- Money Market User Guide

- Risk Free Rates

- Money Market Contract

9.5 Money Market Contract

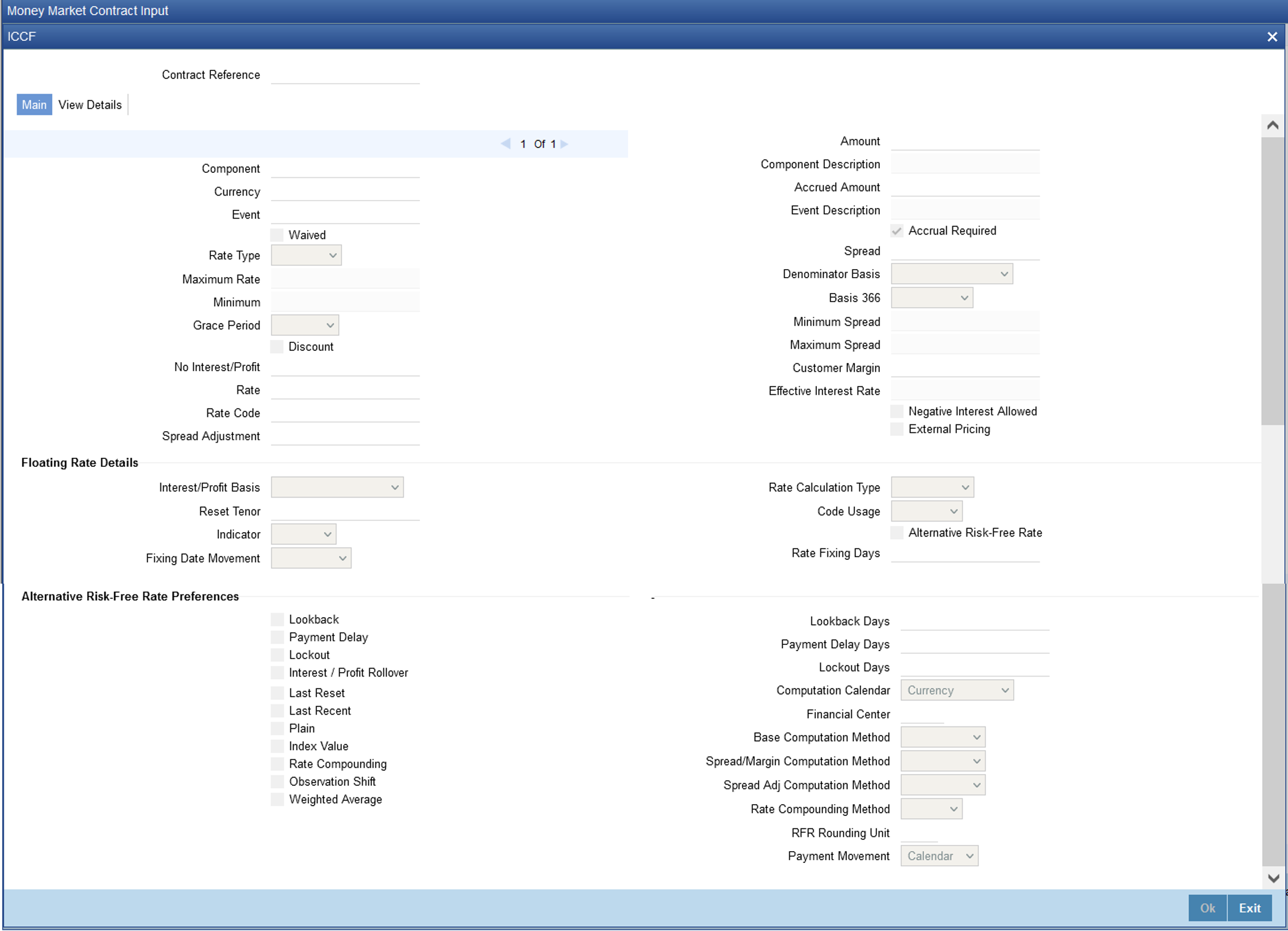

This topic provides the instructions to capture the RFR details in Money Market Contract.

The Money Market Contract screen, Interest call form is enhanced to have similar new fields introduced in Treasury Interest Class Definition (CFDTRINC) screen.

- On the Money Market Contract Screen, click Interest.

ICCF screen is displayed.

- On the ICCF screen, specify the details as required.

During the creation, user can change RFR preferences after defaulted from product level.

When RFR flag is checked, rate code has to be RFR code.

Spread Adjustment field is enabled and is used only for RFR component. Existing spread field is disabled and nullified for RFR component.

System allows mapping of only one RFR interest class as main component for a contract.

Existing Rate Fixing Days field is used as lookback days only for RFR Advance methods.

Once contract is saved and authorized, the RFR preferences cannot be changed.

For information on Interest rate details in schedules explode, see the Schedules Tabsection

- Effective interest rate is displayed as per the below calculation as an

example. Consider a contract with Lookback RFR calculation method with

below details:

- Trade date= 04 March 2020

- Value date= 04 March 2020

- Maturity date= 16 March 2020

- System date= 16 March 2020

- Principal= USD 95000

- Lookback days= 1

- Customer margin=0

- Spread adjustment= 0

- Base amount calc method= Lookback compounded

- Interest basis= Actual/Actual

Below is the calculation for accruals (based on RFR rates taken as an example)

Calender Date Effective Date Rate Principal Accrual 4-Mar

3-Mar

1.01%

95000

2.621585

5-Mar

4-Mar

1.02%

95002.62

2.647614

6-Mar

5-Mar

1.03%

95005.27

8.020937

9-Mar

7-Mar

1.04%

95013.29

2.699831

10-Mar

9-Mar

1.05%

95015.99

2.725869

11-Mar

10-Mar

1.06%

95018.72

2.751908

12-Mar

11-Mar

1.07%

95021.47

2.77795

13-Mar

12-Mar

1.08%

95024.25

8.411982

16-Mar

14-Mar

1.09%

95032.66

2.877378

Taking the final accrual as 32.63 USD with a simple interest calculation method for nominal of USD 95000 for a period from 04 March to 16 March 2020, the effective rate is calculated to be:

Effective rate= 1 + (32.63*365)/(95000*13)= 1.00938947

- To ensure that the rates stay within the stipulated limits, the MM

module supports Minimum and Maximum Rate pick up for RFR enabled

contracts.

If the derived RFR rate for a contract considering the base rate and spread adjustment is less than the minimum rate, the minimum rate maintained is applied on the contract.

If the derived RFR rate for a contract considering the base rate and spread adjustment is greater than the maximum rate, the maximum rate is applied on the contract overriding the RFR rates.

Parent topic: Risk Free Rates