- Interest User Guide

- Interest

- Create Interest Classes

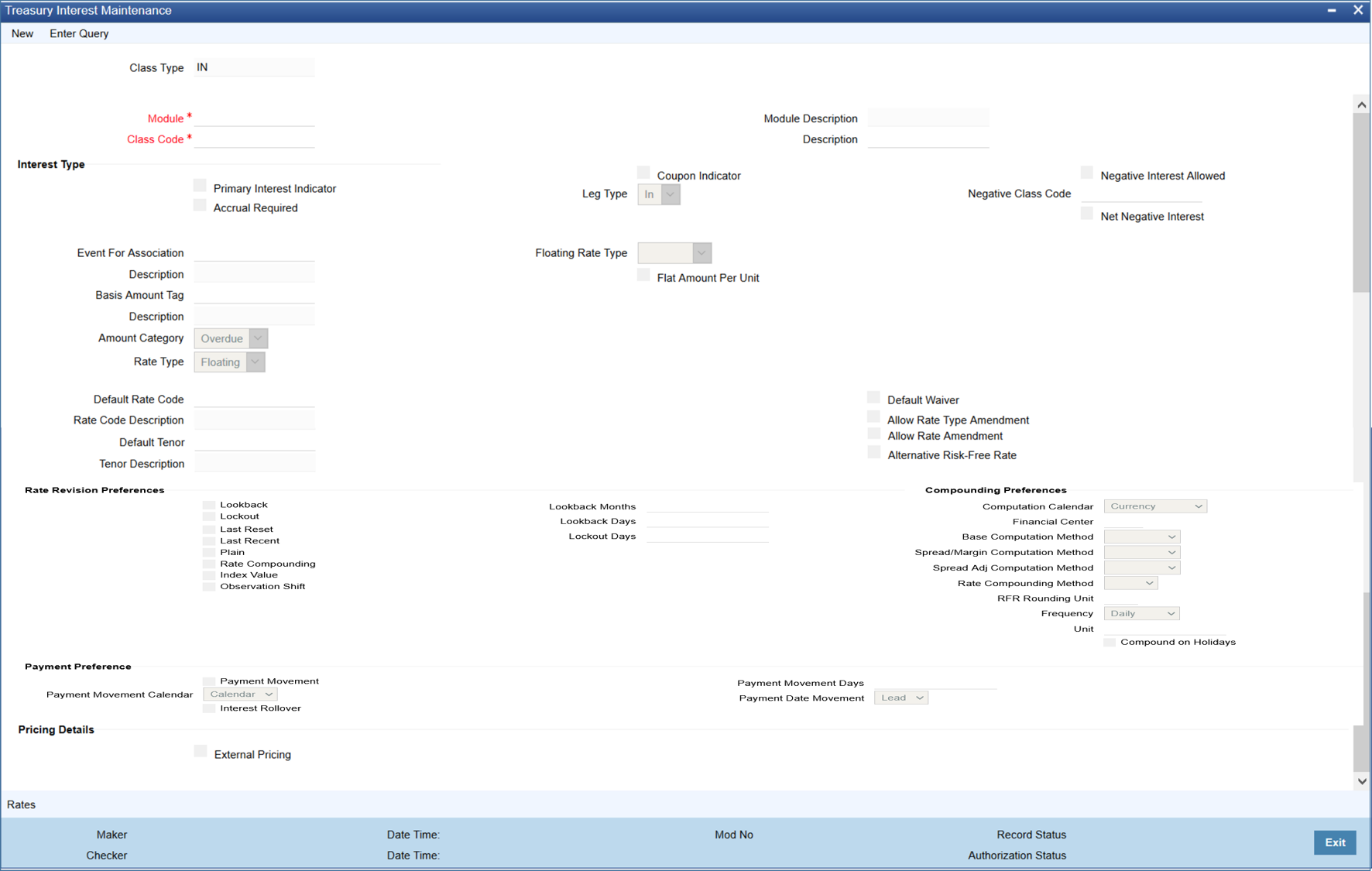

1.7 Create Interest Classes

This section explains how interest classes are built and how attributes are defined for Securities and Derivatives products and contracts.

- The module in which you would use the class

- The interest type

- The association event

- The basis amount on which the coupon is paid

- The rate type

- The default rate code (for floating interest)

- The default tenor

You need to maintain an Interest class specific to the Securities module. For instance, for a Security, you can build an interest class with the attributes of a specific type of coupon, the quarterly coupon paid on the current face value.

- On the Homepage, enter CFDTRINT in the text field and

then click the next arrow.The Treasury Interest Maintenance screen is displayed.

- On the Treasury Interest Maintenance screen, specify the

fields.For field details and description, refer to the below table.

Table 1-11 Treasury Interest Maintenance

Field Description Module An interest class is built for use in a specific module. This is because; an interest component would be applied on different basis amounts, in different modules.Note:

The Basis Amount Tags available would depend on the module for which you build the class.Interest Type While building an Interest Class, you can define two kinds of interest:- Primary Interest

- Coupon

Events and the Basis Amount The term Event can be explained with reference to a deal. A deal goes through different stages in its life cycle, such as:- Deal Booking

- Money Settlement of Deal

- Reversal of Deal

- Cancellation of Deal

The event at which you would like to associate the interest component, being defined, to a contract is referred to as the Association Event.

