5.1.6 Pre-Netting for Initial Margin

User can select the list of Margin accounts, linked to the selected scheme, for which net margin transaction is initiated for the purposes of Initial Margin, Independent Amount, or any margin other than variation margin.

The details that can be captured for Initial Margin pre-netting include,

- Module, Agreement or Portfolio and Margin Type for which pre-netting is initiated

- Margin Accounts linked to the selected Scheme and Agreement or Portfolio

- Margin as per the Collateral Party’s statement

- Settlement Amount to be transferred as net margin call

User can view the details for,

- Account currency and Current balance in the Margin account

- Exchange rate to be used when Account currency is different from the Settlement Currency

- Transfer Amount and Transfer Action as Pay or Receive

On click of Load All Accounts button, all margin accounts linked to the selected scheme, module and Agreement or Portfolio (as selected) would be automatically identified. The details for the net margin required for the deals linked to each Margin account identified are automatically populated in Initial Margin tab.

- User can choose to remove the Margin accounts for which pre-netting need not be initiated as part of this transaction

- Can edit the Statement Margin for each record

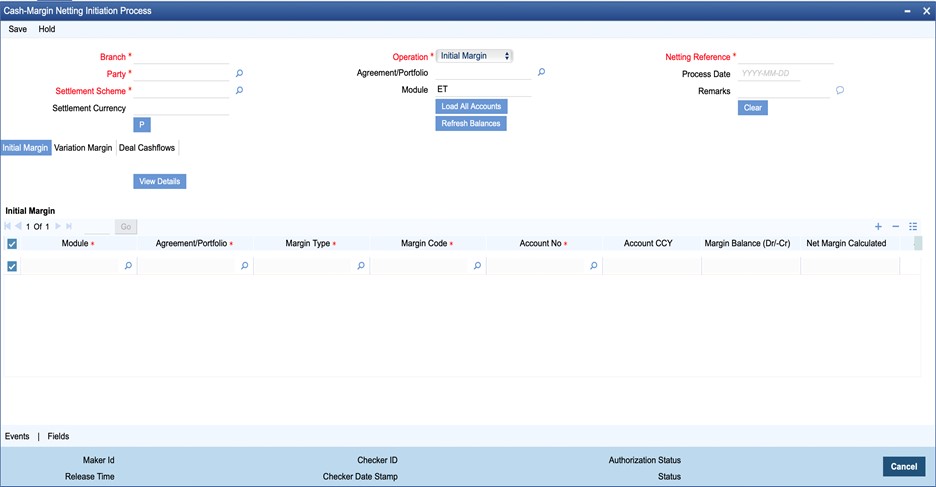

Click the Initial Margin tab of the Cash-Margin Netting Initiation Process (MGDCMINI) function to open this screen

Figure 5-2 Cash-Margin Netting Initiation Process – Initial Margin

The following table describes the fields captured for initiating net margin transaction for Initial Margin.

* Indicates mandatory fields.

Table 5-2 Cash-Margin Netting Initiation Process – Initial Margin

| Field | Description |

|---|---|

|

Module |

Displays the module of the deal(s) for which pre-netting of margin is initiated.

|

|

Agreement/Portfolio |

Displays the Agreement or Portfolio for which pre-netting is initiated for the net margin required for the deals linked.

|

|

Margin Type |

Displays the Margin Type for which pre-netting is initiated for the net margin required for the exposure from the deals linked to the selected Agreement or Portfolio.

|

|

Margin Code |

Displays the Margin Code defined for the selected Agreement and Margin Type.

|

|

Account No |

Displays the Margin Account for which pre-netting is initiated for the net margin required for the deals linked.

|

|

Account CCY |

Displays the currency of the selected Margin Account.

|

|

Margin Balance (Dr/-Cr) |

Displays the current balance in the Margin Account before this pre-netting transaction.

|

|

Net Margin Calculated |

Displays the calculated Margin Required in Account CCY, for the exposure determined as of the Process Date, for the selected Margin Type.

|

|

Statement Margin |

Enter the net margin required in Account CCY as mentioned in the Collateral Party’s statement, for the selected Margin Type and Margin Account applicable for the selected Agreement or Portfolio.

|

|

Settlement Amount |

Displays the Net Margin Call amount in Account CCY to be transferred as of the Process Date, for the selected Margin Type.

|

|

Fx Rate |

Displays the exchange rate to be used when Account CCY is different from the Settlement Currency of the Scheme.

|

|

Transfer Amount |

Displays the Net Margin Call amount to be transferred in Settlement Currency.

|

|

Transfer Action |

Displays the direction of the Net Margin Call to be transferred.

|

|

User Comments |

Enter any additional comments for the net margin transfer for the selected Margin Account.

|

|

Netting ESN |

Displays the accounting event sequence number for the accounting entries posted for the net margin transfer. |