- Collateral Margin & Settlement Netting User Guide

- Maintaining Products and Static Data

- Instrument Margin Calculation Setup

- Instrument Margin Calculation Maintenance Screen

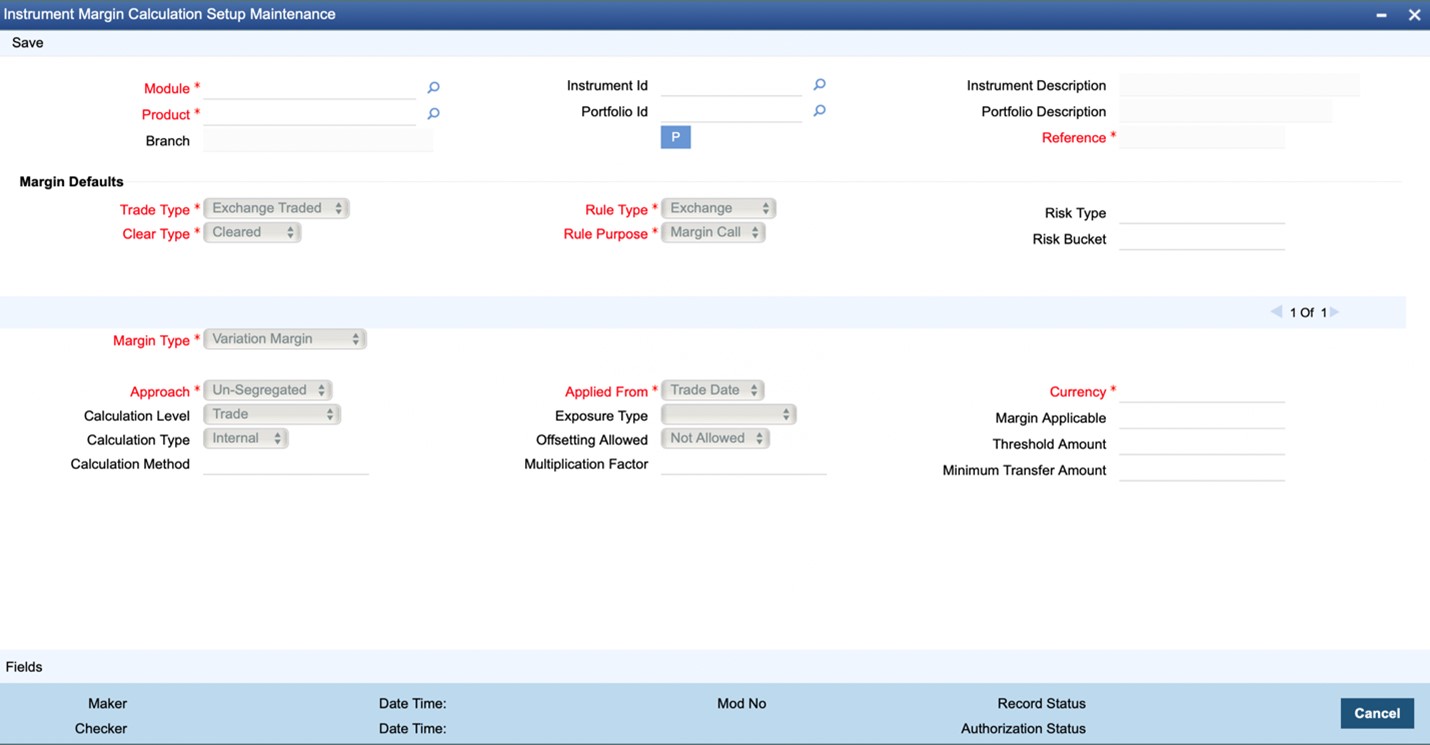

2.5.1 Instrument Margin Calculation Maintenance Screen

- On the Homepage, type ENDINMRG in the text box, and click the next arrow.

Instrument Margin Calculation Maintenance screen is displayed.

Figure 2-3 Instrument Margin Calculation Setup Maintenance

Description of "Figure 2-3 Instrument Margin Calculation Setup Maintenance" - On the Instrument Margin Calculation Maintenance screen, Click New.

- On the Instrument Margin Calculation Maintenance - New screen, Specify the details as required.

- Click Save to save the details or Cancel to close the screen.

For information on fields, refer table below:

*indicates mandatory fields.

Table 2-2 Instrument Margin Calculation Maintenance

Field Description Module

Select the Module for which this setup is applicable.

- This field cannot be amended after saving the setup

Product

Select the Product, in the selected Module, for which this setup is applicable.

- This field cannot be amended after saving the setup

- ‘Instrument Products’ are listed for the modules, in which instruments can be defined separately. These modules are: Securities, Exchange Traded Derivatives and Credit Derivatives

- ‘Deal Products’ are listed for all the other modules

Branch

Displays the current branch code to which the user has logged in.

- Calculation setup defined for HO branch can be used for transactions booked in any of the other branches

- However, calculation setup defined for a specific branch can used only for the transactions booked in that branch

Instrument Id

Select a specific Instrument from the list of instruments defined for the selected Product.

- This field is enabled only for the modules, in which instruments can be defined separately. These modules are: Securities, Exchange Traded Derivatives and Credit Derivatives

- This field cannot be amended after first authorization of the setup

- ‘ALL’ is set by default, if not specified

- If any setup that is specific to the instrument is available, then it is used for the transactions booked with that instrument. Otherwise the setup available for the module and instrument product is used

Instrument Description

Displays the description of the Instrument selected.

Portfolio Id

Select a specific Portfolio from the list of portfolios defined for the selected Module.

- This field is enabled only for the modules, in which portfolios can be defined separately. These modules are: Securities, Exchange Traded Derivatives and Credit Derivatives

- This field cannot be amended after first authorization of the setup

- ‘ALL’ is set by default, if not specified

- If any setup that is specific to the portfolio is available, then it is used for the transactions booked in that portfolio. Otherwise the setup available for the module and instrument product is used

Portfolio Description

Displays the description of the Portfolio selected.

Reference

Displays a unique reference number for the setup.

- Automatically generated when the user clicks on ‘P’ button, after selecting values for the mandatory fields

Trade Type

Select the type of transactions for which this calculation setup is used, based on where the transaction is traded.

- This field cannot be amended after first authorization of the setup

- This field is set to ‘Exchange Traded’ by default and disabled, if the module selected is ‘Exchange Traded Derivatives’

- For other modules, ‘Over the Counter’ is set by default but user can select ‘Exchange Traded’ if applicable for the product

- If ‘Exchange Traded’ is selected, this calculation setup is used for transactions which are ‘Traded On’ an Execution Venue (or Exchange)

- If ‘Over the Counter’ is selected, this calculation setup is used for transactions which are ‘Traded On’ Over the Counter markets

Clear Type

Select the type of transactions for which this calculation setup is used, based on how the transaction is settled.

- This field cannot be amended after first authorization of the setup

- This field is set to ‘Cleared’ by default and disabled, if the Trade Type selected is ‘Exchange Traded’

- For other modules, ‘Uncleared’ is set by default but user can select ‘Cleared’ if applicable for the product

- If ‘Cleared’ is selected, this calculation setup is used for transactions which have ‘To Be Cleared’ checked

- If ‘Uncleared’ is selected, this calculation setup is used for transactions which have ‘To Be Cleared’ unchecked

Rule Type

Select the type of this calculation rule setup, based on the type of the publisher of the rule.

- This field cannot be amended after first authorization of the setup

- Select Exchange, if the calculation rule is published by an Exchange or Clearing House and Trade Type selected is ‘Exchange Traded’

- Select Regulatory, if the calculation rule is published by a Regulator or the margin calculation is for regulatory reporting purposes

- Select ‘Counter party’ if the rule is published by an external party or for calculating margin calls with a counter party

- Select Internal if the rule setup is defined by the bank for internal use

- This field is set to Exchange by default if the Trade Type selected is ‘Exchange Traded’

- This field is set to ‘Counter party’ by default if the Trade Type selected is ‘Over the Counter’

Rule Purpose

Select the purpose for which this calculation rule setup is used.

- This field cannot be amended after first authorization of the setup

- Select Margin Call, if this rule is used for calculating the margin calls with an external counter party

- Select Internal, if this rule is used for calculating notional margin calls for an internal exposure

- Select Others if this rule is used for other purposes

- This field is set to Margin Call by default if the Rule Type selected is Exchange or Regulatory or Counter party

- This field is set to Internal by default if the Rule Type selected is Internal

Risk Type

Select the default Risk Type for the setup, if applicable

- Can be one of the standard risk types maintained using ‘Treasury Static Type Maintenance’ function with type as ‘CRIF_RISK_TYPE’, applicable for the module selected

- Risk type selected is defaulted for grouping contracts using this setup for Risk calculation purposes

Risk Bucket

Select the Risk Bucket for the setup, if applicable

- Can be one of the standard risk buckets maintained using ‘Treasury Static Type Maintenance’ function with type as ‘CRIF_RISK_BUCKET’, applicable for the risk type selected

- Risk bucket selected is defaulted for grouping contracts using this setup for Risk calculation purposes

Margin Type

Select the Margin Type applicable for this calculation setup.

