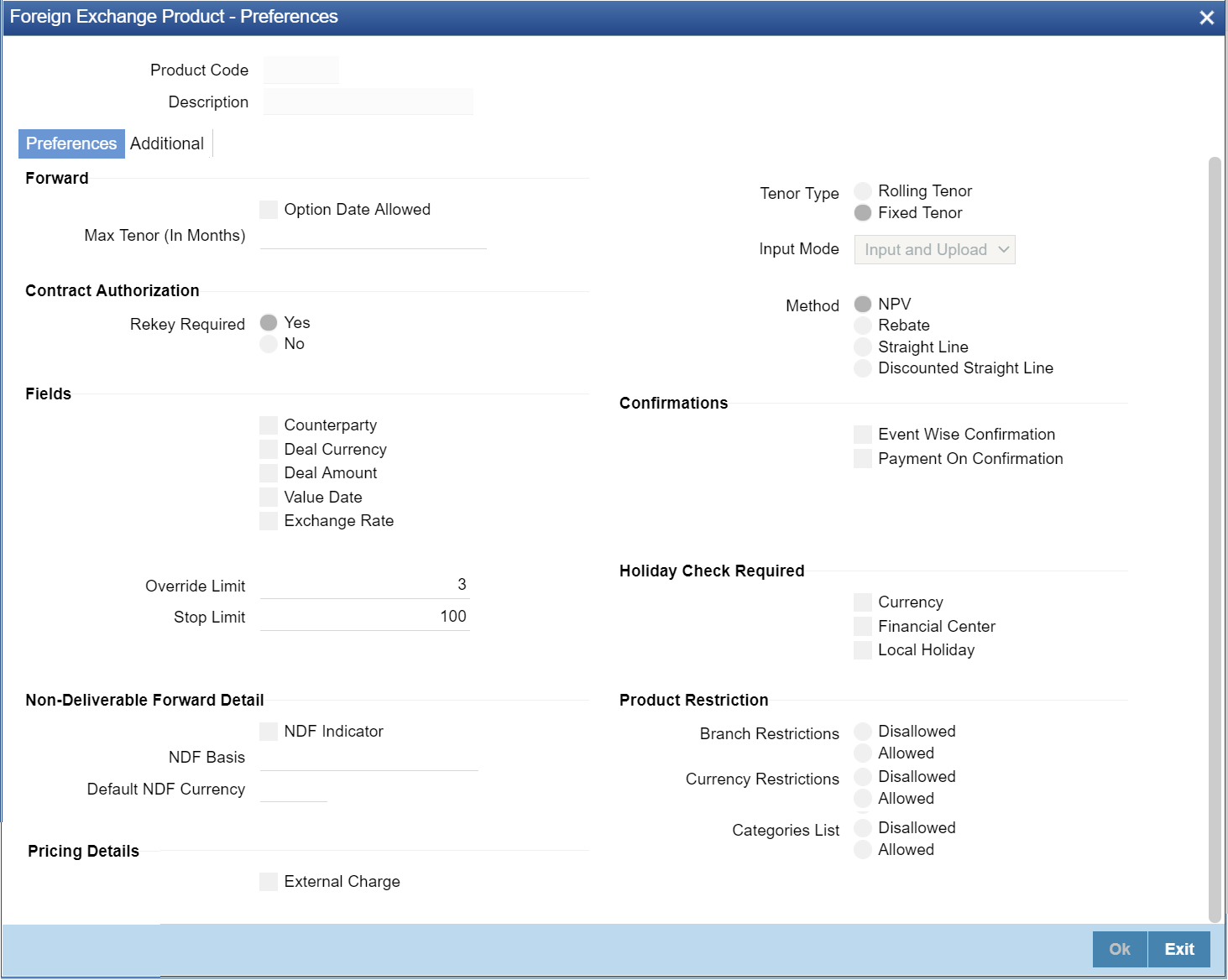

- On the Foreign Exchange Product Definition screen, click Preferences to display the preference screen.

The Foreign Exchange Product - Preferences screen is displayed.

Figure 3-2 Foreign Exchange Product - Preferences

Description of the illustration fxdprmnt_preferences.png - On the

Foreign Exchange Product Preferences

screen, specify the preferences for a product as required.

For information on fields, refer to the below table.

Table 3-2 Foreign Exchange Product Preferences - Field Description

Field Description Product Code

The product for which you are maintaining preferences is defaulted here.

Description

The description of the product is displayed here.

Option Date Allowed

For a product, you can indicate whether an Option Date is specified for forwarding deals during deal processing. If you specify an option date, then you can change the contract value date to any date between the option date and the original value date, This means that the contract may be liquidated anytime between the option date and the value date of the contract.

To allow an option date, Select this check box. However, if you are allowed an option date for a product, you need not necessarily enter an option date during deal processing.

Max Tenor (In Months) When you create a product, you can specify the maximum tenor for forward deals involving the product. You cannot enter a deal with a tenor that exceeds that defined for the related product. However, you can enter an FX deal with a tenor that is less than that specified for the product.

