B.1.4 Example IV – Swaption with European Expiration

On 01-Jan-1998, Tata Projects Ltd. (TPL) foresees a 3-year floating rate-funding requirement, contingent on being awarded a tender after 9 months. A forward swap contract proves costly if the tender bid is unsuccessful. Instead, TPL buys a payer’s swaption from National Bank with an exercise date matching the tender acceptance date – 31-Aug-1998. If interest rates rise by end-August, TPL can raise floating rate funds in the market and simultaneously exercise the in-the-money swaption. Then, it pays fixed rate interest to National Bank and receive floating rate interest from them, with which it pays back in the market. If interest rates decline, the swaption are out of the money and TPL will let it expire and fund itself at the lower rate that it gets in the market.

Assume that TPL buys a payer’s swaption from National Bank with the following terms:

Table B-52 Example IV

| Contract Type | Value |

|---|---|

|

Booking date |

01-Jan-1998 |

|

Option expiration date |

01-Sep-1998 |

|

Exercise style |

European |

|

Exercise date |

01-Sep-1998 |

|

Option Type |

Right to pay fixed rate (payer’s swaption) |

|

Premium |

1% of notional principal |

|

Settlement |

Deliverable |

Terms of the underlying swap between TPL and National Bank:

Table B-53 Example IV

| Contract Type | Value |

|---|---|

|

Notional Principal |

50,000,000 USD |

|

Effective Date |

01-Sep-1998 |

|

Fixed Rate |

9.5% p.a. payable semi annually |

|

Floating Rate |

6-Month LIBOR |

|

Fixed & Floating Payment Dates |

March 1 and September 1, starting March 1, 1999 and ending September 1, 2001 |

|

Floating Rate Reset Dates |

Given in the following table |

On 30-Aug-98, the market swap rate for a 3-year fixed to LIBOR swap with half-yearly resets is 10% -- that is, fixed rate has to be paid at 10% to receive LIBOR at six-monthly intervals over the next 3 years.

Since the market rate is higher than the strike rate (9.5%), TPL exercises the swaption. Simultaneously, it borrows 50,000,000 USD from the market with six-monthly interest payment at LIBOR.

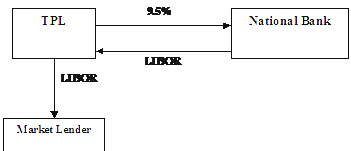

Figure B-1 Flow Diagram

The resultant swap after exercise of the swaption, along with the impact of the market borrowing, is diagrammatically shown as follows:

The floating rates obtaining on the various rate reset dates are as follows:

Table B-54 Reset Dates

| Reset Date | LIBOR (%) |

|---|---|

|

Aug 30, 1998 |

9.8 |

|

Feb 27, 1999 |

9.2 |

|

Aug 30, 1999 |

9.5 |

|

Feb 28, 2000 |

8.9 |

|

Aug 30, 2000 |

9.7 |

|

Feb 27, 2001 |

10.2 |

The fixed and floating payments over the life of the swap are as follows:

Table B-55 Fixed and Floating Payments

| Date | Fixed Rate Payment (Paid by TPL) (USD) | Floating Rate Payment (Paid by National Bank) (USD) |

|---|---|---|

|

Mar 1, 1999 |

50MM*9.5*181/36000=2,388,194.44 |

50MM*9.8*181/36000=2,463,611.11 |

|

Sep 1, 1999 |

50MM*9.5*184/36000=2,427,777.78 |

50MM*9.2*184/36000=2,351,111.11 |

|

Mar 1, 2000 |

50MM*9.5*182/36000=2,401,388.89 |

50MM*9.5*182/36000=2,401,388.89 |

|

Sep 1, 2000 |

50MM*9.5*184/36000=2,427,777.78 |

50MM*8.9*184/36000=2,274,444.44 |

|

Mar 1, 2001 |

50MM*9.5*181/36000=2,388,194.44 |

50MM*9.7*181/36000=2,438,472.22 |

|

Sep 1, 2001 |

50MM*9.5*184/36000=2,427,777.78 |

50MM*10.2*184/36000=2,606,666.60 |

Parent topic: Examples