- Multiple margin types can be configured for the setup, by clicking on the ‘+’ button. However, the same margin type cannot be selected more than once for the setup

- Margin type cannot be amended after first authorization of the setup. However, a margin type can be deleted from the setup by clicking on ‘-’ button

- User can configure separate calculation parameters for ‘Initial Margin’, ‘Independent Amount’, ‘Variation Margin’ and ‘Funding’ types in the same setup

- At least one margin type should be configured for the setup, otherwise the setup cannot be saved

- This field is set to ‘Variation Margin’ by default

Approach

Select the approach to be followed for posting margin call for this margin type.

- Select ‘Segregated’ or ‘Un-segregated’ approaches only if Margin Type selected is not ‘Independent Amount’

- Select ‘Distinct’, ‘Allocated’ or ‘Greater’ approaches only if Margin Type selected is ‘Independent Amount’

- If ‘Un-segregated’ is selected, then margin call for this margin type can be combined and transferred together with another margin type for the same transaction or party

- If ‘Segregated’ is selected, then margin call for this margin type is not combined with another margin type and tracked separately from other margin types for the same transaction or party

- If ‘Distinct’ is selected, then IA is calculated separately from IM

- If ‘Allocated’ is selected, then only IA required in excess of IM is transferred

- Excess IA = Maximum(0, IA Calculated – IM Transferred)

- Example: If IA Calculated = 140,000 and IM Transferred = 115,000, Excess IA = MAX(0, (140,000 – 115,000) ) = 25,000

- If ‘Greater’ is selected, then only one of either IA Calculated or IM Calculated, whichever is greater is transferred for the combined margin call

- Margin Transferred = Maximum(IM Calculated, IA Calculated)

- Example: If IA Calculated = 140,000 and IM Transferred = 115,000, Margin Transferred = MAX(115,000, 140,000) = 140,000

- This field is set to ‘Un-segregated’ by default, if Margin Type selected is not ‘Independent Amount’

- This field is set to ‘Distinct’ by default, if Margin Type selected is ‘Independent Amount’

Calculation Level

Select the level at which the exposure should be aggregated for margin calculation, for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’

- If ‘Trade’ is selected, then margin is calculated for exposure from each transaction individually

- If ‘Portfolio / Product’ is selected, then margin is calculated on the total exposure from all transactions in a portfolio

- For the modules, in which portfolios can be defined separately, total exposure is calculated for each portfolio

- For the modules, in which portfolios are not used, total exposure is calculated for all transactions booked with a deal product

- This field is set to ‘Trade’ by default

Calculation Type

Select where the margin required is calculated, for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’

- If ‘Internal’ is selected, then margin is calculated internally in Oracle Banking Treasury Management

- If ‘External’ is selected, then margin required is calculated and received from an external system

- This field is set to ‘External’ by default

Calculation Method

Select the method that is used for margin calculation for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’

- Select ‘Standard Rate(%)’ or ‘Flat Amount’ if Calculation Type is ‘Internal’

- Details about how OBTR calculates margin using these methods is explained in the description for ‘Margin Applicable’ field below

- Select ‘SPAN', 'SIMM', 'GRID', ‘Standard Rate(%)’ or ‘Flat Amount’ if Calculation Type is ‘External’

- If Calculation Type is ‘External’, Calculation Method selected is only for information and reporting purposes and OBTR is not calculating margin using these methods

- This field is set to ‘Standard Rate(%)’ by default

Applied From

Select the date from which margin call is triggered for this margin type, for the transactions in scope of this calculation setup.

- If ‘Trade Date’ is selected, then margin required is re-calculated and margin call is triggered from the trade date of the transaction itself

- If ‘TD + 1’ is selected, then margin required is re-calculated and margin call is triggered from the next day after the trade date of the transaction

- If ‘Value Date’ is selected, then margin required is re-calculated and margin call is triggered from the value date of the transaction after it is initiated

- If VD + 1 is selected, then margin required is re-calculated and margin call is triggered from the next day after the value date of the transaction after it is initiated

- If the transaction is back dated, then the margin call is triggered from the booking date of the transaction

- ‘Trade Date’ is set by default, if not specified

Exposure Type

Select the amount to be considered as exposure for this margin type for the transactions in scope of this calculation setup.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’ or if Calculation Method selected is ‘Flat Amount’

- If ‘Market Value’ is selected, then current market value or market price * quantity or contract fair value of the transaction (as applicable) is considered as the exposure

- If ‘Principal’ is selected, then the current principal or notional or deal value or deal nominal amount of the transaction (as applicable) is considered as the exposure

- If ‘Maturity Amount’ is selected, then the settlement amount or principal + interest or notional + interest as on the maturity date of the transaction (as applicable) is considered as the exposure

- If ‘Contract Value’ is selected, then the principal or net consideration or deal price * quantity or deal premium of the transaction (as applicable) is considered as the exposure

- ‘Principal’ is set by default, if not specified

Offsetting Allowed

Select whether exposure booked in opposite directions within the same group can be offset, to arrive at the net exposure for margin calculation purposes for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’ or if Calculation Method selected is ‘Flat Amount’ or if Calculation Level selected is ‘Trade’

- If ‘Not Allowed’ is selected, then the exposure in opposite directions is considered as absolute exposures and added together without considering the direction

- Example: For a Long 10,000 and Short 7,000, Net Exposure = 17,000

- If ‘Product’ is selected, then exposures from all the transactions in a Product is netted together considering the direction

- Example: For a Long 10,000 and Short 7,000 in the same product, Net Exposure = 3,000

- If ‘Position’ is selected, then exposures from all the transactions with the same Instrument and Portfolio is netted together considering the direction

- If ‘Risk Type’ is selected, then exposures from all the transactions with the same Risk type is netted together considering the direction

- If ‘Module’ is selected, then exposures from all the transactions in the same Module is netted together considering the direction

- ‘Product’ is set by default, if not specified

Multiplication Factor

Specify the multiplication factor (if applicable) to be used for arriving at the adjusted exposure considered for margin calculation purposes for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’ or if Calculation Method selected is ‘Flat Amount’

- Factor may depend on many parameters like the risk type of the exposure, etc.

- Adjusted Exposure = Net Exposure (after offsetting) * Multiplication Factor

- Example: For a Long 1,000,000 and Short 700,000 with offsetting allowed, with multiplication factor 0.65, Adjusted Exposure = 300,000 * 0.65 = 195,000

- ‘1’ is set by default, if not specified

Currency

Specify the currency in which the margin required is calculated for this margin type.

- This field is mandatory if Calculation Level selected is ‘Portfolio / Product’

- This field is set to Contract Currency ‘CCY’ by default, if Calculation Level selected is ‘Trade’

- Exposure in different currencies are converted to the margin currency equivalent for arriving at the final exposure for margin calculation purposes

Margin Applicable

Specify the applicable margin as flat amount or % of the final exposure to calculate the margin required for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’ or if Calculation Type selected is ‘External’

- If Calculation Method selected is ‘Standard Rate(%)’, then Margin Required = Adjusted Exposure * Margin Applicable /100

- Example: If Adjusted Exposure = 115,000 and with margin applicable = 35%, Margin Required = 115,000 * 35/100 = 40,250

- If Calculation Method selected is ‘Flat Amount’, then Margin Required = Margin Applicable

- Example: If Margin Applicable = 35,000, Margin Required = 35,000

- if not specified, ‘0’ is set by default resulting in no margin required

Threshold Amount

Specify the maximum amount that can be excluded from the margin required before margin call should be mandatorily triggered for this margin type.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’ or if Calculation Method selected is ‘Flat Amount’ or if Calculation Type selected is ‘External’

- Margin Calculated = Maximum(0, (Margin Required – Threshold Amount))

- Example: If Margin Required = 40,250 and threshold = 25,000 then Margin Calculated = Max(0, (40,250 – 25,000)) = 15,250

- If not specified, ‘0’ is set by default resulting in margin required to be fully transferred without any exclusion

Minimum Transfer amount

Specify the minimum amount that should be transferred for each margin call for this margin type, even if the calculated margin amount is lesser.

- This field is disabled and not applicable, if Margin Type selected is ‘Variation Margin’

- Margin Transferred = Maximum(Margin Calculated, Minimum Transfer Amount)

- Example: If Margin Calculated = 15,250 and MTA = 20,000, Margin Transferred = MAX(15,250, 20,000) = 20,000

- if not specified, 0 will be set by default and full amount calculated as margin need to be transferred.

On click of P button, after selecting the values for mandatory fields, system automatically generates a unique ‘Reference’ for the calculation setup.

Parent topic: Instrument Margin Calculation Setup