To specify the maximum allowed tenor for a product, enter an absolute value (in months) in the Max Tenor field.

Indicating the Contract Details to be Rekeyed

All contracts entered in the system should be ratified or authorized by a user with the requisite rights. This is a security feature.

When creating a product, you can indicate if the authorizer of contracts involving the product needs to re-key essential contract details. This is to ensure that the contract is not mechanically authorized. If you opt for re-key of details, click on the button against Yes under Rekey required field.

Rekey Required Select Yes if you want to rekey the details, else select No.

Counterparty

Check this box to rekey the counterparty if needed.

Deal Currency

Check this box to rekey the deal currency details if needed.

Deal Amount Check this box to rekey the deal amount details if needed.

Value Date Check this box if you want the Value date details to be rekeyed if needed.

Exchange Rate

Check this box if you want the exchange rate details to be rekeyed.

You can specify any or all of the above details for rekey.

Under Rekey Fields you can indicate which of the details that you would like the authorizer to rekey. Click on the box adjacent to each contract detail to indicate that it should be rekeyed.

Input Mode

Specify the mode through which product can be used to book contracts

- Input Only - Product is used only from front end Oracle Banking Treasury Management.

- Upload Only: Use the Product during upload of FX contract only.

- Input and Upload: Product used both in case of Manual input through Oracle Banking Treasury Management as well as through upload.

Tenor Type

System calculates the tenor of FX contracts as follows:.

- Fixed: Bought value date – booking date

- Rolling: Bought value date – Branch date

Method

If you have opted to revalue the foreign currency liability for a product, you must also specify the revaluation method by which the profit or loss is to be calculated. You can revalue the profit or loss in different ways. They are:- NPV (Net Present Value)

- Rebate

- Straight Line

- Discounted Straight Line

Event Wise Confirmation Check this box to move the confirmation status of FX deal to Unconfirmed during amendment/cancellation/reverse/rollover, if outgoing confirmation message is configured for the event.

Payment on Confirmation

Check this field for the External Payment System to send the payment messages.

Currency

Select this check box, to execute the currency holiday calender validation of the dates.

Financial Center

Select this check box, to execute the financial center holiday calender validation of the dates.

Local Holiday Select this check box, to execute the local holiday calendar validation of the dates.

Non- Deliverable Forward Details A Non-Deliverable Forward (NDF) is an outright forward or futures contract in which counter parties settle the difference between the contracted NDF price or rate and the prevailing spot price or rate on an agreed notional amount.

The NDFs have a fixing date and a settlement date. The fixing date is the date at which the difference between the prevailing market exchange rate and the agreed upon exchange rate is calculated. The settlement date is the date by which the payment of the difference is due to the party receiving the payment.

Oracle Banking Treasury Management supports NDF functionality for FX contracts. The settlement for the NDF forward contract will be for NDF net settlement amount in the settlement currency, which is the difference between the settlement amount exchanged and the amount at the fixing rate. Provide the fixing rate on fixing the date.

Oracle Banking Treasury Management supports the NDF forward contract using a “Two deal approach”. In this approach two contracts are initiated manually, they are:

- First deal (NDF Forward Contract) is a forward deal between the settlement currency and the NDF currency.

- Second deal (NDF Fixing Contract) will be a spot deal which is used as a fixing deal for the NDF deal.

Note:

Initiate NDF Fixing Contract manually.

The fixing date for the NDF Forward Contract is the settlement days for the settlement currency before the maturity date of the NDF Forward Contract. For both the contracts (NDF Forward Contract and NDF fixing contract) the NDF currency amount is the same, only the settlement currency amount changes depending on the exchange rate at the day of booking NDF forward contract and NDF fixing contract

NDF Indicator

Check this field to indicate whether the product is an NDF product or not. By default, this field is not checked.

For forward product type, if the NDF indicator is checked, then the product is for NDF Forward Contract. For spot product type, if the NDF indicator is checked then the product is for NDF Fixing Contract.

Default NDF Currency

Specify the Default NDF Currency from the option list. This field is activated when the NDF indicator is checked. The option list for this field will be list of all BOT and SOLD currency allowed for the branch.

NDF Basis

Specify the NDF Basis from the option list. This field is enabled if the NDF indicator is checked. NDF basis is used to generate the NDF advices for the NDF Forward contract.

Branch List

Indicate whether you want to create a list of allowed branches or disallowed branches by selecting one of the following options:

- Allowed

- Disallowed

Currency Restrictions

Indicate whether you want to create a list of allowed currencies or disallowed currencies by selecting one of the following options:

- Allowed

- Disallowed

Categories List

Indicate whether you want to create a list of allowed customers or disallowed customers by choosing one of the following options:

- Allowed

- Disallowed

External charge

Check this box to indicate that external charges are fetched from external pricing and billing engine for contracts created under this product.

External Charge is enabled only when the system integrates with external pricing and billing engine (PRICING_INTEGRATION = Y at CSTB_PARAM level).

Parent topic: FX Products