The basis on which an interest is calculated is referred to as the Basis Amount. For instance, a coupon can be on the basis of the current face value of a security. When building an interest class, you have to specify the tag associated with the Basis Amount.

The attributes defined for an interest class, will default to all products with which you associate the class. When maintaining interest details for a product, you can change these default attributes.

Contracts maintained under a product will acquire the attributes defined for the securities product.

Accrual Required You can choose to accrue the interests due on a contract. To accrue the interest payable on a contract, choose the ‘Accrual Required’ option.

The accrual details that you define for an interest class will default to all products with which you associate the class. When maintaining interest accrual details for a product, you can change these default details. Contracts maintained under a product will acquire the accrual details defined for the product. However, you can define unique accrual details for a contract.

Rate Type The interests paid on contracts can be at a Fixed Rate, or on the basis of a Floating Rate.

If you indicate that interests should be calculated on the basis of a Floating Rate, you must specify the ‘Periodic’ Floating Rate Type.

For all contracts maintained under products, associated with a class, the interest will be by default calculated using the specified Rate type.

Default Rate Code Interest payable on contracts would be calculated at specific rates. When building an interest component, you have to specify the rate at which the interest should be computed. When associating a rate code (that you have maintained in the Rate Codes Maintenance screen) with the interest component that you are building, the rates corresponding to the code will be used to compute interest.

The details defined for an interest class will default to all products with which the class is associated. When maintaining interest details for a product, you can change this default information. Contracts maintained under a product will acquire the interest details defined for the contract product. However, you can define unique interest details specific to a contract.

When maintaining a contract, you can choose to waive the rate code altogether or amend the properties of the code to suit the security.

If you allow amendment of a rate code, you can specify if you would like to allow rate code amendment after the association event. You can also allow the amendment of the rate value (corresponding to a rate code).

Default Tenor Each rate code is associated with a tenor. For instance you have a Rate Code ‘LIBOR’. You can link any number of tenor codes to the same rate code.Table 1-12 Tenor Details

Tenor Code Description 1W One week rate 2W Two week rate 2M Two months rate 6M Six months rate 1Y One year rate When building an interest component, you can specify a Tenor Code that you would like to associate, with the Floating Interest Rate Code. Interests for contracts (maintained under a product with which you associate the class) will be calculated using the rate corresponding to the Rate Code and the Tenor Code.

Default Waiver Check this box to indicate that even if charge is computed, it should not be liquidated.

Allow Rate Type Amendment Check this box, to allow rate type amendment.

Allow Rate Code Amendment Check this box, to allow rate code amendment.

Negative Class Code The system displays the negative class code.

When you save the record, the system updates the ‘Negative Class Code’ field with the name of the auto-generated Negative class code. If any interest class already exists with the same class code as the negative class code being auto-generated, then the system displays an appropriate error message on saving the main interest class code itself.

In such cases, specify the ‘Negative Class Code’ field manually and save the record. Any operation on Negative class codes generated by system will be restricted.

Amend after Association If you would like to allow the amendment after association of a rule for a charge component, check this box. Once checked the system will allow you to modify the rule after the association event is triggered for the linked contract.

Allow Rate Amendment Check this box, to allow rate amendment.

Negative Interest Allowed Check this box to indicate the negative rate must be allowed for DV and SR modules.

Interpolation Method Select the required interpolation method from the adjoining drop-down list. The list displays the following values:- Not Applicable

- Linear

Rounding Rule Select the required rounding rule from the adjoining drop-down list. The list displays the following values:- Blank

- Up

- Down

- Truncated

- Round Near

Note:

Rounding Rule is applicable only when interpolation method is linear.Rounding Units Specify the decimal value that must be used for interest rate calculation.

Lookback Months Specify the number of months to look back to capture the Lag.Note:

- For Inflation type interest class, Lookback Days must be disabled.

- For RFR rate type, Lookback Months must be disabled. 2-14 Compounding Preferences

Frequency Select the compounding frequency of the interest from the adjoining drop-down list. The list displays the following values:- Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

- Bullet

Unit Specify the frequency for compounding interest.

Compound on Holidays Check this box to indicate that the compounding must be done on holidays. The system allows to check this box only if the Frequency is Daily.

During save, the system performs the following validations:- Lookback Days and Months can be greater than or equal to zero and can be only positive values.

- When Look back days defined is greater than zero, then Reset date movement should be selected.

- Only the below fields gets enabled

for inflation rate type component:

- Lookback

- Lookback Months

- Payment Delay

- Payment Delay Days

- Payment Date Movement

- Payment Delay Calendar

Payment Date Movement Specify the date on when the payment movement is to be done. The adjoining drop-down list displays the following values:- Lead

- Lag

If the option LAG is selected, then the payment is deferred.

Payment Movement Calendar Specify the payment movement calendar from the adjoining drop-down list. The list displays the following values:- Calendar

- Business

If the option Calendar is selected, then the ‘Payment Date Movement’ ignores holiday maintenance at contract level.

If the option Business is selected, then the ‘Payment Date Movement’ considers holiday maintenance at contract level.

This topic has the following topic: